Amrae will be hosting an open forum for risk managers on the complexities of managing political risk

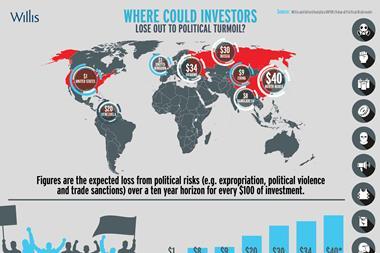

Emerging markets continue to attract business investors looking for new growth opportunities. But in less developed markets, these opportunities could be severely affected by government action resulting in increased political risks, societal unrest and resource nationalism.

Since 2010, almost 10% of countries worldwide have seen a significant increase in the level of dynamic political risk, according to UK analysts Maplecroft.

Its latest Political Risk Atlas 2014 indicated an increase in societal unrest in some emerging markets such as China, Vietnam and Bangladesh. Maplecroft argues that this is owing to the erosion of democratic freedoms, increasing crackdowns on political opposition and the brutality used by security forces towards protesters.

However, the Atlas also identified a number of upward trends. The Philippines, India, Uganda, Ghana, Israel and Malaysia experienced a significant fall in the level of dynamic political risk in the past four years. This steady improvement, in part, reflects a fall in political violence in the Philippines, India and Uganda, while Malaysia and Israel experienced significant improvements in the level of governance.

The opportunities and risks in these markets emphasises the importance of robust risk management processes. Indeed, a forward-looking approach would help identify and anticipate emerging political threats and political risk workshops such as the one being held at the Amrae conference provides an open forum to discuss strategy.

The workshop’s moderator Gaëtan Lefèvre, chairman of the Belgian Risk Management Association, said: “The difficulty for the risk manager is to co-ordinate all the aspects of the risks and all the consequences. You need to think in advance about what could happen and when it could happen. Be prepared and ensure that you have the tools in place to handle the problems correctly.”

He said the workshop’s goal was to help risk managers understand how to go further in managing political risk.

Risk managers were given the opportunity to share their experience and encouraged to discuss how political risks have affected their business lines. Secondly, brokers explained what types of insurance are available and asked to discuss any gaps in the market. Finally, insurers gave an overview of the insurance market.

No comments yet