Josef Ackermann’s doom-laden speech shocked the industry with his predictions of continued and deepening economic crisis, but he’s not the only one who fears the worst

Deutsche Bank chief executive Josef Ackermann’s keynote speech at the Ferma conference in Stockholm received a great deal of attention around the exhibition. Risk managers themselves were left stunned by his dire economic warnings, which predicted low growth for many years, compounded by crippling public debt, and extremely high asset price volatility.

“Sentiment indicators suggest the global economy is on the brink of a sharp slowdown. And uncertainty about sovereign debt lies at the heart of this market turmoil,” said the bank boss. “As long as this persists, it is almost inevitable that we will see tremendous asset price volatility.”

His comments were made a day before Deutsche Bank reported that it would miss its targeted €10bn pre-tax profit from operating businesses this year - mainly owing to a €250m impairment on Greek sovereign debt. The bank is also due to shed 500 jobs because of falling customer demand.

It is almost inevitable that we will see tremendous asset price volatility.”

Josef Ackermann, Deutsche Bank

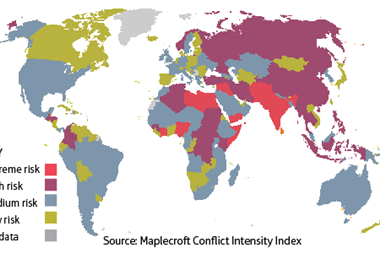

But Europe’s risk managers will be more struck by Ackermann’s predictions on the state of the economy and the changing world dynamics, which he thinks will lead to a shift in economic might from the West to the East.

“The share of emerging markets in global GDP will probably rise above 50% for the first time this year, while Europe’s share of global GDP will be around 20%,” said Ackermann.

Reacting to the news, Ferma vice-president Julia Graham told me: “I think what Ackermann said reflected the seismic shift our world is going through. These economic challenges are part of that seismic shift and we, as risk managers, have to be able to manage that.”

It is scary, yes. But you can’t put your head in the sand.”

Julia Graham, Ferma

“The economy is slowing in the West, but in other parts of the world clearly it is not,” she continued. In order to take advantage of these growth opportunities in the emerging markets, organisations and their risk managers will have to learn to work with other cultures, noted Graham, who is also chief risk officer of the international law firm DLA Piper. “We may see the flavour or mix of our companies change.”

But now is not the time to “run for the hills” added Graham. “It is scary, yes. But you can’t put your head in the sand.”

“The economic crisis is adding to the professional demands on risk managers,” she said, so risk managers have to make sure they are ready to live up to the challenges ahead. This means making sure they have the professionals skills, expertise and financial literacy to deal effectively with senior management.

We are facing probably the biggest crisis since World War II.”

Jorge Luzzi, Pirelli

Ferma’s new president, Jorge Luzzi, who is group head of risk for Italian tyre maker Pirelli, also shared his thoughts with StrategicRISK. He said: “We are facing probably the biggest crisis since World War II. And you saw that, after the war, the world changed in immeasurable ways. This is the moment to rethink our position and to analyse the world that we are living in today.”

Luzzi said that increased regulation and a move towards protectionism are going to be the major challenges facing businesses in the years ahead.

But, on a more positive note, he added: “If it doesn’t kill you, it will make you stronger.”

No comments yet