The investment potential of China, India and Russia is being undermined by poor governance and societal resilience, according to a new report

Brazil, Russia, India and China (collectively known as the BRIC countries) are no better placed to withstand shocks from major risk events than they were four years ago, according to a new report.

The Global Risks 2012 report (see attachment), from Maplecroft, indicated that strong economic performance in the BRICs has not translated into improved societal resilience or governance.

This is constraining these countries’ ability to adapt and combat potential shocks from pandemics, terrorism, conflict, resource security, economic contagion and the impacts of climate change.

The resilience of the BRIC economies is increasingly important as they become central to the fortunes of the global economy.

According to this research, none of the BRICs have improved their resilience to global risks over the course of the last four years.

This is despite cumulative GDP growth between 2009 and 2012 of 16% for Brazil, 13% for Russia, 28% for India and 32% for China.

“With hopes for a global economic recovery resting with the BRICs, investors and business seeking new high-growth, high-risk markets need to be aware of their limited resilience to global risks,” said Maplecroft CEO Alyson Warhurst.

“A country’s resilience to external and internal shocks is built up over time, so as the BRICs political risk environment improves we might see resilience strengthen, but our results reveal this is yet to happen.”

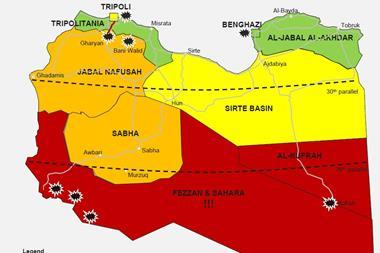

The 10 countries most exposed and least resilient to global risks are:

1 Somalia

2 DR Congo

3 South Sudan

4 Sudan

5 Afghanistan

6 Pakistan

7 Central African Republic

8 Iraq

9 Myanmar

10 Yemen

“Economic gains have yet to transform the resilience of the BRICs to major risk events,” added Warhurst.

“Improvements in basic social infrastructure, such as education, healthcare and sanitation for large sections of society, are vital in combating the impacts of global risks. Without these, and improvements in governance, the BRIC economies may not fully realise their investment potential.”

Brazil (ranked 97) performed better than its BRIC counterparts, due, in part, to its strong democratic governance and regime stability, said Maplecroft.

However, poor governance and a relative lack of societal resilience in India (19), Russia (30) and China (58) are identified as significant factors that could undermine their ability to combat the effects of “black swan” events.

“Continuing poor governance is evidenced by the endemic nature of corruption, especially in India and Russia, where the political process is undermined by an inability to tackle the problem,” said the research.

“Uncertainty for investors in Russia has also been compounded by anti-government protests relating in part to suspected irregularities in the elections.”

Maplecroft also identified terrorism and political violence as particularly prevalent risks in India and Russia, which threaten human security and business continuity.

Security issues in China also exist due to localised protests and unrest relating to a lack of political freedom and social gains.

Upheaval on a national scale remains unlikely though, said the analysts, as China’s strong economic performance buffers it from further popular dissent at present.

Meanwhile, Maplecroft also identified some “high growth” markets that are well insulated from global shocks. These include: Argentina (123), Chile (131) and Mongolia (117).

New Zealand (176), Finland (175), Denmark (173), Norway (171), Canada (169), Sweden (168), Germany (163) and Australia (159) are among the countries exhibiting the lowest risk.

No comments yet