Global corporates are increasingly self-insuring, with captives retaining more income and taking on bigger risks, finds a new report

Captives are carrying more capital to write risks than is required under current regulatory minimums, found the latest captive research from Marsh. That’s because many captives are choosing to retain their underwriting profits rather than returning excess earnings to their shareholders.

Marsh’s study found that annual captive premium income was an estimated $55-$60bn. But the research also revealed that for over 55% of captives globally, the issued capital is now less than 5% of the total asset base of the captive. ‘A lot of captive earnings are retained and built up in the captive over the years,’ explained Jonathan Groves, head of captive consulting for Marsh in Europe, the Middle East and Africa (EMEA).

As many captives are currently carrying an excess of capital, Solvency II, the European Union’s proposed risk-based capital regime, will have a limited impact on them, according to Groves.

Chris Waterman , managing director insurance, at Fitch Ratings, said captives could be holding onto their earnings for a number of reasons: ‘They may want to retain some of their profits so they have a buffer over the regulatory margins. There may also be some tax benefits in maintaining funds offshore.’

He added: ‘A fairly benign loss environment over the past few years means insurers have been doing some profitable underwriting. Prior to the credit crunch investments have also been making good returns.’

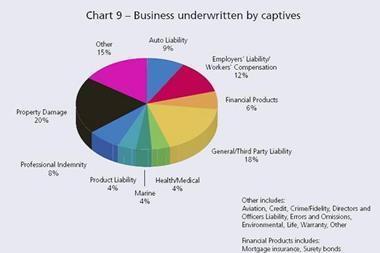

Captive owners are also prepared to take on more risks with those captives with reinsurance backing tending to display the most rigour. Captives participated in all risk areas, with 20% of business underwritten being for property damage, 18% for general or third party liability and 12% employers’ liability and workers’ compensation.

“The wide ranging nature of the risks is reflective of the fact that irrespective of the industry group there is a role for the captive to play.

Jonathan Groves, head of captive consulting for Marsh in Europe, the Middle East and Africa

‘The wide ranging nature of the risks is reflective of the fact that irrespective of the industry group there is a role for the captive to play,’ added Groves.

Financial institutions accounted for 20% of all captives, with healthcare companies owning 11% and manufacturers 10%, according to the research that surveyed one third of the global captive market where the owners were identifiable.

The broad range of the risks underwritten, including unexpectedly directors and officers policies, demonstrates that utilising captives for long tail financing issues are less of a concern for companies than is often stated, said the report. Overall the research found that captive insurers reflected 20% of the total property and casualty insurance spend in the world today.

The analysis also showed some of the different approaches to risk retention taken by captive owners in different regions. Captives owned by Asia Pacific companies generally assumed the most risk. Over 30% of the lines underwritten by captives owned by Asia Pacific companies provided policy limits of over $250m. This compared with the Americas, where over half of the lines underwritten were for amounts less than $2.5m. For the EMEA region, just over one third were for limits between $2.5m and $25m.

Across all industries, the use of captives to underwrite higher frequency but lower severity events was commonplace. The research also pointed to a new trend whereby captives insure against less frequent, high severity events. ‘We believe this is reflective of the optimization of the captives,’ said Groves. However, Marsh also pointed out that many captives were not optimising their structure to their full potential.

Groves noted that the two main reasons for companies choosing to establish their own insurance operations were a significant change in the size of their business and rising insurance rates in the commercial market.

Other key findings include:

The cumulative number of captives has increased at a steady rate since the early 1980s.

US companies own 57% of the world's captives and all companies that comprise the Dow Jones 30 own captives.

UK, French and Swedish companies are, respectively, the second, third and fourth most prolific owners of captives.

Bermuda is the single favourite domicile for captives, accounting for 29% of the total. However, when aggregated together, US states actually account for 30% of the total. From a European perspective, Guernsey continues to have the largest number of captives.

Almost half of captives are currently achieving a return on capital employed of greater than 10%. However, more than one-third have a return of 5% or less.

Globally, almost 60% of captives do not use reinsurance. When considered in conjunction with the level of retained profits held by captives, this suggests that most captive business continues to be profitable. There is also evidence that once a company decides to pay premium to a captive, versus the general insurance market, a significant majority of that premium is permanently removed from the market.

No comments yet