Whether it's a supplier going bust or a dispute with a key partner, the potential risks in a supply chain have only increased with the downturn. StrategicRISK surveys the issues

(Click on one of the images and scroll through to reveal the findings)

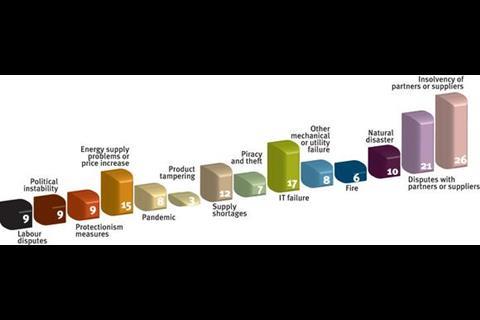

Insolvency of partners or suppliers was highlighted as the principal risk to supply chains over the next three years, according to the latest StrategicRISK reader survey. Respondents overwhelmingly confirmed the hypothesis that supply chain disruption has increased as a result of the downturn (70% believed that it had).

In fact, over a quarter of the respondents (26%) said that within the last 12 months their supply chain had been disrupted by the insolvency of a key partner or supplier.

Labour disputes, IT failures, natural disasters, disputes with partners, energy supply problems, protectionist measures, supply shortages and political instability were also identified as significant threats in the future, according to the 100 person poll. Interestingly the respondents did not generally believe that pandemics represented a significant risk in the future.

Other threats that a significant volume of respondents said had caused disruption to their supply chains already included disputes with partners or suppliers (21%), IT failures (17%) and energy supply problems or price increases (15%). Only a small proportion indicated that their supply chains’ had actually been disrupted by last year’s swine flu pandemic (8%).

Organisations are generally confident in their ability to handle these supply chain risks, according to the poll. Over half (60%) said that they were either extremely good or good at managing supply chain risk. Only 6% said their organisation was poor at doing so.

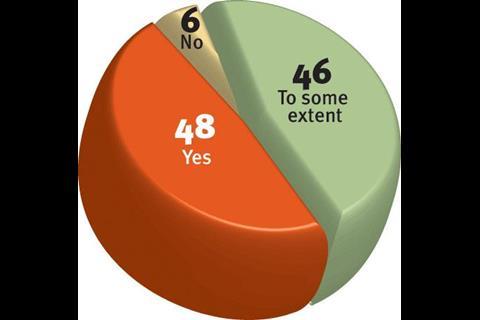

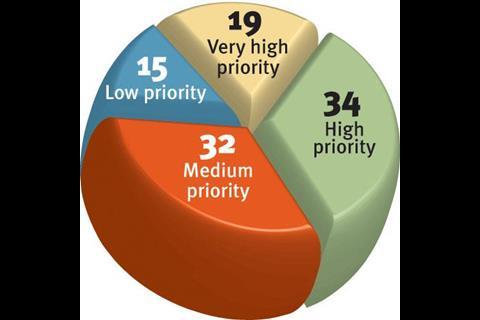

Further, about half (48%) said their board adequately understood supply chain risk. The majority of the remainder said the board did to some extent (46%). This tallied with another finding; that half of the respondents assigned either a high priority or a very high priority to supply chain risk management (53%). About a third (32%) assigned supply chain risk a medium priority within their organisation.

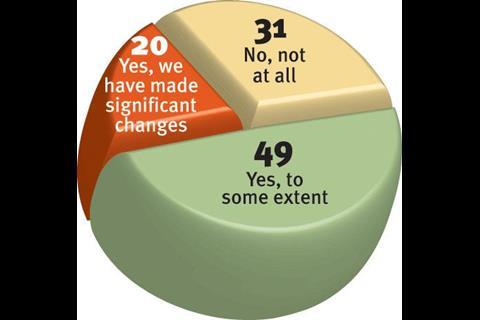

A significant volume of respondents have recently re-engineered their supply chain by moving production or establishing contracts with new suppliers in new geographical territories. Well over half (69%) said they had done so, 20% of these said they had done this to a significant extent.

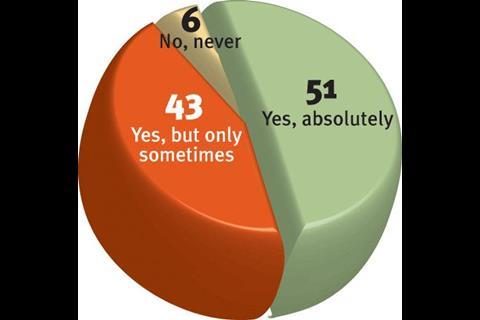

When negotiating contracts with new suppliers over half (51%) of respondents said that attitude and approach to supply chain risk management is a big part of the prequalification process. Most of the rest (43%) said that it did, but only sometimes.

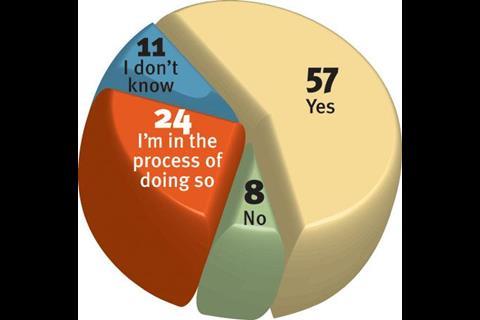

A significant portion of respondents (24%) indicated that they are currently in the process of identifying critical exposures in their supply chains. Most said they had already done so (57%).

On the steps taken to increase supply chain resiliency, most respondents were improving their business processes (48%), strengthening their business continuity planning (47%), shifting from single sources to a multiple supplier base (35%), conducting a risk audit of their key suppliers (34%) or introducing a supply chain management system (18%). A smaller number were also centralising their distribution (11%) or increasing their inventory levels (7%). A few of the respondents (7%) are confident with their current measures and do not see resiliency as a problem—and are therefore doing none of these things.

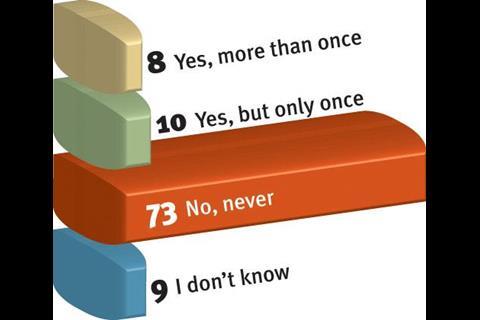

Most respondents had never been forced to issue a product recall (73%), but a small volume (18%) had, 8% of these said they had done so more than once.

Generally speaking the survey painted a rosy picture of supply chain risk management.

Expert view

Phil Wall, Senior Account Engineer, ACE European Group

Regardless of future financial market trends, it is clear that many companies have already taken the long term decision to re-engineer their supply chains in an attempt to cut costs and improve business efficiency in the face of the current economic downturn. With change often comes increased exposure to risk if this process is not carefully managed.

So what have we seen that gives cause for concern – or at least should make a company tread carefully when considering a major change to their supply chain?

1. Winning economies of scale

Companies are typically placing larger contracts with fewer suppliers in order to increase buying power and reduce costs. There has been an increase in the dependence on single source suppliers – an interruption at a critical supplier may now have significant consequences downstream.

2. Consolidation of operations

Just in time (JIT) production and closure of small warehouse and production facilities in favour of large, centralised distribution and manufacturing sites has increased the dependence on single locations. With suppliers adopting similar strategies to remain competitive, the potential exposure from a single event is typically increasing.

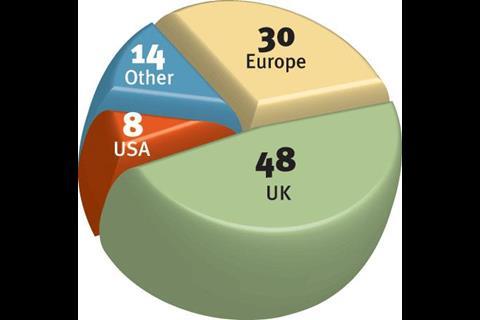

3. Venturing into new territories in the search for cheaper overheads

There is a clear trend to relocate parts of the supply chain to areas of the world which have the benefit of lower overheads. However this is sometimes completed without a full understanding of local loss prevention standards. There is also the potential to introduce new, unforeseen natural hazard exposures to the group.

4. Using buying power to apply pressure to reduce supplier’s prices

Suppliers are also facing difficult choices concerning reducing maintenance staff, running equipment harder, faster and longer to improve efficiency or reducing security manpower.

From what we see, implementation of these strategies without a proper evaluation of the associated risks represents a potentially dangerous approach to reducing supply chain costs – and may actually expose the bottom line.