Energy and power firms face a difficult time in the insurance market because of new risks, continued losses, large capacities and selective underwriters, says Willis executive

Firms within the energy and power sector must combat selective underwriting due to new risks and consistent losses according to Willis executive director David Reynolds.

Speaking to StrategicRISK, Reynolds said: “In the face of continuing losses in the power sector and healthy levels of insurance market capacity that limit underwriters’ ability to apply significantly increased rates, many of the technical insurers are trying to be more selective in the risks they underwrite.”

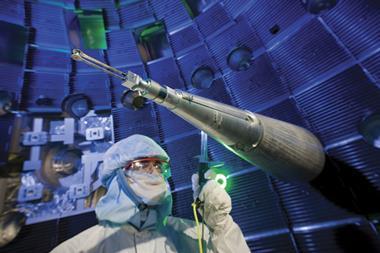

Willis’s latest Power Market Review, which Reynolds co-wrote, states that while the renewable sector continues to thrive, it means underwriters must contend with many complex new risks.

“The EU Renewables Directive, which stipulates that at least 20% of total energy consumption in the EU will be obtained from renewable sources by 2020, a target also set by the Australian government, means companies are building larger wind turbines and as they increase in size, so too does the cost when things go wrong,” the report said.

On the topic of things going wrong, Reynolds spoke of an emerging risk within the power sector being the continued losses incurred by the relatively new Combined Cycle Gas Turbine units, which are complicating insurance products further.

Reynolds said: “This relatively recent technology is continuing to receive underwriting attention, with the focus on whether a particular machine is proven, unproven or prototypical – which influences the level of cover that insurers are prepared to give.”

He added: “At the other end of the scale, there is concern among some underwriters over the reliability of ageing plants and equipment, as machines which came into operation in the 1960s and 1970s approach the end of their expected operational life.”

In light of the challenges facing insurers and underwriters, Reynolds believes it is important for buyers to be able to differentiate themselves in terms of risk quality, maintenance, operational behaviour and risk management.

He said: “Insurers have become more analytical in their underwriting, with greater modelling of their exposures, such as their aggregate exposure across their book of business to natural catastrophe events.

“These factors are likely to mean that buyers should prepare to provide more detailed underwriting information than has been customary in previous years.”

No comments yet