Chaired by Nathan Skinner, a roundtable discussion entitled changing markets took place at AXA Corporate Solutions Switzerland’s client and broker gathering on March 31 in Zurich

Nathan Skinner: How do the participants think the insurance cycle is going to evolve? Will this phase of hardening be worse than what has come before?

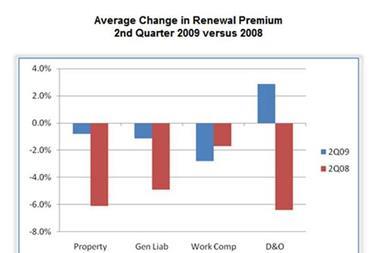

Marcel Abegg: Everyone would agree that rates are at the bottom of the cycle. But the reality is there is still competition in the market and we still see rate decreases. The only exception is financial lines where there is an upward trend.

Philippe Jouvelot: Some property and liability insurers are still willing to soften their terms when the accounts are clean of claims. The surprising thing is that clients are trying to secure these terms for two or three year long term agreements. This is because they are scared of a brutal reaction from the market. At AXA Corporate Solutions, we do not want any brutality. It is better to make increases gradually and progressively.

Luca Piazza: The problem with a long term agreement is you never know when the market is going to turn. We have been expecting the market to harden for a few years but it has not yet happened. At SGS we subscribe our major lines every year. We still see decreases in premiums in the range of 10 % to 20 % on our main insurance lines. Long-term agreements are important but at the same time we would also like to see a proper service level maintained. If we are not totally satisfied with the services provided by the incumbent insurer and a competitor makes a strong commitment to high service levels, we do not hesitate to change carrier. This is the idea of competition.

Heinz Risi: The premium question is only one element in the decision to go with a certain insurance company. It is important, but there are other factors at play. First of all, do they have a global network in place? Does the insurer have a strong commitment and presence in the markets where we do business? How about service levels? That is very important. What about risk engineering? More than once I have chosen a more expensive carrier for all these reasons. My decision is based 50 % or 60 % on the premium level. The rest is something else.

If you conclude long-term agreements you never know if the market is softening or hardening. But it is not that important. We always conclude three year contracts. When we negotiate the premium we agree that it is the correct price. I do not expect that one or two years later it is cheaper.

Jean-Paul Rignault: This is music to our ears. At AXA Corporate Solutions we do not want to be perceived as a cheap deal.

You mentioned the US. In the US it is very important that insurers provide good local services because it is a tough market. We have developed a company, fully licensed everywhere in the US, to act as a fronting for our property and casualty international programmes. The international network is very important. Our services cannot be located in just one country, like Switzerland. You are global companies and you need global service. Today political borders are no longer business borders.

You mentioned risk engineering. Risk management and risk engineering is in our DNA. We have to bring value to the decision making process of the risk manager. That is why we purchased Matrix, a risk engineering consultancy in the US. Risk engineering is an important part of our service commitment.

Michael Heimburger: For a big corporation premium stability is important particularly in these times. The CFO does not want surprises. Our company makes three year deals, because we think that premiums will probably go up more than they will go down. A big upswing is not in the interest of insurers either, because companies will just retain more risk in a captive as they try to minimise the risk transfer premium.

Luca Piazza: You can improve and optimise your terms and conditions in the most effective way when you renew a policy. You get the most out of the insurer two or three months before renewal. I am not saying that we should change carrier every year. Of course, continuity and long term relationships are important, but at the same time we want to offer everyone the chance to play a role in all of our insurance lines.

Jean-Paul Rignault: The most important thing is that the underwriter’s risk assessment is adequate. If it is adequate it is not important whether the cycle is up or down. If it is adequately priced why not stay together for a three year deal wherever we are in the pricing cycle?

Marcel Abegg: But what is the technically adequate price?

Philippe Jouvelot: If you look at the underwriting results of all the insurers, 2004 was the last time they were technically profitable without investment income. I am not saying that companies were wrong to take investment income to offer a more competitive price to the market. But if we want an idea of the technical price it was 2004. It is nothing we have not experienced before.

Marcel Abegg: Perhaps insurance companies can also help brokers and clients by bringing more transparency into their pricing?

Philippe Jouvelot: When it comes to motor or liability where there are frequent claims we can exchange those statistics, which means clients can see the results that we have. But when we enter into a global property programme, for example, with a self retention of $10m and no claims in the last 10 years, then the technical price is more difficult to explain.

Roger Konrad: We are once again focused on price after we said that price was not so important and it was the level of service that was key. There is one important question we have missed. What about the financial security of the insurers?

Hansruedi Schoch: It is important to focus on the financial stability of insurers. Clients need to know that reliable insurance companies can provide adequate capacity. Insurers need to continue to demonstrate that they can deliver what they promise. That is something we always put first.

Nathan Skinner: What kind of information do insurance buyers need to assess the security of their insurance partners? And how can brokers and insurers help them with that?

Heinz Risi: The question of insurer financial stability has increased a lot recently. Today financial strength is a key asset - especially when you look at what has happened with several large insurance companies. If you have these insurers in your programme then your boss will be concerned. Fortunately, so far a Swiss insurer has not gone insolvent but it could happen.

The rating agencies have not done a good job in the last few years. Does this mean we have to make our own assessments as well? I think brokers have an important role to help their clients assess the situation. That is one of the strengths of global brokers at the moment. They can provide clients with insights.

Marcel Abegg: We have dedicated resources that analyse the security of insurance companies. We only recommend an insurance contract with a company that is going to be around in 10 years to pay losses. As such we monitor the situation with carriers. We are in the close contact with the top management of these companies. We do not just look at the financial figures, we also look at the management, strategy and reinsurance arrangements. It is not just a snapshot at 1 January based on the balance sheet which is presented.

Roger Konrad: Since the global crisis started even Swiss (re)insurers have been affected financially. When we present a market comparison to our clients you will find the rating on top. If a provider has a rating that does not meet our minimum financial guidelines, we make the client aware of that in writing, and also if it falls below the guidelines after inception date of the policy.

Michael Heimburger: How does AXA Corporate Solutions assesses the financial stability of partners which are not subsidiaries of yours on a global programme?

Régis Demoulin: We have an established process of rating our partners when they are not subsidiaries of AXA Corporate Solutions. If the client wants to know what the quality of a given partner is, we are able to show how the rating process is set up. The rating is controlled by several notifications regarding the financial security of the partner. It takes into account counterparty risk. It is also dictated by their ability to issue policies, to handle and settle the claims, and also to produce financial flows. All these areas are taken into account, we enforce them if needed and we disclose this information to our clients on request.

Luca Piazza: We have to be careful with looking purely at ratings. Certainly it is an important element but recent examples show that a company can be at risk even with a strong rating. Generally, however, we live in a more regulated environment which helps insurance buyers select the proper carriers.

The broker can help us by giving good advice but at the end of the day, the strategic decision to stay with a carrier or change provider remains with the company and the risk manager. In the past, brokers may have given advice in this regard, but now they tend to be more cautious and leave the decision entirely to the client.

Jean-Paul Rignault: I do not think that rating agencies are the only ones to be blamed for not doing their job properly. Financial regulators around the world did not do their jobs properly either. And in that you can include auditors, who have been approving for years the accounts of these firms which are in difficulty. We are in the middle of an unprecedented crisis, it is too easy to blame the rating process. What is important is that buyers can compare one rating with another. They must also keep in mind their own rating as a corporate. Risk transfer only makes sense if you transfer the risk to someone with at least the same rating as yours.

Buyers cannot purely rely on rating agencies, financial analysis or the broker. Our strategy is to go out and meet with brokers and clients to share, explain, and communicate. We think we are better placed than some of the other players on the market. But communication is key because the issues at stake are complex, for example, the French regulatory authority and the German regulatory authority calculate solvency margins in different ways. This means there may be differences between insurers depending on where they are headquartered. It is difficult to communicate and explain everything on paper, but it is something that you can do face to face.

Nathan Skinner: What are the new risks emerging from the economic turmoil? How can risk managers and their insurers tackle them? What new approaches are risk managers adopting?

Marcel Abegg: We have learnt over the last few months to think the unthinkable. Things that we thought were not likely to happen, like the insolvency of a longstanding insurance company, all of a sudden became a potential. Clients have to think about what they are doing if a company disappears altogether.

Heinz Risi: A typical risk exacerbated by the crisis is supply chain risk. There are a lot of sub-risks around this.

Michael Heimburger: In these difficult times certain risks become bigger. Counterparty credit risk is a big concern.

Jean-Paul Rignault: Globalisation is a fact of life today. Companies have subcontractors everywhere, so the risk of subcontractor default is a major issue. In the recession you may even have lower quality of goods because everyone is trying to cut costs. That may lead to deficiencies in product quality. We see that more and more with product recalls coming out from low-cost countries. Risk managers have to be much more careful about the quality of their subcontractors and supply chain. If you keep in mind also that the level of stock in certain industries is very low, a disruption in the supply could lead to a business interruption claim. And with the number of bankruptcies in the industry today it could be more difficult to find another supplier to replace them.

These are the new challenges companies as well as brokers and insurers have to face in today’s changing markets.

Participants

Marcel Abegg, head of international business, AON

Régis Demoulin, chief commercial officer, AXA Corporate Solutions

Michael Heimburger, risk manager, Kraft Foods

Philippe Jouvelot, chief underwriting officer, P&C, AXA Corporate Solutions

Roger Konrad, business manager, KESSLER

Luca Piazza, risk manager, SGS

Jean-Paul Rignault, CEO, AXA Corporate Solutions

Heinz Risi, risk management and insurance, SCHINDLER

Hansruedi Schoch, CEO, AXA Corporate Solutions Switzerland

Postscript

Nathan Skinner is associate editor, StrategicRISK