A slowdown in the world economy topped a list of risks facing global businesses, with reputational damage also front of mind for corporate bigwigs, according to a survey from Aon.

The insurance broker surveyed 2,600 risk managers working across 33 industries and 60 countries as part of the survey, which it undertakes every two years.

There is swelling concern about protectionist trade policies, which captures worries over growing regulatory activity and geopolitical tensions. The issue has taken centre stage with Donald Trump’s so-called “America first” strategy in the US and the ongoing Brexit negotiations in the UK, which helped boost the concern to number three on the list - up from 38 last year.

An aging workforce twinned with a population that’s getting older has been bumped up the list of concerns - ranking 20 in the most recent survey, up from 37. Similarly, climate change moved to 31 on the list from 45.

For UK risk managers, the biggest concern was damage to reputation and brand, while Brexit was number two on the list of worries.

“Extensive media coverage of corporate scandals, such as the product recall by a French diary giant over salmonella scares, the US Justice Department’s action against healthcare professionals who dealt in illegal prescription of opioids, the resignation of a European banking executive over money-laundering schemes as well as a number of massive data breaches, have made survey participants more aware of their organizations’ exposure to reputational risk,” Aon said.

And there is a further concern about how the individual risks on the list interact with each other. The CEO of Aon’s UK business Julie Page said: “The survey highlights the growing interconnectivity of risk faced by organisations today.

“Cyber risk, which is ranked third in the UK, is a major contributor to damage to reputation and brand, which survey respondents in the UK ranked as the number one risk they face,” she continued.

“At the same time, business interruption, which is ranked number six in the UK this year, is influenced by several of the top ten risks, including Brexit, cyber-attacks and economic slowdown.”

It may not stop there. Page says UK respondents expected cyber risk to increase.

And there is good evidence to support that. Many industries, such as banking, government agencies, healthcare, insurance and technology companies, already consider cyber-attacks to be their number one risk.

“In a weakening economic environment, companies are more sensitive to volatility, particularly from emerging risks such as cyber-attacks, business interruption from non-physical threats and shortages of skilled workers,” said Aon boss Greg Case.

“These risks are less well understood as there is less experience and less data available to help manage them.

And, as a result, risk managers are less prepared for those risks.

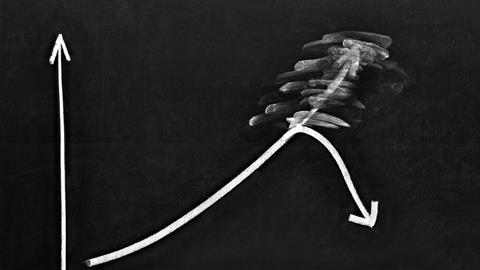

Despite the plethora of risks facing businesses in late 2018, when the survey was conducted, risk managers reported their lowest level of readiness in 12 years.

At the time of the survey, two of the world’s oldest democracies were struck with national emergencies - the month-long government shutdown in the United States, and the chaos surrounding Brexit.

“Companies of all sizes are struggling to prioritise their risk management efforts amid so much change and uncertainty,” said Rory Moloney, who is head of global risk consulting at Aon.

“What was once a tried-and-true strategy for risk mitigation – using the past to predict the future – is now less reliable and coupled with a more competitive global economy, it is causing an all-time low level of risk readiness.”

“As a result, risk management plans need to take a different approach than they have in the past.”

Stunningly, only 20 percent of respondents said they use risk modelling and 10 percent said they have no formalised process in place to identify risks.

No comments yet