Is fleet risk management just a poor sister in your organisation? John Stevens argues that is too important to be left out in the cold, and needs to be integrated into enterprise risk management. He suggests the solution.

Ideally fleet risk management should involve an enterprise-wide process for integrating the risk management of fleet and related risks at strategic, management and operational levels. One that covers risks across a full range of business, commercial, operational and support functions. It needs to identify and assess risks across the whole organisation and its supply chain, within fleet management support, vehicles, drivers, loads, sites, journey and delivery.

The use of fleet and related operations to satisfy supply chain needs has substantially increased over the last ten years. The procurement of goods from overseas has grown significantly, with increasing outsourcing to overseas production. Land-based alternatives to road transport have almost disappeared; coastal sea transport has not stepped in to fill the gap, so road-based transport methods have become the automatic choice. Additionally, the supply chains of many organisations require the use of fleet and related services to deliver 'just-in-time' fulfilment. The growth of the internet and general consumer spending has created a demand for 'instant customer fulfilment', both home-based delivery and local retailer availability. As a consequence, traffic volumes have grown significantly, and congestion is a major concern for many organisations. In turn this has raised concerns about environmental impacts and provoked a growing discussion about viable alternatives.

So, where does fleet risk management sit in this scenario, and how can it contribute to valid solutions that maximise opportunities for an organisation, whilst minimising risks?

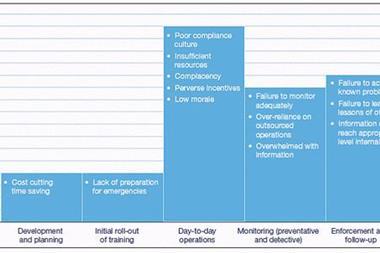

Fleet risk management is often viewed as a pure operational level activity, and other organisational functions – production/operations, finance, commercial, procurement, human resources and quality – are only considered in their departmental silos and not fully integrated with fleet activities. Rarely does fleet management receive a high level of management attention and very rarely is it considered as a strategically important corporate risk to be consistently managed as a key aspect of the business. Yet with the importance of fleet transport ever increasing, this risk area is one that can not be ignored.

Initiatives typically deal with driver recruitment and training, human resource issues, vehicle purchasing and allocation, fuel consumption, accident data and post accident management. Resulting control measures normally only relate to the core focus of the initiative.

Pressures are increasing to think of new ways to reduce and manage risks and exposures and maximise organisational benefits from improved risk management. Organisations are therefore looking for new ways to identify how they are creating risks across their operations, whether directly or indirectly managed and how risk management can add new value to business success.

ERM and fleet risk management

Enterprise risk management enables an organisation to develop and implement a consistent approach to managing risk across its entire organisation. Corporate governance requires the enterprise to identify its risks throughout its total operations and prepare a strategy to reduce the impact on the business and its stakeholders.

The integration of fleet risk management within an overall ERM process will provide an opportunity for an organisation to set a risk appetite for the management of its fleet and related risks and manage improvements and opportunities accordingly. It will also elevate fleet risk management to a strategic level activity, with resulting benefits.

Research

Our research showed that organisations with fleet and related operations need a sustainable reduction in overall fleet risks and costs, vehicle and personal injury accidents, insurance claims and premiums and diverted management time and resources. They also need tools and techniques to improve the management of a broad range of fleet and related risks and to assist the process of integration with normal business processes. The ability to benchmark internally and externally is a key requirement. And it is important that any approach identifies the underlying causes of risk and also opportunities to improve controls to benefit the business.

“Rarely does fleet management receive a high level of management attention

We identified that current interventions are mostly compliance based, operationally focused, dealt only with a specific fleet management process and often use a tick-box approach. Some organisations do have management systems, but in the main these are focused on a compliance approach, for example health and safety, and they vary greatly in effectiveness, business relevance and added value.

There is clearly a need for a holistic approach to cover a full range of fleet and related operations, that could be part of an organisation's ERM system. In addition any approach has to include a full range of risks at strategic, management and operational levels, cover a full range of business functions, be linked to the overall business performance measurement process and provide benchmarking functions. It is time for a real step change.

Fleet and related operations

Fleet and related operations cover a very broad range of organisational and business activities in virtually all sectors of the economy. Fleet and related operations are used in a wide variety of road transport circumstances, across widely variable organisations. These differences can mostly be encompassed within two broad types of organisations that use fleet and related operations:

n Customer organisations those that use fleet and related services as a supporting activity, for example food or clothing retailers, utility companies, emergency services

n Supplier organisations those where fleet and related operations are their main business activity, for example contract logistics companies, supply chain partners, vehicle suppliers.

These types of organisation have greatly different risk profiles and risk management needs, both in type and level, requiring the application of a specific mix of strategic, management and operational risk managing activities.

Corporate risk assessment

A logical starting point to create a valid and effective methodology is to build on a proven process.

Our approach was developed using a combined total of over 100 years of international experience in the development and implementation of fleet, health and safety, fire and business continuity risk management systems. It was developed in response to the need for a process with a business wide focus that is comprehensive, commercially relevant and risk based. The approach has been used successfully for over 15 years.

The process has three steps:

“The use of fleet and related operations to satisfy supply chain needs has substantially increased over the last ten years.

1 Determine the risk profile of an organisation, by identifying how it is creating risks and expose the implications for fleet and related operations

2 Evaluate existing fleet risk management systems to determine their relevance and effectiveness to meet organisational needs

3 Identify opportunities and develop new management systems to improve fleet risk management controls and facilitate their integration with normal business processes

Fleet risk profiling concept

The corporate risk assessment process provided significant benefits over traditional risk assessment methods, but to meet a complete range of needs further development was required.

The primary objective was to produce an online comprehensive risk profiling, risk assessment and benchmarking process which used valid risk management methodologies, produced consistent added value outputs and covered all types of fleet and related operations and risks at all levels.

Additionally the process needed to be flexible, adaptable, usable for a corporate level review, on a site-by-site basis for multiple sites and for an organisation's supply chain.

With the growth in multinational organisations, the process needed to use generic content that did not relate to specific legal requirements.

Fleet risk profiling process

The online process that was developed uses the following steps.

1 Appoint an administrator to manage the use of fleet risk profiler, including the allocation of users to undertake the process.

“Initiatives typically deal with driver recruitment and training, human resource issues, vehicle purchasing and allocation, fuel consumption, accident data and post accident management. Resulting control measures normally only relate to the core focus of the initiative.

2 The main user identifies the operational risk profile of the organisation or site being assessed. Over 10 operational risk factors are used to identify an overall level of risk. The overall level of operational risk sets the risk levels for the next step.

3 The user or multiple users undertake the risk assessment process via risk areas, risk elements, risk managing status factors and performance metrics, using over 600 data elements. The users only select the risk areas and risk elements that are relevant to their organisation or site, ensuring that the organisation is only assessed against relevant criteria and not against an artificially set level.

4 Automatic reports are produced and provide a strategic overview, management information, detailed analysis and action plan guidance.

5 Benchmarking options provide a full range of internal and external comparisons to be used for action plan development.

6 A regular repeat review is used to identify action plan status and improvements in risk managing performance.

An organisation can customise the content to make it even more relevant for their fleet and related operations, including the development of an internal standard.

Fleet risk profiling benefits

Fleet risk profiling creates an enterprise-wide process for integrating the risk management of fleet and related risks at strategic, management and operational levels. Risks are covered across a full range of business, commercial, operational and support functions, and across the whole organisation and its supply chain.

Such a process provides a wide range of benefits and enables an organisation to set its own risk appetite for the management of fleet and related risks. Furthermore, it adds value to client and contractor relationships by risk profiling and undertaking due diligence of supply chain partners. It can be used as an internal standard, including customisation of the content to meet specific needs.

The setting of a relevant risk managing target, rather than an artificially imposed one, enables an organisation to focus on its risks. Benchmarking options (including within fleet industry sectors) provide internal and external comparisons to enable an organisation to set a specific risk managing control level and associated resource allocations.

The development of a risk-based focused action plan to achieve a relevant risk control level leads to reduced risk exposures and costs, resulting in major benefits for an organisation and its insurers.

Case studies

- A third-party logistics company used a corporate risk assessment for a strategic review of its organisation and fleet risk management process. The report was used to develop a range of enhanced control measures at strategic and management levels. The next step was to identify in detail the fleet and related risks across the whole organisation, including all sites that used vehicles and related services. Fleet risk profiling was the method chosen for this, with the automatic reports and benchmarking data being used to create targeted actions for each site. Progress is being reviewed at regular intervals .

- A facilities management company used a corporate assessment and then site-by-site profiling. They operate from multiple sites throughout the UK with different levels of fleet usage and with over 1500 vehicles of all types. They needed to initially identify the status of their corporate fleet risk management policies, and then to risk profile and assess each site to identify their most significant risk exposures. A detailed account plan was developed at corporate level and on a site-by-site basis using the automatic reports and benchmarking data. A progress review is scheduled using the fleet risk profiler process.

Postscript

John Stevens is managing director and head of strategic fleet risk management product development, Risk Frisk Ltd, www.riskfrisk.com

No comments yet