PCI blames ‘huge’ and ‘growing’ risk from storms in the region

Florida lawmakers have subpoenaed property insurers in an investigation of the high cost of property insurance in the state, according to reports.

Florida’s Senate Banking and Finance Committee plans to hold a hearing in February to probe why home insurance rates have not declined a year after the state doubled its hurricane insurance pool to at least $32bn.

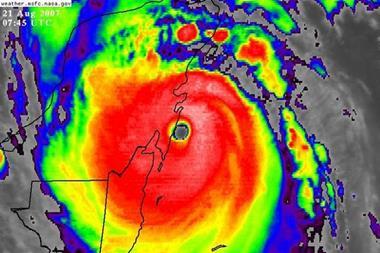

The Property Casualty Insurers Association of America (PCI) said: ‘ Florida lawmakers’ continued search for someone to blame for the state's property insurance woes ignores the real problem: the huge and growing financial risk that we all face from the next storm.’

The PCI went on to say that 80% of the insured property in Florida is vulnerable to storm losses, a figure which it said is growing as development in high risk areas continues.

It added that innovations—like catastrophe bonds and building regulations—would help insurers.

Florida was devastated by four hurricanes in 2004 and battered by Hurricane Katrina in 2005.

No comments yet