What happened?

UK brokers are failing to consider ESG factors when evaluating insurers, according to new research from GlobalData.

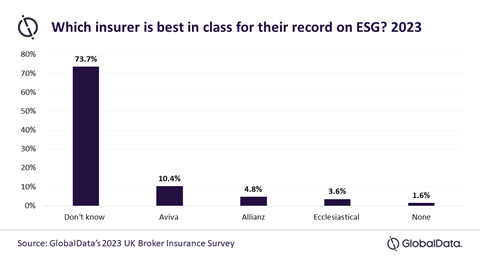

The research found that fewer than a quarter (24.7%) of brokers surveyed could name the best-in-class insurance firms when it came to vital environment, social and governance (ESG) factors.

1.7% actively chose ‘none’, but just under three quarters (73.7%) said they did not know. The leader was Aviva, though it received just 10.4% of total responses.

When asked what factors were most important when choosing to work with an insurer, being strong in ESG received no responses.

The top answers were flexibility in underwriting cover (23.5%), claims service quality (19.9%), price of premiums (17.9%), the quality of the insurer’s product material (8.0%), and speed of response to queries/quotes (7.6%).

”This level of uncertainty suggests that brokers do not consider ESG to be essential when working with insurers”

This shows that day-to-day business concerns are still far more important than more long-term ESG theme in the eyes of brokers.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, commented: “This level of uncertainty suggests that brokers do not consider ESG to be essential when working with insurers, as very few brokers are able to identify insurers who are strong in the area.”

What does it mean for risk managers?

For risk managers, ESG is a growing concern. FERMA’s annual risk manager survey found that wo of the top three risks on a 10-year horizon are climate change and environmental change, and natural disasters.

A significant proportion of the risk managers (41%) believe that some operations or locations could become uninsurable.

The same survey found that risk managers are increasingly involved in sustainability matters and the management of environmental, social and governance (ESG) related risks.

More than half (56%) said they were playing or planning to play a significant role regarding ESG risks, compared to just 40% in 2020.

A significant proportion of risk managers (41%) believe that some operations or locations could become uninsurable, due to environmental or climate factors.

Furthermore, there has been a 12% increase in collaboration with corporate social responsibility / sustainability; 37% of risk managers said they work together closely and 3% said it is now a risk management responsibility.

Against this backdrop, the news that UK brokers are not able to evaluate which insurance firms are doing well in ESG is a significant cause for concern.

Carey-Evans said: “The more innovation and progress that brokers see from insurers, the more likely they are to prioritize it as a factor in building relationships, especially as the theme is only going to grow in importance.”

What next?

As the occurrence of extreme natural weather events continues to increase at pace, organisations need to develop their capacities with regards to climate change and environmental risks.

The more ESG is perceived as a strategic risk and critical for business transition, the more risk managers have a pivotal role to play in ensuring that the ESG approach is embedded in their organisation’s strategy.

This may mean leaning on brokers to ensure that ESG is a critical factor when choosing an insurance providers or finding new ways to evaluate the ESG credentials of potential partners.

”Quantitative and qualitative data on sustainability risks will probably remain at the top of the challenges for risk manager for some time.”

In its risk manager survey report, FERMA said: “Raising expectations for companies to act with responsibility and to care for the present and future society brings new challenges for enterprise risk management.

“There is an international debate on simple versus double materiality… Different voices and trends disagree on that principle, with an EU position clearly supporting double materiality and consideration of companies’ impact on environment, people and broadly society.

“Therefore, top management should be aware of all the potential risks the business model may have on its ecosystem and ensure appropriate resources are in place to actively manage these risks and limit their associated impacts.

“With this in mind, quantitative and qualitative data on sustainability risks will probably remain at the top of the challenges for risk manager for some time.”

No comments yet