Insurance resilience is lowest for natural catastrophes, with the protection gap growing to a record $1.4 trillion

The COVID-19 crisis has reduced global macroeconomic resilience by close to a fifth in 2020, according to the Swiss Re Institute’s Resilience Index.

Global economic growth is expected to recover strongly this year after the pandemic-induced recession in 2020. This will help to build macroeconomic resilience again, but there will not be a return to pre-COVID-19 levels of resilience in 2021.

Meanwhile, the global insurance protection gap reached a new high of around $1.4 trillion in 2020. However, global insurance resilience is expected to grow in 2021 due to increased risk awareness.

Jérôme Haegeli, Swiss Re Group chief economist, commented: “Our study clearly shows that economic resilience pays off. Advanced regions benefitted from both stronger levels of macroeconomic resilience and health insurance resilience than their emerging counterparts. However, to restore macroeconomic resilience and drive long-term growth, deep structural reforms are needed.

“The global pandemic has accentuated the gap between the rich and poor. It has laid bare the need for governments to focus on rebuilding and promoting social cohesion. Social equity – and at its heart, creating equal opportunities for all – will be a defining feature of a more resilient world.

“The global insurance protection gap reached a new high of $1.4 trillion. Closing this gap would both support long-term economic stability and increase society’s capacity to absorb shocks.”

“Making insurance more widely available and affordable will be essential. But re/insurers and leaders in business and government must make resilience a shared priority.”

Key findings include:

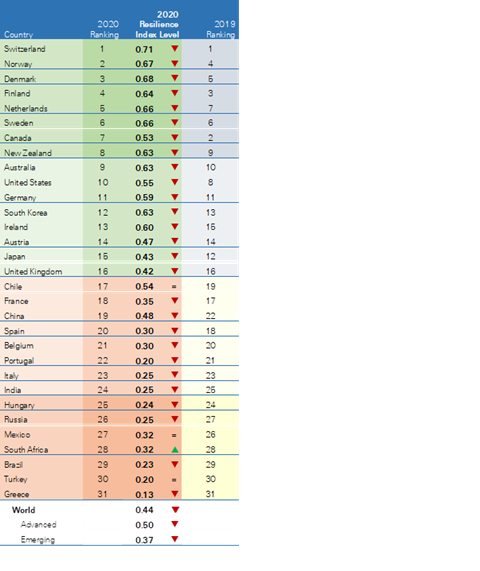

- Global resilience has significantly weakened due to the COVID-19 crisis, with the Macroeconomic Resilience Index falling to 0.44 from 0.54 in 2019. This was driven by extraordinary levels of fiscal stimulus in advanced markets to cushion the economic blow of the pandemic. For instance, as of January 2021, both the US and UK allocated roughly 30% of their GDP to spending and liquidity support for their economies.

- Consequently, government debt levels in advanced economies rose by more than 16%, the largest annual increase since the turn of the century. These increases were accommodated for by very loose monetary policy, which kept a lid on debt servicing costs.

- With a strong economic recovery in 2021, Swiss Re Institute forecasts global macroeconomic resilience to strengthen, mostly driven by the advanced economies, but doesn’t expect a return to pre-pandemic levels this year.

- Structural reforms must remain a priority to build long-term growth prospects and replenish macroeconomic resilience.

- Growth in countries with higher levels of macroeconomic resilience pre-pandemic, such as Switzerland and Norway, was stronger during the global downturn than in others, such as Spain and Greece. Switzerland, Norway, Denmark, Finland and the Netherlands are the most economically resilient countries, while Mexico, South Africa, Brazil, Turkey and Greece are the least resilient.

- Global insurance resilience is expected to strengthen in 2021, underpinned by rising risk awareness. For many people, the COVID-19 experience has highlighted the importance of risk protection covers.

- The combined world protection gap for health, mortality and natural catastrophe risks reached a new high of around USD 1.4 trillion in 2020 amidst the pandemic crisis.

- The global SRI Health Resilience Index weakened slightly in 2020. Emerging markets with lower health resilience were most vulnerable. The global health protection gap widened to USD 747 billion in 2020, 63% of which derived from the emerging markets.

- Mortality resilience weakened due to a drop in financial assets and growing household debt amidst the pandemic crisis. The global SRI Mortality Resilience Index slipped to 45.8 in 2020 from 47.5 in 2019.

- Global natural catastrophe resilience remains the lowest of all, with the global index reading at 24% in 2020, meaning that 76% of these protection needs around the world are uninsured.

No comments yet