One of the most high profile ongoing cases is the ClientEarth case against 13 directors of energy giant Shell

Environmental, social and governance (ESG) concerns are now a business imperative for UK companies as British courts tackle a rising tide of legal actions concerning corporate approaches to ESG issues.

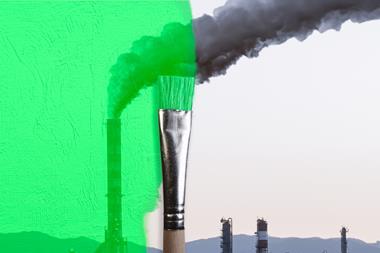

Carmel Green, partner at law firm RPC, warned that the risk of corporate greenwashing was on the rise as activists, shareholders and regulators were becoming increasingly concerned that companies’ sustainability-related claims could be substantiated.

UK courts have also issued judgements that have seen UK parent companies deemed liable for the actions of their overseas subsidiaries and their ESG impacts.

She said that firms involved in ESG-related litigation had made numerous legal challenges to slow the progress of the cases – while many cases have been ongoing for years, no substantive claims have yet been upheld.

Green said the eventual results of the cases were likely to have a fundamental impact in future litigation.

Eyes on Shell lawsuit

One of the most high profile ongoing cases is the ClientEarth case against 13 directors of energy giant Shell.

The charity has alleged that Shell’s directors failed to ensure the company met its ESG obligations under the Paris agreement has not met emissions reduction targets.

The Paris Agreement, or Paris Climate Accords, is an international treaty on climate change adopted in 2015 that sets out goals for signatories aimed at mitigating global temperature rises.

Green told delegates at the firm’s Global Access Conference that companies needed to turn the growing issue into an opportunity to provide directors and officers (D&O) cover.

“Directors and insurers in the UK need to brace themselves for a rise in claims as the courts look to make judgements and we see both activists and shareholders looking for companies to meet their ESG obligations,” she said.

“However, for insurers there is also the opportunity to make a real impact on their clients’ corporate agenda around ESG.

“In terms of today’s corporate culture, ESG is a business imperative for every company.”

Both risk and opportunity

She added that there were multiple ways insurers could take advantage of growing concern around ESG risks.

She explained: “We have already seen broker Marsh looking to work with insurers to create schemes which will offer more favourable insurance terms to US companies which have validated ESG frameworks.” .

“Regulated companies with good ESG risk management will be likely to suffer less D&O risks.”

She noted a recent study by consultant PricewaterhouseCoopers that found 83% of consumers believed companies had to shape future environmental practices, while 75% of shoppers would avoid spending with firms who were not delivering on their ESG responsibilities.

“There is so much ESG related legislation with which companies need to ensure compliance,” she explained.

“Aside from climate change, most ESG cases we see are not around laggards, but around best-intentioned efforts to address ESG issues that have failed to deliver the desired results.”

No comments yet