The conflict in Ukraine was the main driver of risk in 2022 with rising inflation sparking discontent further afield

Political risks stand at a five-year high globally, according to data from Verisk Maplecroft covering civil unrest, conflict intensity and government stability.

After two years in which the Covid-19 pandemic served as the primary source of global instability, the conflict in Ukraine was the main driver of risk in 2022.

As a result, political risk at the start of 2023 is at the highest global level in the last five years. Russia’s invasion sparked an upheaval of geopolitical norms that had existed since the end of the Cold War and the fallout will continue well into the foreseeable future.

Runaway inflation and the rapid reshaping of the global energy system, both of which combined to fuel an unprecedented rise in socioeconomic tensions, will remain key factors in 2023.

Conflict returns to centre stage

Unsurprisingly, Ukraine saw the sharpest annual uptick in risk on Verisk Maplecroft’s Conflict Intensity Index, which measures the severity of armed conflict in a given region.

Ukraine is now the 5th highest risk country on the index, down from 24th at the start of the year. Russia, meanwhile, has fallen to 26th highest risk, down from 33rd in Q1-2022.

“The fallout from armed conflict will remain a key risk trend for corporates, investors and insurers in 2023,” says Verisk Maplecroft’s Head of EMEA Research, Hugo Brennan.

“The war in Ukraine is likely to escalate as both sides prepare for spring offensives; conflict and insecurity will continue to destabilise pockets of Africa; and interstate tensions risk tipping over into fighting in parts of the Caucasus, Central Asia and the Balkans.”

Looking beyond Europe shows that 2022 was a year defined by conflict at a global level. 26 countries saw a significant uptick in risk on the index over the past year, compared to just three across 2021.

The ongoing civil war in Myanmar saw the country downgraded to 3rd highest risk in the index, down from 12th at the start of the year.

Ethiopia’s sharp deterioration – down to 12th from 20th – is also a result of civil conflict, although there are hopes that the Ethiopia-Tigray peace agreement will arrest this decline.

Runaway inflation and cost-of-living crisis

The turmoil brought about by the war in Ukraine and Western efforts to break the dependence on Russian energy have contributed to rising inflation on the price of staple foods and energy.

Indeed, 75 countries saw a significant uptick in risk on Maplecroft’s Inflation Index in 2022, which measures the rate of CPI inflation for a country relative to historical rates among regional economic peers.

“The cost-of-living crisis is forcing Western governments to take unprecedented steps to protect consumers and domestic industries,” adds Brennan. “2023 will be a year where respect for free markets takes a back seat to state intervention and industrial policy in Brussels, London, Washington and beyond.”

Social pressure cooker builds

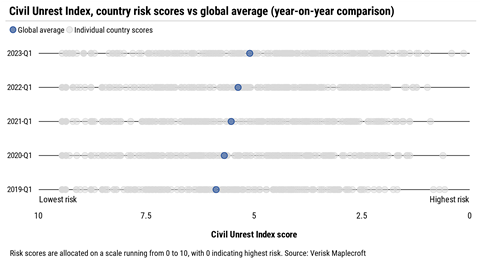

This upheaval added fuel to social and political pressures that had simmered since the outbreak of the pandemic. Data from Maplecroft’s Civil Unrest Index shows that 48 countries registered a significant uptick in risk throughout 2022, the biggest ever annual rise recorded in the index.

The impact of this was felt worldwide, stretching from Europe – where farmer protests roiled the Netherlands, France and Italy – through to emerging markets including Sri Lanka, Peru and Kenya.

This unrest has had a tangible impact on political stability. In July, protests driven by socioeconomic unrest forced the resignation of the Sri Lankan president.

As shown by the unrest seen in Brazil and Peru in January, socioeconomic pressures that simmered throughout 2022 are likely to boil over in the year ahead.

“As the social pressure cooker proves increasingly unable to contain the discontent of populations facing protracted economic hardship, the frequency and magnitude of the backlash against political institutions will remain near boiling point throughout 2023,” says Verisk Maplecroft’s Chief Analyst, Jimena Blanco.

“It is likely no region will be spared, but the Americas will be particularly hard hit.”

No comments yet