How global risks are altering our journey to net zero and what this means for businesses

For many, 2022 was a year of turmoil and tipping points. After emerging from the pandemic,optimism was stymied by geopolitical tension and inflation. One constant has been the global drive towards a net-zero future.

Global interconnectivity (including international trade, support, and migration), collaboration, and co-operation are essential for addressing climate change. However, there are several global risks and trends altering the backdrop against which we are progressing towards a net-zero future.

At COP27, we saw world leaders gather once again in Egypt to progress commitments and plans to mitigate climate change.

The challenges of galvanising change were highlighted a year earlier during COP26 – as Alok Sharma, COP26 president, notably stated at the end of the Glasgow gathering:

“We can now say with credibility that we have kept 1.5 degrees alive. But its pulse is weak and it will survive only if we keep our promises and translate commitments into rapid action”.

Despite this cautionary message, COP27 demonstrated that the pace of change is dictated by more than the diminishing viability of the 1.5 degrees C target.

Conflict and inflation

Global inter-connectivity (including international trade, support, and migration), collaboration, and cooperation are essential for addressing climate change. However, there are several global risks and trends altering the backdrop against which we are striving for a net-zero future.

The question is, are these trends here to stay, and what does this mean for businesses? To answer this, we need to explore how recent geo-political unrest, inflation, and wider realities of the growth cycle are changing the world around us.

One of the biggest challenges of 2022 has been the Russia-Ukraine conflict and the impact it has had on the rest of the world. The speed and severity of action has caught many dependent countries unprepared.

Resulting back-up plans, and the implications of commodity supply change, have driven significant direct and indirect inflationary pressures into the wider global economy.

Sanctions have taken effect and are reshaping market pricing (see following rebased commodity and gas pricing last 24 months). This has led to steep increases in wholesale gas pricing and subsequently to many countries having to change their energy mix strategies.

Now, natural gas price rises are out-striping many other commodities, which in-and-of-themselves were bad enough due to post-pandemic demand-side increases.

When coupled with capacity constraints, again related to the Russia-Ukraine conflict (note 2019 wheat and cooking oil exports from Ukraine below), one can see the drivers and leading indicators of inflation and how they track back to the conflict.

Energy market pressures

Local energy policy is equally fraught; to some extent, the proximity to business has a more immediate impact on risk considerations and approach.

In the UK, there has been some noted back and forth on the contentious fracking agenda. The three-year moratorium on fracking was recently lifted by at the time Business secretary Jacob Rees-Mogg, as attention was placed on domestic energy needs and almost immediately reinstated by his successor.

This speaks to a more self-reliant approach to power and energy, certainly from the UK, but also highlights the shifting sands of politics and how energy policy and risk for business can be affected.

This policy shift and reverse was during a particularly and uncharacteristically unstable time of politics in the UK, but certainly paints a picture of how energy polarises politics and intersects with commerce.

In the case of renewables, it is however fair to say, that the profit motive has needed stimulus, as low investment returns and tech and supply chain risk have led to modest institutional up take.

To get passed this notion of investability of these assets, and to create a stimulus seed of growth or a green injection, governments have mostly acted to bring the market pricing in-line with brown comparable generation assets.

This interventionist approach will likely continue for reasons of timings and alignment of interest; potentially tapering off as allocation of resources and profits normalise with the success of the maturing market forces.

Ever-evolving risk landscape

What can be seen now in terms of conflict in Eastern Europe and inflation, will likely and sadly be seen again over the horizon as we journey to a net-zero future over the coming years.

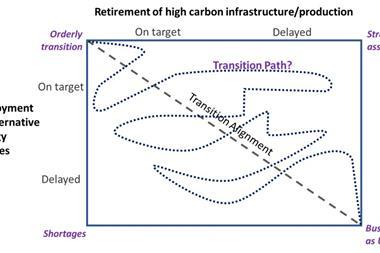

As politically motivated energy policy sharpens — balancing as ever national security needs against the new environmental considerations — we will see a (fundamental) tightening of traditional hydrocarbon supply.

This tightening is the goal, but geopolitical / energy security pressures may continue to impact the journey.

Changes to the risk landscape, by direct impact or value chain association, will be noteworthy and few businesses will be able to comprehensively isolate in their commercial and operating models.

Conversely, opportunity for those that embrace the transition will no doubt manifest.

New sources of green aligned and positive capital, creation of new markets, and interconnection opportunities will likely increase in availability.

The upside and downside to the economics of transition risk will now need to be considered fully in corporate strategy — not just as a procurement ‘price-at-the-pumps’ issue, but to the wider knock-on effects to many basic demand and supply side factors.

Charles Sincock is ESG Strategy Leader – UK Advisory, Marsh

1 Readers' comment