Deadly flash floods have left a trail of further devastation, with energy and chemical sectors among those exposed to supply chain disruption

Hurricane Ida is continuing to inflict damage and disruption as it moves up the Eastern Seaboard, claiming at least 43 victims in New York, New Jersey, Pennsylvania and Connecticut and leaving more than 150,000 homes without power.

The hurricane brought intense rainfall and floods as it moved northwards, submerging basements and causing power outages and further property damage.

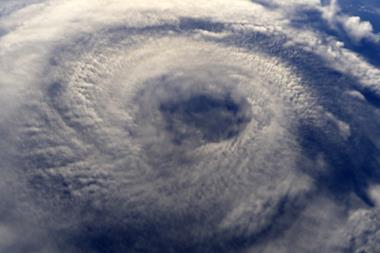

“Hurricane Ida has been an extremely complex event,” says Charles Blanchet, VP of Solutions at ICEYE. “This is particularly given the fact that the predicted storm characteristics changed significantly as it made landfall, with a reduction in the rate of inland travel and a shift in the expected track for the storm. Ida also underwent at least one eyewall replacement which increased the extent of rainfall impact.”

ICEYE combines satellite (SAR) imagery with multiple auxiliary data sets to perform rapid analysis of the flood extent and depth for most affected regions, including level of depth for individual buildings. This analysis is ongoing.

Not another Katrina for Louisiana

Initial damage estimates for Ida, which made landfall on 29 August - the 16th anniversary of Hurricane Katrina - on the coast of Louisiana, are for insurance losses of up to $25 billion for the state, according to AIR Worldwide.

The path was similar to that of last year’s Hurricane Laura, which resulted in about $5 billion in insured losses, but Ida landed further east and had more of an impact on New Orleans. This will likely result in a larger share of losses for the commercial lines, notes rating agency AM Best.

Even at the higher range of losses, claims are expected to be significantly lower than was the case with Katrina, which caused insured losses of $60 billion ($87 billion when adjusted for inflation) when it overcame the levees protecting New Orleans.

Due to the market dislocation in the aftermath of Katrina, commercial insurance and reinsurance pricing rose significantly. But the hard market was short lived as new, opportunistic capital entered the sector.

Greater resilience

In the 16 years since Katrina, flood defences have been substantially improved. Further, the trajectory of Ida and the fact its storm surge did not coincide with a high tide meant the city was better protected.

Charles Graham, Bloomberg Intelligence senior industry analyst, said: “Hurricane Ida will be bringing reinsurers a sense of déjà vu, with North Atlantic hurricane activity being the biggest event risk for reinsurers’ exposure currently.

“However, there are strong reasons to believe Hurricane Ida may not cause loss on the same scale as Katrina in 2005: the New Orleans’ flood-protection program has been substantially upgraded in a $14.6 billion project completed in 2011 and Louisiana has adopted new codes to reduce the vulnerability of buildings and the likelihood of wind damage.

Supply chains disrupted

However, additional wind and flood damage caused as Ida moves inland could increase the claims burden and drive up the cost of business interruption for affected industries.

There is also the potential impact of COVID-related inflation on the cost of rebuilding and restoration, particularly if there are further landfalling storms as the season progresses.

According to Adapt Ready, the energy and chemicals sectors could feel the brunt of supply chain disruption going forward.

The risk modelling firm notes a significant reduction in production capacities, due to both damages/electricity outages and any pre-emptive closures, including:

- Approx. 428 MMcfd natural gas refining capacity potentially at risk

- 5M barrels petroleum refining capacity at risk

- Dow Chemicals, Shell Chemicals, ExxonMobil are some of the well-known companies that will have significant reductions in their daily production capacities

The impact to these facilities will be felt long into the year, it anticipates, specifically by immediate consuming industries.

The chemicals sector is set to experience some of the largest impacts to its supply chains, especially the Plastics & Rubber industry that relies on chemicals from the impacted regions, including:

- Polymeric MDI (for foams),

- Polyethylene (for packaging materials),

- Butadiene (for tires), PVC and chlorine.

These issues are a double blow for firms which have already been affected by multiple challenges in the past year, including declaration of force majeures on key products like PVC after last year’s record-breaking hurricanes.

No comments yet