There will be strong growth in investment in renewable energy, smart and resilient infrastructure

Investment in infrastructure development is set to be one of the main drivers of sustainable growth in the emerging markets after the COVID-19 crisis subsides, the latest sigma says.

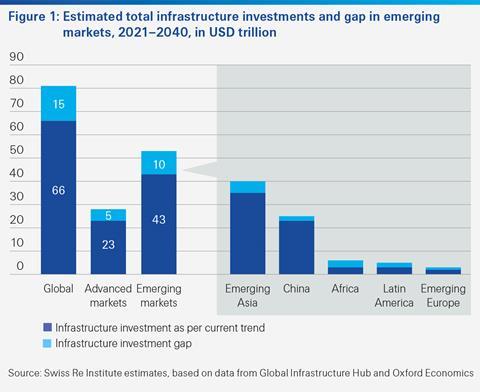

Emerging markets will invest $2.2 trillion in infrastructure annually over the next 20 years, equal to 3.9% of gross domestic product (GDP), according to estimates in the report. The energy sector, in particular renewable energy, smart and resilient infrastructure, and healthcare facilities are expected to attract strong investment.

“Spending on infrastructure could be one of the ways to kickstart parts of the economy after the COVID-19 pandemic and help drive strong and sustainable growth over the next decade,“ said Jerome Jean Haegeli, group chief economist at Swiss Re. “Most infrastructure spending will be in emerging Asia, which we also expect to be the engine of global economic growth.“

The sigma estimates that emerging market infrastructure represents an annual investment opportunity of USD 920 billion for long-term investors, including insurers. The construction and operational phases of infrastructure projects will also generate new demand for insurance solutions, with engineering, property and energy lines of business set to benefit most.

Prior to the COVID-19 outbreak, many emerging markets had already put multi-year infrastructure projects into motion, and the associated investments are not expected to drop off to the same extent as seen in previous crisis periods. The pandemic has also shown the urgent need for more investment in health infrastructure in many emerging markets.

Focus on renewal and sustainable infrastructure

Based on current spending trends and economic growth forecasts, sigma estimates that the largest share of the estimated investment in emerging markets will be in energy infrastructure (34%), with a core focus on renewable energy. Building and upgrading of existing infrastructure to become more resilient to climate change impacts will also be a key area of sustainable investment.

“In the coming years, Asia will invest more in infrastructure than anywhere else in the world, with the region’s emerging economies accounting for more than a third of associated spend,“ said Russell Higginbotham, Swiss Re chief executive, Reinsurance Asia. “Critically, infrastructure will enable sustainable growth by fostering improved productivity; while rising incomes and a continuing trend of urbanisation will mean that the composition of infrastructure needs will also evolve.“

China will invest an estimated $1.2 trillion (4.8% of GDP) each year, accounting for 35% of global investment in infrastructure and 54% of all emerging market investment in infrastructure. India will be the second largest infrastructure investment market, accounting for around 8% of all emerging market spend.

Africa will invest an estimated 4.3% of GDP in infrastructure, but the absolute levels will be low. Emerging Europe will invest 3% of GDP in infrastructure, in line with the global average, but spending in Latin America will lag at 2.3% of GDP.

Traditionally, emerging markets have relied mostly on public funding for their infrastructure needs. With government budgets under strain, the private sector will play a bigger role via public-private partnerships, and with finance-embedded risk transfer solutions, anticipates sigma.

Infrastructure-related insurance premiums to exceed USD 50 billion over 10 years, mostly from engineering, property and energy.

No comments yet