While COVID-19 was a stress test for society and the economy, it has an expiry date – climate change does not, warns Swiss Re chief economist

Global economic losses from natural catastrophe events in 2020 were $190 billion, according to sigma research.

In GDP-normalised terms, losses rose 1.6% between 1970-2020 on a 10-year moving average basis. This is indicative of the larger scale of losses that could result if an event of the past were to occur today, given the accumulation of socio-economic value and other dynamics such as changing weather conditions in the intervening years.

According to Jérôme Haegeli, Swiss Re Group chief economist: “2020 will be remembered for the global health and economic crisis triggered by the COVID-19 pandemic. But while COVID-19 was a stress test for society and the economy, it has an expiry date – climate change does not.

”In fact, climate change is already becoming visible in more frequent occurrences of secondary perils, such as flash floods, droughts and forest fires,” he warned.

”Natural disaster risks are increasing and climate change will significantly exacerbate them,” continued Haegeli. ”This underlines the urgency to better protect our communities against catastrophic losses while dramatically reducing carbon emissions.”

“Unless mitigating measures are taken, such as greening the global economic recovery, the cost to society will increase in the future.”

”In many regions of the world, the need to close protection gaps persists for both primary and secondary peril exposures. Re/insurers can do more to help people, businesses and societies become more resilient.”

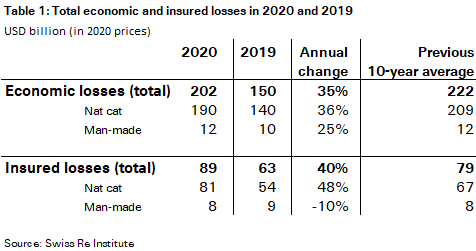

From a re/insurance industry perspective, insured losses from all of last year’s disaster events around the world were $89 billion, the fifth highest on sigma records. Other key takeouts from the report include:

- Global insured losses from natural catastrophes were $81 billion in 2020; man-made disasters resulted in $8 billion insured losses.

- Secondary peril events accounted for more than 70% of the natural catastrophe insured losses, resulting mostly from severe convective storms (SCS) and wildfires. In the last 10 years, SCS have contributed more than half of global insured losses from secondary perils. Given the high losses, this sigma includes a deep-dive on SCS specifically.

- However, 2020 also serves as a reminder of the peak-loss potential from primary perils. Notably, last year’s North Atlantic hurricane season was very active: it is just chance the storms hit areas of low population density/activity and/or low insurance penetration.

- Further, history indicates a similar trend of rising losses from primary perils, suggesting that future peak-loss scenarios could also grow significantly. For example, we estimate that in a year of both a peak-loss inducing hurricane season and multiple secondary peril events, combined annual insured losses could be as high as USD 250-300 billion.

- The underlying factors influencing primary and secondary peril event outcomes are the same, including changing socio-economic developments and climate-change effects. Primary perils are well-monitored by the insurance industry, but secondary-peril risks less so. Risk assessment efforts need to rebalance to make secondary perils a priority.

- Given the dynamic nature of risks, forward- rather than backward-looking data analysis is paramount so as to not underestimate the scale of potential present-day and future losses. to this end, risk model build also needs to de-bias away from reliance on historical data observations, which may not be a good proxy for present-day conditions.

2020 also serves as a reminder of the peak-loss potential from primary perils. Notably, last year’s North Atlantic hurricane season was very active

Martin Bertogg, Swiss Re’s head of Cat Perils, added: “We have seen an increase in losses from secondary perils in recent years, such as severe convective storms, floods and wildfires. The same upward loss trend for primary perils and 2020 serves as another reminder of their peak loss potential. The two peril types are affected by the same loss-driving risk trends, including population growth, increasing property values in exposed regions and the effects of climate change. This suggests that with climate change, future peak loss scenarios could also increase significantly.

”There were a record-breaking 30 named storms during hurricane season 2020 and a further record was set when 12 of those made landfall in the US. It cost the insurance industry $21 billion in claims. Yet, incredibly, we would regard that as somewhat of a lucky escape.

”Given the dynamic nature of risks, re/insurers’ risk models need to increasingly consider forward-looking risk trends, such as climate change, urbanisation and socio-economic inflation – rather than relying on historical data observations – when assessing the potential magnitude of losses.”

No comments yet