The latest energy market review from Willis Towers Watson outlines why energy volatility means supply chain resilience is more important than ever

What’s happening?

Market volatility is very likely to continue for the global energy sector, which remains beset by challenges.

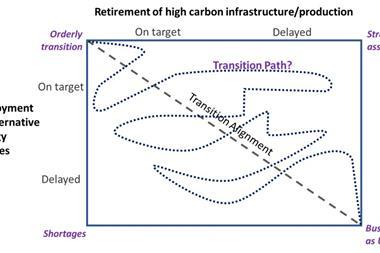

These include the necessity of net zero transition, dramatic price fluctuations, immature alternative development and adoption strategies, and a fluctuating regulatory backdrop.

What does it mean for risk managers?

The uncertainty resulting from these market disruptions is one factor fuelling continued insurance price increases across the sector, according to the Spring, 2023 WTW Energy Market Review published by Willis Towers Watson.

The review considers the future beyond “peak oil”, highlighting the challenges the energy sector faces, but also illuminating opportunities.

“Security of supply will remain a top priority for governments,” the Review states. “The US is responding to higher prices by striding ahead in all areas of energy production. If international governments follow suit, then operators and contractors are set to benefit.”

Paul Sankey, the carrier’s head of downstream says that the Ukraine war has revealed the energy industry’s integration with the global economy, as highlighted by Europe’s turn from Russian oil towards imported LNG.

”The need to maintain energy supplies today and the transition to clean energy tomorrow have never been more critical.”

He adds: “In the short term the world is focusing on energy security, and that shift alone makes the energy industry different, while other factors such as energy sustainability and energy affordability are also going to change it in the long term. As economies move away from their dependence on Russian natural resources, I think these changes are inevitable.”

Nicki Tilney, Head of Construction and Natural Resources, Asia, WTW, says: “The continuing fallout from the Russia-Ukraine conflict, ongoing inflationary pressures and more volatility in the prices of oil and gas meant that the need to maintain energy supplies today and the transition to clean energy tomorrow have never been more critical.

”Yet the supply chains that underpin these objectives are struggling to deliver the infrastructure and operational capacity to meet the demand.

“Our 2023 Energy Supply Chain Risk survey has shown that companies recognise the need to overcome these challenges and improve supply chain resilience, but they are hampered by an inability to get hold of enough accurate data to manage their risks.”

What next?

It is key for energy companies, including those in Asia, to work closely with their suppliers to better understand their supply chains. Diagnostic tools could help to increase visibility and support proactive risk assessment and decision making.

Andy Smyth, who leads the WTW Risk & Analytics team in London, says insurance managers need to understand fully their key risk drivers, how they may be mitigated, and how different strategies balance cost and the need for protection.

Justin Paglio, Senior Director for Risk, Forensic Accounting, and Complex Claims at WTW, adds that the new inflationary environment has altered the value of assets.

Risk managers should therefore re-evaluate them to optimise risk transfer and support a broader exploration of vulnerabilities and resource deployment. A Competence Management and Assurance Scheme can help reduce risk.

No comments yet