Data and analytics are key to the future of companies working in the insurance sector. The connected car and home and wearable devices offer a technological edge to insurers

The insurance industry stands at the precipice of significant change and disruption. The winners will be those best placed to leverage data and analytics in a way that helps them make better decisions.

Insurance companies remain under significant pressure, on both sides of the balance sheet.

Low interest rates, intense competition and the persistent soft market conditions have combined to present a tough operating environment precisely at the moment many need to overhaul their legacy IT systems and – using data more effectively than ever before – design products and services better tailored to the customer.

These opposing dynamics – the need to keep costs down and the urgent need to digitise – do not make easy bedfellows, says Celent’s insurance practice senior vice-president Jamie Macgregor.

“In the UK there’s a general tightening up of IT budgets, as aggressive market pricing and low interest rates continue to make a dent in insurers’ profits. Growth in distribution and finding profitable niches for new products still appear high on the agenda, although efficiency is now a very close second.”

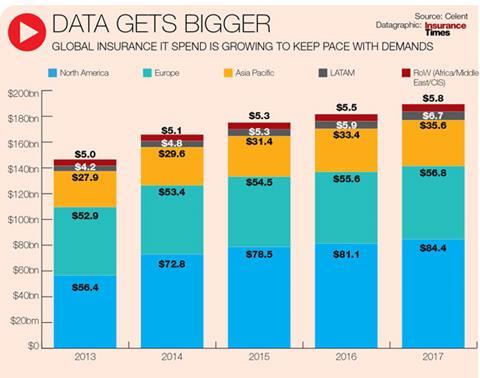

But it’s not all doom and gloom, and Celent estimates global IT spending by insurance companies will reach $181.6bn (£127bn) by the end of 2016.

“Digital remains a strong theme across the industry, although now with a stronger emphasis on a rapid return in value,” says Macgregor. “The days of wondering what digital might mean to the business are behind us now and execution is the prime focus.”

He says the insurance industry has some of the most exciting technology in the financial services area, with the connected car, connected home and wearable devices coming in on the personal lines side.

While, on the commercial side, the ability to bring together disparate systems offers the ability to better manage aggregators and price risk, even within emerging areas such as cyber.

“Finding a profitable niche that no-one else has yet identified is a critical competence for a modern insurer,” says Macgregor.

“Increasingly, it is the speed at which these niches can be identified and responded to ahead of the competition that’s key to whether you make superior or inferior profits.”

Amazon’s example

The insurance industry has in the past been accused of being slow to wake up to the digital revolution, but this is beginning to change. Guidewire data and analytics market strategy director Dawn Mortimer says retail giant Amazon offers a good case study in how the industry could move forward.

“It is phenomenal at milling that data and taking those analytics and serving up other items for me as a consumer. They’re often relevant – whether it be products or services – because they know so much about me. But they don’t do it in a way that’s invasive or Big Brother-like.

“Insurers have to be careful how they use the data,” she says. “You can use it as a carrot or a stick. You can use that data for good and to help that customer, or you can use that data and start surcharging the customer and taking penalties against them.”

Using data to penalise customers won’t win back trust, says Mortimer. “I have a survey that shows we are [rated] below dentists. The IRS and the telcos might rank lower on the trust scale than insurance companies. If we want to change that conversation, we can’t penalise customers for being willing to share their data.”

For those insurers who are ahead of the curve, the ability to spot new trends and underwrite a better book of business will offer a competitive edge. The challenge, once they have embraced the digital future, is in convincing customers – particularly in personal lines – that these new products and solutions are of value. Telematics, for example, has yet to take off in the mass market space.

“According to Celent research, 73% of consumers say they are selective when sharing their personal data with firms”, says Macgregor.

“To give up their personal data to an insurer to use in pricing or risk control, there has to be an answer to the question ‘what’s in it for me?’. This may be as simple as a price discount.”

With data exploding, the key to gaining a competitive advantage will be in isolating which data is of value and how to spot a niche to exploit within an otherwise saturated market.

Mortimer says: “Having worked for an insurance carrier in the US I can tell you there’s loads of data but nobody knows how to mine it. There is so much data that for many insurers, they have the IT resources they need, but with analytics it’s a new type of talent.

“Many insurers have many disparate systems, and those things are often in conflict. It’s a nightmare to try and pull everything together.

Data mountain

“Then there is the analytics aspect. Today there’s so much data, if you think about just the core systems and the transactional activities, not to mention emerging trends like telematics or Internet of Things in the home or business or even drones, it’s creating enormous amounts of data.”

For an insurer, the ability to bring all these data together across different classes of business offers much greater insight into any concentrations of risk. In a similar way to probabilistic catastrophe modelling, many carriers can now use analytics to model casualty clash aggregations and make more strategic decisions.

There remains uncertainty over whether insurers will be penalised for using this data.

The FCA’s consultation on the use of Big Data in retail general insurance could deem that by using health and wellness data as a rating factor, for example, insurers are unfairly selecting against the infirm, creating an uninsurable underclass.

In a sense, the need for Flood Re – the government and industry-backed insurance pool for properties at a high flood risk – came about as a result of better data and modelling. Insurers are now able to assess flood at a highly granular level.

And without Flood Re, cover would be prohibitively expensive or simply unaffordable for high-risk properties. The flipside to this of course is telematics, which has stepped in to solve a long-standing problem within the motor insurance world.

By monitoring their driving and offering feedback, telematics has offered young drivers more affordable insurance solutions which can also improve driving behaviour.

This article was first published by Insurance Times, StrategicRISK’s sister publication

No comments yet