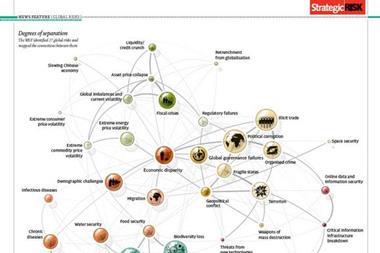

The risks associated with Black Swans are unexpected, complex and dealing with them can be laborious. When ANRA met in Milan this was the topic on the table

The question of how to manage the risks associated with Black Swans was one of the main topics of debate when the Italian risk management association, ANRA, met in Milan in November.

The breaking and forced rescue of major banks, the failure of great business empires like GM and Chrysler, the defaulting of whole countries, until recently, these were all considered extremely unlikely events. But, as ANRA delegates heard, recent developments prove that these scenarios are not unimaginable.

These risks are unexpected, complex and dealing with them can be laborious, so much so that senior management may not want to face them in a structured way. Despite this, it is the responsibility of the risk manager to find solutions to these questions. This was the story told to the Italian risk managers who had assembled for the day at the Palazzo Mezzanotte in northern Italy’s economic and cultural capital.

Uncertainty in the economy also took centre stage. In Italy, as elsewhere in Europe, businesses are concerned about the tremendous increase in public expenditure to support the economic recovery.

“The Italian government has injected millions of Euros into infrastructure projects in order to stimulate the economy. This may be good in the short term for some companies but we are concerned about the future long term implications and the negative impact of the stimulus, which has completely destroyed all previous efforts to reduce public debt,” explained Alessandro De Felice, group risk manager of Italian cable manufacturer Prysmian.

“The problem now is for the middle and small enterprises in obtaining credit. Credit insurers are very reluctant to provide coverage for new customers. This is affecting the economy. Credit risk has become a very important issue, because a lot of small and medium companies are not paying their suppliers and that is having a knock on effect,” added Felice.

Fortunately, Italy has been spared the financial pain inflicted by collapsing banks that require government rescue packages. With the exception of UNI Credit Group—which did experience some problems after it purchased financial firms in Eastern Europe and Germany that were exposed to subprime toxins—no Italian bank has had to be rescued.

“The behaviour of the Italian banks has been mainly conservative,” commented Felice. He also explained that, in some ways, risk managers appreciate this conservative attitude to risk. In these difficult times, by and large, the insurance sector has come up smelling of roses compared with the more speculative investment banks, noted Felice. “The insurance industry is reluctant to start investing in innovative aggressive financial schemes that caused the ruin of the banking system.”

Felice is also impressed by the way AIG managed its way through the crisis. “If you look at how the spin-off process of Chartis from AIG Group has been done this has demonstrated that the insurance part of that group is perfectly sound. It is in the position to spin-off an insurance company which is financially sound, and which knows how to do its business,” he commented. “I think AIG handled the whole matter in a professional way.”

At the same meeting ANRA also announced that it is re-launching its training season, organised through cooperation with the University of Engineering in Milan (Politecnico di Milano).

ANRA president Paolo Rubini, director of risk management for Telecom Italia, said: “We are extending the risk management programme to more students. The idea is to promote risk management in Italy and equip young people with the skills required to cope with the challenges facing professionals in the field of risk management.” ANRA plans several new training facilities all run through the university’s specific risk management department.