While India’s banks are not that exposed to the eurozone debt crisis, Italy is one of India’s key trading partners and would therefore suffer from an Italian default

India could be heavily affected if Italy, on of its key trading partners, was to default on its debts, warned Exclusive Analysis.

So far, India’s banks have not been particularly exposed to the debt crisis that has been causing so much trouble in the eurozone. The nation’s financial institutions are regulated by the Reserve Bank of India, whose regulations don’t allow foreign banks to own local ones. This limits the risk of Eurozone contagion spreading to Indian financial institutions.

While Indian banks have limited exposure to the eurozone banking crisis, Italy is a key trading partner. Italy accounts for 11.5 % of Indian exports, while the remaining PIIGS (Portugal, Ireland, Greece and Spain) account for less than 10 % of Italian exports all together.

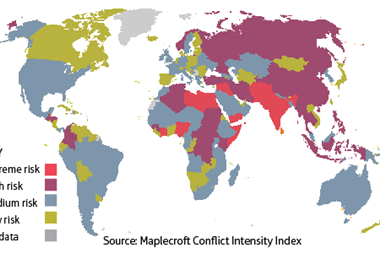

India is globally integrated in trade and financial markets and will feel the impact of its major trading partner’s downfall significantly, said Exclusive Analysis, which also predicted that an Italian default is “highly probable”.

As a result, like Russia and China, India has indicated its support for a eurozone bailout mechanism. India is likely to channel its financial assistance through the International Monetary Fund instead of direct intervention, though.

No comments yet