Brokers and insurers lack time, resources and the right culture to innovate effectively, survey finds. But many are starting to look outside the industry for what they need

Many brokers and insurers say they are too busy to innovate.

On top of that, they complain that they don’t have the resources, the internal culture or expertise necessary to drive forward new technology, new processes or new products.

But the industry is waking up to the need to innovate, and, while there is a lack of expertise within companies, many are looking outside for innovative expertise: either through strategic partnerships with technology companies or buying it through mergers and acquisitions.

These are the key findings of the Insurance Innovation Survey from StrategicRISK’s sister publication Insurance Times, in association with technology consultancy Ingenin.

The survey portrays an industry that is under-invested and ill-prepared for the wave of disruption through new technology, new products and new ways of business unanimously predicted to be coming.

Innovative thought

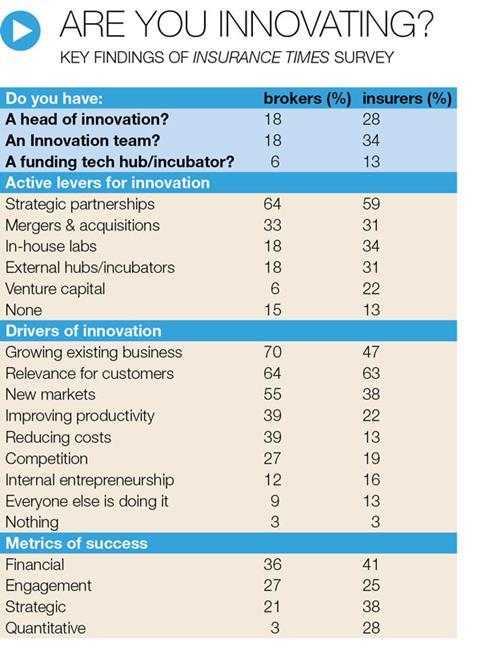

The survey found that, while some of the 33 brokers and 32 insurers polled have embraced innovation, there has generally been little overall movement towards more innovative thinking in the insurance industry over the past 12 months.

Last year, more than 70% felt they were unable to be more innovative because they lacked the skills or knowledge, or they couldn’t hire the right staff.

This year’s survey found a lack of internal culture held back 55% of brokers and 50% of insurers, while a lack of skills or knowledge hampered 45% of brokers and 41% of insurers.

Lack of time and resources

A lack of resources was cited by 61% of brokers and 50% of insurers, while 42% of brokers and 47% of insurers said they lacked the time to focus on innovation.

Only 18% of brokers had a dedicated head of innovation or a team responsible for innovation. For insurers, the figures were much higher, but still poor, with 28 % having a head of innovation and 34% an innovation team.

There is awareness of the need for innovation to protect business and develop new areas.

The business case

Brokers listed the need for current business growth as the biggest innovation driver, with 70% of respondents. Some 64% said innovation is driven by the need to develop products that are relevant to customers, while 55% cited a desire to move into new business areas.

For insurers, relevance was the key driver, chosen by 63% of respondents, followed by growth and new business areas.

When gauging the effectiveness of innovation, there is a clear key metric for both brokers and insurers – the impact on the company’s financial performance.

“Innovation funding and resources are scarce,” says Ingenin founder and chief executive Manjit Rana. “Neither cash nor staff is available for innovation efforts in any scaled quantity. At most organisations, therefore, innovation efforts are piloted either by a lean, dedicated crew or as a fly-by-night operation involving folks with other main responsibilities.”

Innovation culture

Rana says the main challenge for insurers and brokers is to create an innovative culture for generating ideas; and developing expertise to evolve them into market-ready propositions.

AXA UK head of strategy, M&A and innovation Parul Kaul-Green says: “For a highly regulated industry such as insurance, one of the key bottlenecks that we have identified is the cumbersome bureaucracy that surrounds attempts to introduce anything that is not ‘business-as-usual’.

“The structures built to mitigate risk of failure have had the consequence of slowing down innovation.”

Exciting industry

But she adds that insurance is “one of the most exciting industries to be innovating in. The opportunity to make significant societal change through customer-led problem solving is unmatched in our industry,” she says.

“The challenge is to keep ones enthusiasm in the face of conflicting priorities and risk aversion from the incumbent business model.”

No comments yet