More innovations in insurance linked securities

Despite softening property catastrophe insurance prices, the issue of insurance linked securities has picked up since March with further innovations in the perils covered and types of trigger mechanisms. By the end of July, there had been at least 13 new property catastrophe bonds issued in 2008 with a total of about $2.7 billion capacity, according to Artemis, the alternative risk transfer (ART) portal.

Issuance began rather slowly in 2008, but market experts are now more optimistic that new deals will exceed the value of those being retired, so that by the end of the year the total capacity placed in capital markets will climb beyond the $22 billion that it was at the end of 2007.

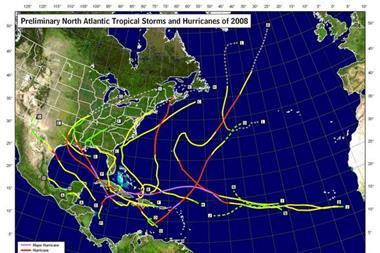

The largest transaction so far in 2008 is the $350 million securitisation by United Services Automobile Association (USAA), a personal lines insurer for US military families. USAA is now something of an old hand with cat bonds; this deal is the 12th in its residential reinsurance series. It protects the company against various US weather perils and natural catastrophes.

All but one of the bonds cover at least one US peril. The exception is that issued for Zenkyoren, Japan’s National Mutual Insurance Federation of Agricultural Cooperatives, which gives the company up to $300 million in protection against earthquakes via a collateralised reinsurance from Munich Re.

The most unusual structure is the one year retrocessional contract sponsored by Hannover Re to cover its US property catastrophe reinsurance contracts. It is called a side car because it allows investors equity participation in specific contracts alongside the company’s whole book. The deal was made up of $100 million of debt securities and $33 million equity.

Several of the transactions now include a geographically wide spread of perils, such as Flagstone Re’s $104 million deal that covers US windstorm and earthquake, Japanese typhoon and earthquake, European windstorm and protection against annual aggregate worldwide losses.

Sponsors are increasingly innovative in devising bond triggers, offering investors the comfort of some objective measure of loss while at the same time minimising basis risk. For example, Allianz’s $120 million hurricane risk bond uses as its default trigger state level loss estimates from Property Claims Services (PCS), but allocated down to county level to reduce the likely mismatch with Allianz’s own losses.

In addition to the property catastrophe issues, on the life insurance side, Munich Re has established a $1.5 billion bond programme to transfer extreme mortality risk to the capital markets in case of exceptional deaths from major pandemics or similar events across the United States, Canada, England and Wales, and Germany.

No comments yet