Gilbert Canameras, Amrae president and director of risks and insurance at Eramet, says the economic crisis is no longer a risk it is a reality. Risk managers now have to deal with the problems it has brought about

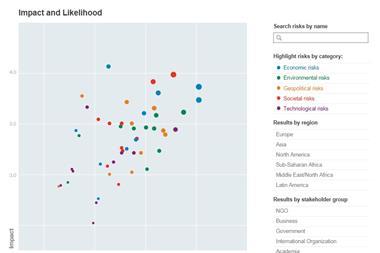

Financial crisis

One can’t really talk about the financial crisis as a risk anymore, it’s a fact. The question for risk managers is how to deal with the problems that the crisis has brought about, such as increased credit risk, counterparty risk and bankruptcy. The financial crisis was brought about by a scissor effect of excessive debt, causing an endemic problem in banks to explode, and the subsequent government bailout. As many governments now have huge stakes in major banks, excessive regulation in the financial sector could become a problem for business. With Basel III’s higher liquidity requirements affecting the flow of credit, it could prove to be difficult to effectively restart the economy. Risk managers need to know exactly how the general risks brought about by the crisis will affect their companies.

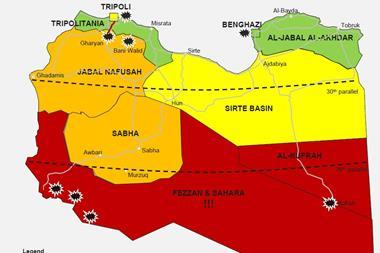

Political risk

As we saw in 2011, political risk presents a serious threat for business. This kind of risk is particularly relevant to emerging countries and markets where the slowdown in the world economy could bring about serious social unrest. This kind of risk isn’t limited to emerging countries, we have already seen serious rioting in Greece, and with heavy austerity measures coming into play in Spain and Italy, the question is whether the same kind of social unrest will spread. In general, governmental budgets will be hugely restricted in 2012 which will have a continuing effect on the economy and on the possibility of additional political risk. It’s the job of the risk manager to predict how these factors will manifest themselves, and plan a course of action to allow their companies to effectively deal with the situation.

We have already seen serious rioting in Greece, and with heavy austerity measures coming into play in Spain and Italy, the question is whether the same kind of social unrest will spread

Natural catastrophes

A third major risk is that of natural disasters or acts of God. 2011 saw several catastrophes including tsunamis and earthquakes, which had serious effects on the world economy. There is enough capacity in the insurance market to cover these risks but coverage has become more expensive in general, and some policies contain disclaimers which we must be aware of. Risk managers can’t prevent natural disasters but they can better prepare their companies to deal with them by examining logistics and, for example, organising alternative suppliers.

Cyber crime

In addition, I would also mention that cybercrime is a threat that cannot be forgotten, even if it’s no longer being covered by the mainstream media. Cybercime affects a huge amount of people and is a major reputational risk for companies. We have to deal with this issue on two fronts, by protecting our information systems and by educating our colleagues.

No comments yet