Staff and assets of foreign companies are considered legitimate targets by extremists

Continuing instability in Arab Spring countries and the threat of forced regime changes in various other nations are two of the biggest political risks in 2012, according to Maplecroft’s Political Risk Atlas.

The Index identified some of the most significant political risks for business and investors in 2012. It is based on 45 risk indices and maps built to identify the key issues affecting 197 countries.

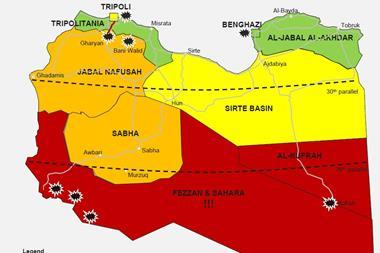

Of the ten states with increasing risk profiles nine are located in the Arab world. These are Algeria, Bahrain, Egypt, Kuwait, Libya, Morocco, Oman, Syria and Tunisia. Businesses are exposed to high security risks in these places.

“The risk posed to businesses by militants in countries that have been severely affected by the Arab Spring should not be ignored,” commented Maplecroft Director Anthony Skinner.

“There are particular concerns over al-Qaeda in the Islamic Maghreb, which has sought to exploit the turmoil in North Africa, while al-Qaeda in the Arabian Peninsula, has sought to take advantage of extreme instability in Yemen. Staff and assets of energy companies are considered legitimate targets by both groups.”

The Top Ten Political Risk Hotspots

| Rank | Country | |

| 1 | Somalia | |

| 2 | Myanmar | |

| 3 | DR Congo | |

| 4 | Afghanistan | |

| 5 | Sudan | |

| 6 | South Sudan | |

| 7 | Iraq | |

| 8 | Yemen | |

| 9 | Pakistan | |

| 10 | Central African Republic |

According to Maplecroft, a number of other countries have similar characteristics to those found in the Arab Spring countries, marking them as vulnerable to forced regime change. These include Bangladesh, Belarus, Equatorial Guinea, Guinea Bissau, Iran, Madagascar, Turkmenistan and Vietnam.

On the other hand, Maplecroft identified some countries that represent investment opportunities thanks to a reduction in political risk. These are Indonesia, Mexico and the Philippines. Strong growth in these countries helps provide the conditions for greater human security and socio-economic development, said the analysts.

Jim O’Neill, chairman of Goldman Sachs asset management and a Maplecroft investor said: “In a time of unprecedented geopolitical turmoil, political risk analysis has become essential for investors. Maplecroft’s annual evaluation of political risknot only identifies hotspots of instability, but shows investors which economies exhibit the hallmarks of future economic growth by revealing positive change over time. It appears that the BRIC economies might have turned the corner in that regard.”

No comments yet