Pay closer attention to cultural issues. You can have the best governance processes in the world but if they are carried out in a culture of greed, unethical behaviour and an indisposition to challenge, they will fail.

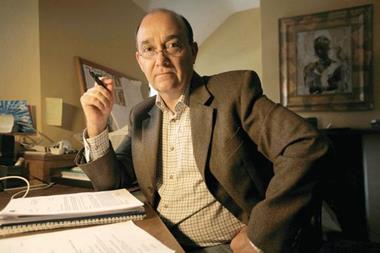

This was the message from Paul Moore, the former HBOS head of regulatory risk who blew the whistle on the failed British bank. Addressing the Airmic conference on Tuesday morning, he said the banking crisis was caused by a failure in organisational culture and ethics. “You can have the best governance processes in the world, but if they are carried out in a culture of greed, unethical behaviour, and an indisposition to challenge, they will fail.”

“People say culture is intangible, but it is absolutely possible to understand culture if you want to. We've got to find a way of being more analytical about it.” The former bank risk manager, who has since set up his own risk management consultancy, told delegates he was fired from HBOS after he raised concerns about the bank being overly sales oriented and its “cultural indisposition to challenge”.

He said the head of risk at the Halifax – a division of HBOS – once told him: “Risk management is not seen as a core business imperative or competence … Sales are regarded as more important than anything else.” Moore also said the head of HBOS’s risk management committee complained he didn't understand the first thing about risk. “I was totally flabbergasted,” Moore recalled.

He said it was this culture that caused all the problems for the bank. “Regulators have to start supervising culture,” he said. Moore was charged with conducting an internal investigation into HBOS’s risk management systems after the financial regulator raised concerns about the bank’s controls. After initially being tasked with this inquiry, he met significant opposition internally and was eventually given the shove. “If people don't like having their tyres kicked, that is a cultural indicator of significant risk,” he said. “Culture is more important in risk management than process or structure,”

Moore added. He also urged the risk management profession to up its game. “We need to professionalise ourselves to the same level as actuaries, lawyers and accountants.” He also insisted that executive management is far too powerful. “There has been a completely inadequate separation and balance of power between the executive and those responsible for overseeing and reining them in.”

Moore went on to complain that the current structure of corporate governance is “totally inadequate” and that those responsible for reigning in the banks, like auditors, non-executives and regulators, proved incapable of doing so. “I suggest a new dedicated, expert, non executive role,” he said. “Control functions should primarily report to this non executive.”

Read more about Paul Moore's story here: Advice from a whistleblower