The construction industry and its customers are in an economic vice, squeezed on one side by the downturn and, on the other, by radically reduced funding options, says Garry Booth

In today’s climate, inevitably, the risk management function is feeling the pressure and is being forced to adapt.

‘We’re seeing two very different responses from developers and contractors,’ says Tony Rastall, partner with insurance broker JLT Construction. ‘On one hand, risk management is seen as being non-core by some large groups and they are laying off risk managers. Other companies are taking the opposite view and are reinforcing the risk management function and looking to hire risk managers.’

Paul Hopkin, technical director of UK risk manager association AIRMIC, says that construction industry risk managers holding on to their jobs are being asked to do more with less. ‘Clearly, in an economic downturn, cost is more of an issue in the sector than in better times,’ Hopkin explains. ‘Managers across the board are being told ‘you must reduce costs by 5-10%,’ and risk managers are not immune from that. So some [companies] will be looking to cut their cost of risk by 5-10%.’

Antony Faughnan, head of commercial excellence at international built asset consultant EC Harris, believes that many companies recognise that they need to cut their overheads – and the risk management function, will inevitably come under the knife.

‘Management should be aware however that proactive risk management is even more important in times of uncertainty,’ he warns. ‘Business as usual is no longer an option. We are in a very different environment and we need to do things differently.’

Observers agree that there is no discernible cutting back on health and safety practices in the industry. If anything, the downturn makes construction companies more risk averse. Hopkin says: ‘They don’t want to have expensive accidents or hold-ups in this climate.’

Cost cutting is being passed down the infrastructure construction chain, with project developers increasingly cancelling bids and requesting contractors to tender again. Some are even asking contractors that are already engaged to re-price their contracts in view of the climate.

The recession has affected contractors’ entrepreneurial risk appetite on projects. Rastall says that in the boom times, when property speculation was at its peak, contractors were reluctant to take financial risks and so were not bidding on deals, or deliberately bidding too high. ‘But now, because of the downturn, contractors are more willing to take risk to get the contract – even though the risks to them are greater in this climate,’ he says.

Faughnan agrees that recession triggers different behaviours in the marketplace, some of which are not positive. ‘These can include contractors buying work by bidding below cost to secure cash flow, or taking on risks that in better times they would not take. It is little wonder that we tend to observe an increase in litigation in times of slow down.’

“Cost cutting is being passed down the infrastructure construction chain

Faughnan says there are three elements to sharing risk: designing an effective risk management framework; creating the right relationships, and ensuring your contract or service level agreement (SLA) reflects the terms and conditions you agree to.

Risk management frameworks allow you to identify risks, to understand their nature, their probability and likely impact, and to establish clear roles and responsibilities with your partners. In terms of relationships, sharing risks means collaborating, building up trust, seeking early involvement, creating transparency and stimulating innovation, he says.

‘Be clear through your SLA and contract what sharing risk means to both parties. Some suppliers will seek to take on risk, because they believe they are well placed to discharge it and make a profit,’ he says. ‘However, some may assume risk because they see it as necessary to secure work, or because their client demands it. Willingness to bear risk is good, but having the capacity to take it on and competence to discharge it are equally important considerations.’

Construction insurance

The construction insurance market should be hardening in line with the wider market. But it is not, according to Rastall. ‘The reason is two-fold: insurers’ loss experience from the construction sector has been good and at the same time there is plenty of capacity in the market to keep it competitive – and of course the number of projects that require insurance is decreasing,’ he says.

Insurers are sometimes criticised for their pedestrian approach to solutions in construction. But that is because projects require a panel of insurers – a multi-million dollar project could require as many as a dozen or more. That creates a problem for any single insurer that wants to innovate because their capacity isn’t sufficient in isolation, Rastall says.

Specifically, contractors would like to see insurers write liquidated damages cover. Liquidated damages is a clause in a construction contract whereby the contractor has to pay to the client an agreed amount for delay or performance failure that is not due to a pre-agreed no-fault event. But insurers are wary of LD insurance as they have incurred heavy losses in the past, according to Rastall.

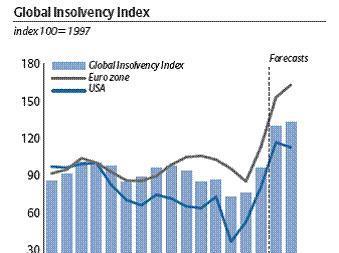

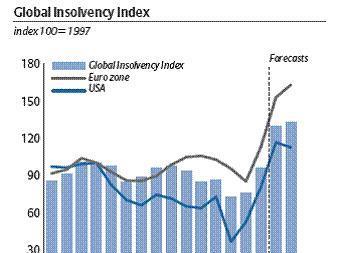

Hopkin says risk managers would like to access wider cover related to their suppliers and customers. ‘The downturn places pressure on a company’s supply chain, with insolvency among suppliers a greater risk in the construction industry than in boom times,’ he explains. ‘The big insurers are looking at introducing supply chain risk coverage beyond BI extensions, and our members are anxious that the downturn won’t slow that down.’

Postscript

Garry Booth is a freelance insurance writer

No comments yet