Here’s some Friday fun: in a two-week experiment to prove the value of quantitative risk analysis, Alex Sidorenko, chief executive of Risk Academy, and a consortium of risk managers took extreme measures. They set out to build a risk model for winning the lottery. The result was very positive…

I started writing yet another article trying to convince risk managers to grow their quant competencies, to integrate risk analysis into decision-making processes and to use ranges instead of single point planning. But then I thought, why bother, why not show how risk analysis helps make better risk-based decisions instead?

After all, this is what Nassim Taleb teaches us. Skin in the game.

So, I sent a message to the Russian risk management community asking who wants to join me to build a risk model for a typical life decision? 13 people responded, including some of the best risk managers in the country, and we set out to work.

We decided to solve an age-old problem – win the lottery. With the help from David Vose and his free ModelRisk we set out to make history (not really, been done before, still fun though).

Here is some context:

- lotteries are an excellent field for risk analysis since the probabilities and range of consequences are known

- in Russia, as in most countries of the world, lotteries are strictly regulated

- There is a rule when a large amount accumulates, several times a year it is divided among all the winners. This is called roll-down.

- if no one takes the jackpot before or during the roll-down, then the whole super prize is divided between all other winners

- so the probability of winning is the same as usual, but the winnings for each combination can be significantly higher if no one wins the jackpot.

And so we set out to test our risk management skills in a game of chance.

8.06.2019

WhatsApp group created. Started collecting data from past games. Some of the best risk managers in the country joined the team, 15 in total: head of risk of a sovereign fund, head of risk of one of the largest mining company, head of corporate finance from a O&G company, risk manager from a huge O&G company, head of risk of one of the largest telecoms and many others.

9.06.2019

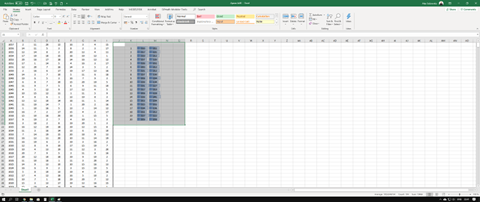

Placing small bets to do some empirical testing.

10.06.2019

First draft model is ready…

11.06.2019

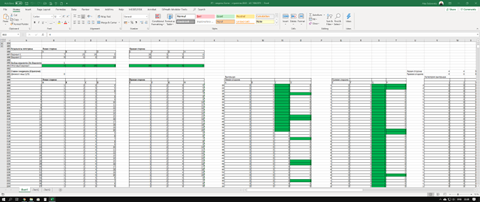

Created red team and blue team to simultaneously model potential strategies using 2 different approaches: bottom up and top down. Second model is created…

12.06.2019

Testing if the lottery is fair, just in case we can game the system without much maths. Yes, some numbers are more frequent than others and there appears to be some correlation between different ball sets but not sufficient to make a betting strategy out of it. The conclusion – the lottery appears to be fair, so we will need to model various strategies.

13.06.2019

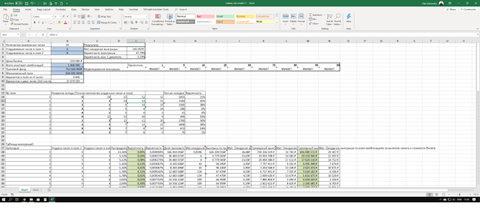

Constantly updating red and blue models as we investigate and find more information about prize calculation, payment, tax implications and so on. The team is now genuinely excited. Running numerous simulations using free ModelRisk.

14.06.2019

Did nothing, because all have to do actual work.

15.06.2019

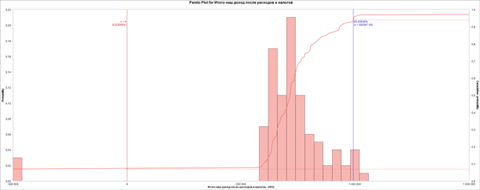

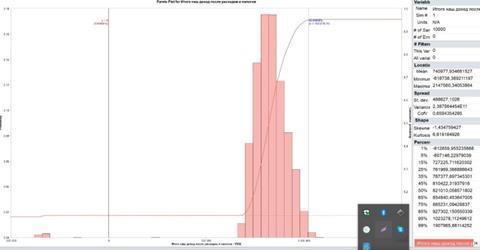

After running multiple simulations we selected a low risk good return strategy. Dozen more simulations later here are the preliminary results:

- used very conservative assumptions

- probability of loss 9.8%, worse case scenario we lose 60% of the money invested

- probability of winning 90.2%, 80% of the time winning would be between 50% and 100% of the amount invested, after taxes (this means there is a high possibility to double invested cash at relatively low risk)

- potential upside significantly higher than downside

Red and blue team models produced comparable results.

16.06.2019

Started fundraising.

If we manage to collect more than the required budget, we decided to make 2 bets: one risk management bet (risk management strategy) and one speculative bet with much higher upside and as a result greater downside (risky strategy).

Full budget collected within just a few hours, actually collected almost double the necessary amount and, as agreed, separated 50% of the funds in to the second investment pool. Called it risky strategy. Separate team set out to develop the strategy. While I was an active investor in the risk management strategy, I decided to play a role of a passive investor in the risky strategy and only invested 16% into the risky, compared to risk management strategy.

17.06.2019

Continued to develop the model, improving estimates every time. Soon we felt the financial risks were understood by the team members and we need to take care of other matters before the big day.

First, took care of legal and taxation risks. Drafted a legal agreement clearly stating the risks associated with the strategy, the distribution of funds and the responsibilities of team members. Each member signed. Agreed to have an independent treasurer.

Then started to deal with operational risks. Apparently transferring large sums of money, making large transactions and placing big bets is not plain vanilla and required multiple approvals, phone calls and even a Skype interview :)) 5 team members in parallel were going trough the approvals in case we needed multiple accounts to execute the strategy.

Probably the biggest risk was the ability of the lottery website to allow us to buy the tickets at the speed and volume necessary for our low risk strategy. This turned out to be a huge issue and we found an absolute ingenuous solution. And I mean it was amazing, I have never seen anything like this. It’s a secret unfortunately, because you guessed it, we are going to use it again.

18.06.2019

The lottery company changed the game rules slightly. Ironically this made our 90% confidence interval and the probability of loss a bit better. So thank you, I guess.

More testing and final preparation. The list of lottery tickets waiting to be executed.

In the true sense of skin in the game, team members who worked on the actual model put up at least double the money of other team members.

19.06.2019

8am. We were just about to make risk management history. A lot of money to be invested based on the model that we developed and had full trust in. I felt genuinely excited. Can proper risk management lead to better decisions? I am sure other team members did too.

By about lunch time, the strategy was executed, we bought all the tickets we were planning and now had to wait for the 10pm game. Don’t know about the others, I couldn’t do any work all day. I couldn’t even sit still, let alone think clearly. Endorphins, dopamine and serotonin and more.

At 9:30pm we did a team broadcast, showing the lottery game as well as our accounts to monitor the winnings, both for excitement purpose and as full disclosure.

While they were announcing the winning numbers, two of the team members actually managed to plug them into the model and calculate the expected winning. We had the approximation before the lottery company knew themselves.

You guessed it, we won. Our actual return was close to 189% on the money invested after taxes (or 89% profit, remember our estimate was 50% to 100% profit, so well within our model). We almost doubled our initial investments. Not bad for risk management. Good luck solving this puzzle with a heatmap :))

20.06.2019

More excitement and lessons learned and, this was most difficult but not surprising, explaining to all non-quant risk management friends that no, this was not luck, it was great decision-making. In fact our final result was close to P50, so in all honestly we were actually unlucky, both because we didn’t get some of the high ticket combinations and, more importantly, because 5 other people did, significantly reducing our prize pool.

No comments yet