Financial crisis is still a lingering threat to global economy, says Towers Watson

Recent actions of European policymakers have temporarily reassured markets but only gained enough time to introduce necessary policy measures and consolidate the weak financial outlook, according to global investment experts.

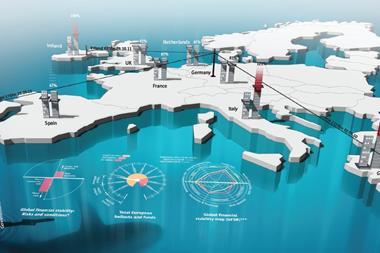

Recent policy moves clearly indicate that the global financial crisis is still a lingering threat to the financial and economic system, said a Towers Watson report.

Robert Brown, chairman of the Global Investment Committee at Towers Watson, said: "Markets generally ignored credit risk in sovereign bonds before 2008. Now, the recent elevated level of sovereign spreads is probably not supported by the credit fundamentals and we think that differentiation in sovereign credit spreads will remain pronounced."

Towers Watson maintains that it will be extremely important to monitor the implementation of the announced support programme as well as the progress made in consolidating fiscal policy and rebalancing the European economy.

Brown said: "The main issue for public policy, within and outside the Euro area, is not the current level of government debt, but the size of structural deficits and the implied transition path for future debt levels. For this reason, structural reform of fiscal policy is likely to remain a key issue over the coming years and is also much more important than a restructuring of current debt levels in small economies."

The firm suggested that, in respect of Greece, the significant involvement of the IMF is a positive aspect, as the Fund will likely be a driving force in the coming consolidation process. For policymakers, rigid rules imposed by the IMF can serve as a driver to make unpopular cuts.

Brown continued: "In the near-term, the policy intervention has probably safeguarded the stability of the Euro and will prevent the default of individual Euro sovereigns. However, in the medium and long term, the stability of the Euro area will depend on the progress of economic and fiscal reform and policy uncertainty is a key factor that needs to be considered."