Inconsistent and insufficient risk management strategies are holding back the major oil companies

Oil companies are facing an increasingly volatile risk landscape and need better risk management practises, warned management consulting firm Oliver Wyman.

Risk management has not yet been embraced properly by oilers, but it could maximise their commercial potential and help overcome some major challenges, said the consultant. For now, though, inconsistent and insufficient risk strategies are holding back the oil giants.

Especially for the oil industry an

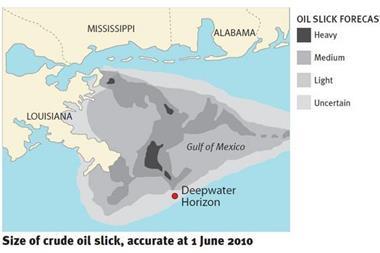

Unexpected errors can have a catastrophic impact far beyond the oil company itself, warned Mark Robson, author of Oliver Wyman’s paper.

“While it is not unusual for successful companies to be challenged to manage risk when making critical decisions, for NOCs the stakes are even higher. Their actions can potentially change the futures of their countries. If oil companies wish to continue funding their governments’ visionary strategies in this new environment, they must develop sound risk governance practises.”

Oliver Wyman said oil companies should implement a four step risk management programme to: define risk appetite; prioritise risks; aggregate risks; and link risks to strategic decision making.

Jim Pierce, chairman of Marsh’s Global Energy Practice, said: “Oil companies have faced increasingly complex risks in recent years; and the pace and scale of events which introduce uncertainty into earnings is continuing to rise. Taking a more strategic approach to risk management is a vital step in the evolution of oil companies, if they are to maintain their competitiveness and contribute to their countries’ continued economic success.”

No comments yet