Deciding how much risk to retain can be a challenging balancing act. You have to take account of a wide range of factors including the operational as well as the financial elements

Deciding how much risk to retain can be a challenging balancing act. You have to take account of a wide range of factors including the operational as well as the financial elements – not to mention the risk appetite of the board which could well be affected by the current trading conditions in your particular sector. And you have to decide whether the high comfort factor that might be provided by transferring risk to the insurance market is worth a possibly higher cost and, perhaps even more important, the imposition of restrictive conditions that could be detrimental to the way that you operate or even impact on your customer base. The issue of being in control of your own destiny was certainly one that was important for some risk managers participating in this discussion.

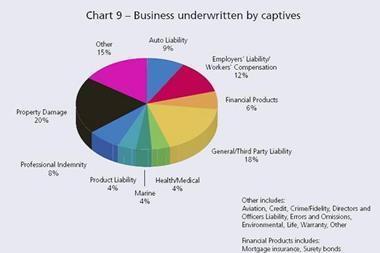

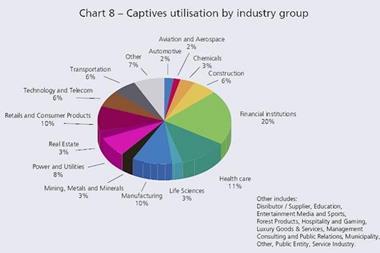

The decisions don’t stop there. Do you put your risks into your own captive – if so, which risks? - and can you justify the relatively high costs of a captive anyway? Is establishing a mutual insurer an acceptable approach in your industry sector? Are there viable alternatives to traditional insurance and captives which you can use for uninsurable risks?

These are just some of the questions that our panel of experts discussed in this issue’s roundtable. And the points that they raise are likely to strike a chord with many risk managers faced with the difficult problems surrounding retaining risk.

Downloads

Risk retention

PDF, Size 2.25 mb

Postscript

Sue Copeman, Editor, StrategicRISK

No comments yet