Social unrest, market crashes, tropical storms and interstate conflict should all be top of the risk register in 2020

Social unrest is the fastest growing risk to the world’s economy, according to data from the Cambridge Centre for Risk Studies.

While it was only placed 14th overall, with a GDP risk value of $8.3bn, it has climbed three places up the rankings of the biggest threats facing the international economy.

2019 has been characterised by protest civil disobedience and social unrest.

In London, we saw Extinction Rebellion occupy five key locations in Central London and hold global protests in 60 international against the climate change caused by major corporations.

Meanwhile, other social unrest has swept developing nations, where issues like inequality and failing infrastructure caused mass distrust in business.

Dr Andrew Coburn, chief scientist at the Cambridge Centre for Risk Studies explained: “Over the past year we have seen global unrest building.

”There have been gilet jaunes protests sparking violence in France, extradition riots in Hong Kong, uprisings in Venezuela and the potential signs of a second Arab Spring.

“All demonstrate turmoil over issues of economic and political equality.

“Continued demonstrations and rioting – which affect tourism, business continuity, and air travel – suggest that a new era of unrest is in the making.”

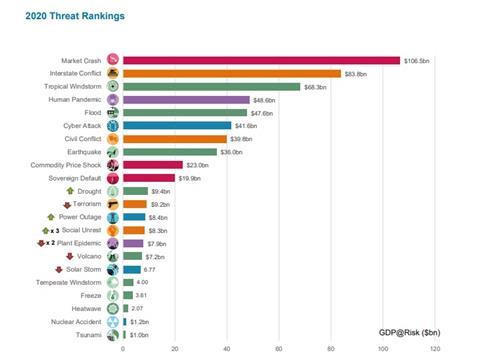

Market crash, interstate conflict and tropical storms remain the top threats

The Annual Risk Index, created by the Centre for Risk Studies analyses where future disruptions to revenues and economic activity could impact most across the world’s leading 279 cities.

It found that over the past year, total global risk has increased by 3 per cent to $584bn or 1.55 per cent of 2020 GDP.

While the level of risk has risen, the rate of increase has slowed along with overall GDP growth.

Consistent with 2019, the top three individual threats are market crash (slightly reduced to $106.5bn), interstate conflict (increased to $83.8bn) and tropical windstorm (with an increase to $68.3bn).

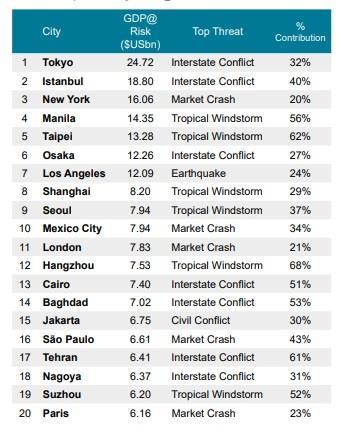

The top five riskiest cities

Interstate conflicts make Tokyo ($24.72bn) and Istanbul ($18.8bn) the cities with the most GDP at risk in 2020.

New York is third ($16.06bn) due to its exposure to potential market crashes.

This is followed by Manila ($14.35bn) and Taipei ($13.28bn), which are both vulnerable to tropical windstorms and other combinations of threats.

Appearance at the top of the risk list of cities indicates two characteristics: a large annual GDP output, hence the potential for major losses; and exposure to particular shocks associated with the geography and type of economy of each city.

Dr Coburn continued: “Ability for businesses and cities to recover quickly after a crisis is critical to reducing relative risk exposure.

“If the rate of recovery of all cities having the lowest two levels were to be improved to match cities with the greatest resilience, their relative risk exposure would reduce by 31 per cent.

”International businesses need to match their activities around the world to protect their earnings ahead of inevitable yet unpredictable shocks.”

The research also examines a city’s aility to bounceback from shocks - also known as its ‘rate of recovery level’.

Refreshing the rate of recovery levels for each city yielded some interesting insights for 2020. Key cities which have seen an increase in their rate of recovery include St Petersburg, Kazan, Tallin, Kraków, and Medellin.

Iran, meanwhile, has seen a decrease in the rate of recovery for its major cities. This is due to the impact to its national GDP as a result of imposed sanctions by the United States which began in 2018 and continue to the present.

No comments yet