In these changing times, one of the few things anyone can be sure about is that uncertainty will continue. But while risk exposure for business is growing, it’s not all doom and gloom

Political and economic instability around the world is increasing risk exposure for businesses. According to research by Aegis Advisory and Integro, ‘strategic risks’ (political, economic, security and criminal risks) have increased five percentage points this year.

“Political and security risks accounted for most of the increase. And the increase in the level of strategic risks in the Middle East has been large. But there is instability across the board,” says Aegis Advisory assistant director of risks Mal Bozic.

He says that the current turbulence is challenging but also believes businesses can’t just bury their heads in the sand: “It’s a bit like going surfing. You can’t stay on the beach until the waves get comfortable enough to ride. You have to get out there and ride them, even though they are unpredictable and messy.”

It’s clear that most companies are paying more attention to risk than they were a couple of years ago. Developments in the eurozone or the Arab Spring are confirmation of how unstable the world has become in recent years. Risks are also becoming increasingly harder to predict and mitigate against.

Principalis Asset Management president and founder Pippa Malmgren specialises in understanding risks that can’t be easily quantified. She lists some of the pressures facing the world economy: “We have the risk of inflation versus deflation, and the high probability of sovereign defaults including municipal defaults in the USA, which I think are very likely to occur,” she says.

“Now you also have food inflation pressures, which lead to political instability and civil unrest issues in emerging markets, all of which starts to deteriorate the productivity of those emerging markets.

“All these things tell me that volatility ought to be higher,” adds Malmgren. “And that will affect all sorts of asset classes. We’ll see this in particular in commodities. Brands are very powerful in this new environment. You want to own brands that have the capacity to pass on higher costs because I think higher costs are inevitable.”

China is not as safe as it was perceived to be a year ago. There are big questions around dissent and economic sustainability’

Mal Bozic Aegis Advisory

This scale of uncertainty makes life hard for risk managers. But nowhere is uncertainty more monstrous than in the European sovereign debt crisis. Commenting recently on the eurozone crisis, Malmgren said: “I think we’re going to have sovereign defaults, I think that’s unavoidable. And that’s been my view since the beginning of the financial crisis.

“What we [governments] did was to take the losses that were on the banks’ balance sheets and move them onto the governments’ balance sheet. But that doesn’t diminish the loss. It still has to be paid for. The round of austerity that we’ve experienced here in the UK is only round one. Eventually it becomes clear to the political leadership that the cost of defaulting is lower than the cost of paying.”

But Malmgren’s advice to investors is far from gloomy. “My bottom line is we should buy when the default is announced. Most people will do the opposite, they will see default, get scared and want to sell everything in their portfolio. My view is that once you get default it is like hitting the reset button on your computer. It clears the decks, you start again and now you can grow.

Europe’s bailout fund for troubled sovereigns now stands at a staggering €1 trillion. “The European bailout fund was supposedly designed to bail out Greece but what it was really designed for is to bail out the banks if Greece defaults,” Malmgren says.

“What we now know is that the firewall is working and so maybe companies are a better bet than countries. And that raises some interesting questions for investors. The new risk free rate of return maybe isn’t governments. That’s something to really think about.”

China’s own subprime crisis?

China’s ‘economic miracle’, and more importantly the sustainability of it, also raises serious concerns. It is estimated that China needs to sustain economic growth above 8% a year merely to avoid a breakout of widespread civil unrest. There are doubts over its ability to do this in the current climate. “China is not as safe as it was perceived to be a year ago,” Bozic says. “There are big questions around dissent and economic sustainability. You always think it had the potential but now we are seeing some symptoms manifest themselves.”

China relies heavily on growth in the developed markets to shift the goods that it manufactures, says Bozic. “It’s all about linkages. China grows because we in Europe and America buy their products. But we have fewer jobs and less ability to raise debt to buy those products with.”

There are signs that China is stockpiling goods and also selling houses to poor families who can’t afford them - it could be building up to its own subprime crisis. China’s government is even saying that its ability to keep growth high is reaching its limits.

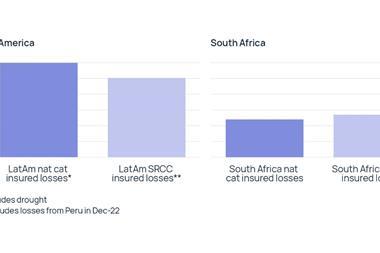

And if China’s growth dips it will have catastrophic consequences far and wide. “There is a linear relationship between China, Latin America and Africa,” Bozic says. “The great strides of progress in these other emerging markets could not necessarily continue on the current trajectory if China’s economy doesn’t continue to grow,” he says.

“If Brazilian growth rates drop, it could lead to considerable unrest in the favelas.” Seen in this context, it’s easy to see how China lending money to help Europe’s ailing economies - as has been mooted - is in its interest, because it gives China the option to grow out of its problems.

The risk is not knowing how the economic situation will play out, warns Bozic. So seeking out a better understanding of the issues could help risk managers prepare for the worst. “Mitigating risk through knowledge can help an entity take the risk it wants to take and transfer the ones that it doesn’t,” he says.

Overall both Bozic and Malmgren are quietly confident about the risk outlook. “I’m optimistic about the future,” Bozic says. “I think we will see similar rates of growth in the future to those of the recent past, but in a rebalanced economy in the North Atlantic [Europe, North America]. If the rebalancing [meaning lower wages, which would tend to attract more manufacturing] is successful we could see a new European renaissance.”

Two ways out

As for Malmgren, she says: “The environment we’re in has two exit doors. One exit door is what you might call the renegotiation of the social contract - that’s where the state is defaulting on its citizens. The state says: ‘We’re not going to pay for the things you thought we were going to pay for anymore and now you’ve got to pay for it.

“Some countries will manage that process smoothly, others will see some civil unrest. It’s going to be complicated but that’s one way you fix this whole picture.

“The other exit door is innovation and I’m a big buyer of innovation. These pressures I’m describing are so severe and they will compel businesses to be more creative, more innovative, to use their ingenuity in getting back to the bottom line of positive, unimpaired, genuine cashflows.

“You want to be in genuine cashflows and out of anything that is strictly driven by speculation. That requires some discernment and skill. It’s a trickier, more complex environment than we’ve had for a while.”

Key points

- Risks are more unpredictable than ever, but companies cannot let this stop them going out and doing business

- Inflation/deflation, sovereign defaults and food price pressures are all leading to greater volatility

- Investors should actually buy not sell when an inevitable sovereign default is announced

- The economic sustainability of China’s growth is still under question, due to its reliance on the buying power of Europe and the USA

- The future will either see governments absolve themselves of responsibility, or businesses will become more creative

Capitalism will continue to reinvent itself

The Occupy Wall Street movement, a loosely organised political movement in favour of reforming or, in some cases, overthrowing the status quo, is gaining strength around the world from New York to Toronto, Rome and London.

But the collapse of capitalism remains a remote risk. “The genius of North Atlantic capitalism is its ability to renew and reform itself before it is thrown off in a Russian or Soviet style,” says Aegis Advisory’s Bozic.

“Capitalism’s response to communism was to institute workers rights and the weekend. You respond by removing some of the excesses of the system.

“Right now, in the UK, we have a centre-right government agreeing with some of what the anti-capitalist movement is saying. Our political systems are responsive and able to respond before the masses get the pitchforks out.”

No comments yet