Change is a constant, and the absolute speed of change today is increasing

Today’s business news, outcomes from business surveys, and discussions internally in businesses and at a host of conferences are regularly about the challenge of dealing with disruption, complexity in the business environment, the fourth industrial revolution (of digitisation), and the immense speed of change the world is experiencing.

Many business people are worried or even anxious about the extent and pace of change – and many believe that it is, and will continue to be, extremely challenging to cope with, let alone to benefit from it.

If this is your position, we feel we must say that, as risk professionals, we can only advise that your environment will experience further and faster change – and you need to use risk management to benefit from it. Change is a constant, and the absolute speed of change today is increasing.

Your perspective about change determines how you respond to it – positively or negatively. Here’s an analogy for you to consider.

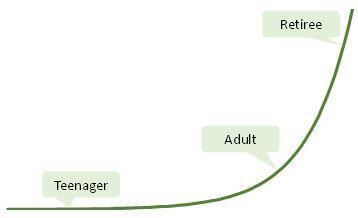

The basic chart we are showing describes a relative change of 10% per year. Year on year, it ramps up and becomes more and more pronounced.

In this “life example”, at the bottom-left lower end is the teenager (we deliberately chose to start here rather than any younger than that). They see a rather stable world through their eyes, where nothing much is changing in their view. In fact, they believe that if the world changed any slower, it would move backwards.

In the middle we have the adult, who remembers the stability of the past, and thinks that that these days, the world is changing increasingly rapidly, more than before. Intellectually, they see that the pace of change will continue to speed up, and emotionally some of this is an unsettling thought, since stability is sought after.

At the top-right end, we have the retiree, who fondly remembers (and perhaps exaggerates) the stability of his youth, and the hard work they had to do to keep up with change when they were an adult. Today they see the world changing in uncontrollably fast way, and they find it emotionally hard to fathom that the speed of change could increase any higher.

Well, too bad, Grandpa - your 16-year old Grandson is at the bottom of this curve, and he is seeing the present day in the same stable way as you did when you were his age. He doesn’t expect a phone (actually, it’s more a mobile computer nowadays) to be up-to-date for more than two years, SMS texting is passé, email is antiquated, and he has switched social media platforms several times in the past couple of years. As for music, of course it is all available on his phone, and of course he has his whole music library in his pocket. Who would put up with having it all stored on clunky CDs, or flimsy and unreliable cassette tapes? Vinyl is pretty cool though, so a small part of the collection is OK on that, to use when at home.

Disruption is one of the “words of the day” in business, but much of what is happening has done so before - in a different and slower way, but similar patterns have occurred before.

Think about these examples:

- · The Romans disrupted government by introducing bureaucracy

- · Gutenberg disrupted publishing by inventing printing (“What? We allow the masses to read? Surely that will lead to problems!”)

- · Ford disrupted personal travel, and industry with the assembly line

- · The early telecoms companies disrupted the whole medium of communication

- · IKEA disrupted the furniture industry

- · Apple disrupted the mobile phone and music industry

- · Airbnb is disrupting the hotel industry

- · Crypto currencies are disrupting parts of the finance industry

The world has always seen significant change down the ages – which we now call disruption. There is a reason the current industrial changes are called the fourth industrial revolution – and that is just within industry and commerce.

The key thing about today’s fourth industrial revolution is that disruption is occurring more frequently, faster and has a more immediate effect than it has in the past. Much of this is due to the inter-connected nature of how we all live and work (and benefit from). Some say that in 2017, more data will have been created than what mankind managed to create in the previous 5,000 years. More than half of the scientists and researchers in the history of mankind are alive and working today (some believe the figure is as high as 90%).

Currently, most disruption in business is based on the digitisation of actions, processes and services, which also enables a sharing economy where ownership is not a prerequisite of use.

Few saw the increased automation at the factory floor as anything but sound efficiency gains. Today, automation is moving into the offices and affects business strategies – and now everyone sees potential burning platforms.

Rejoice – prosperous times lay ahead: use risk management to drive them

Throughout most of the 20th century, size and scale was a key strategic competitive advantage in many industries. A slogan for large businesses was “dominate or die”, and Forbes 500 companies had a life expectancy of 60+ years.

Then, around the turn of the 21st century, “outsourcing” became a strategic focus. Companies of various sizes saved costs by outsourcing tasks to low-cost countries and built complex networked supply chains and organisations to manage this.

Today, neither of these approaches can provide you any significant competitive advantage. They may still be valuable in certain situations, for sure, but fast-moving and unexpected disruption from any direction can change your business conditions to such an extent that stability is not something that will last for long.

Today, the slogan is more like “disrupt or die” - Forbes 500 companies now have a life expectancy of more like 18 years, and declining.

Manoeuvrability for businesses of all sizes has become the key to competitive advantage. This means:

- · You need to be able to spot, or create, trends and changes – and act on these faster than your competitors (some of whom you may not even be aware exist);

This includes “inventing” a new market, where there currently isn’t one – which is what Facebook, Uber, Airbnb and other have done – as have many small pop-up companies, which are subsequently sold to the major players for huge amounts, e.g. Navision (bookkeeping), Mojang (Minecraft), etc.;

- · You need to increase operational flexibility, and exist on a shorter horizon than your competitors;

This is how Inditex/ZARA has outperformed the rest of the apparel industry by having a vastly shorter design to sales process than anyone else;

- · You need to have bold(er) strategic planning, based on future needs and desires, and a willingness to be flexible and adapt to change, to a higher extent than your competitors;

This is what Tesla, Google, Amazon, and others are doing addressing electric-powered and autonomous vehicles, and green/emission free energy supply

Such moves may not be immediately seen as risk management, but if you think about it, risk management concepts, tools and processes enable you to tread these paths. For example:

- · Systematic scouting for emerging risks … and opportunities, by addressing what is and may be happening in your industry, in parallel industries as well as in the economy at large (e.g. sharing economy, blockchains and crypto currencies, water scarcity, CO2 emissions, work/life balance, etc.);

- · Predefined and known levels of risk capacity (what can you really afford to risk) and risk tolerance (what will you accept) on multiple parameters such as financial, environmental, reputational – your key performance criteria, based on your company mission;

- · Understanding of inter-connectivity, and running through scenarios to look at how events could unfurl and how to act upon them in a flexible way;

- · Defined and monitored early warning indicators showing when a risk or an opportunity is about to materialize – and they are likely to materialize (“trigger points”);

- · Defined and validated/tested (business continuity and resilience) plans to deal with things that do happen, including acting on early warning indicators to “head off” the most damaging effects;

Leading companies, be they large, medium-sized or small, already take this approach – with, or maybe without calling it risk management. If your organisation is still waiting to adopt this approach and mindset, the longer it waits the harder it will be to catch up, or stay in existence.

Risk managers – step up and lead

Most risk managers are currently working in organisations, where the executives and the board are not aware of how valuable risk management can be to help the organisation to truly prosper. This gives you a tremendous opportunity.

You have a job enrichment and career opportunity to be a key enabler in a company, to assist executives and the board to set strategies and deliver on plans to succeed in a world they may still think is changing faster than they are comfortable with.

Did we say comfortable? We have yet to hear from any athlete stating that “winning was comfortable”. Winning involves taking and managing risk, and it is hard and difficult in sport – just as it is in business.

Business and commerce constantly moves forward. Business development is like walking up a down-escalator. The minute you are too slow, or not moving, you will be moving the wrong direction. Risk management is not just about being safe if and when the boat is rocking – but also about having the skills and courage to be the one rocking the boat.

What is the alternative – sit back, and be content being an ever-smaller player with decreasing sales and profitability in an industry that either you become obsolete in, or it becomes obsolete itself. Not a happy or inspiring thought.

So, dear risk manager – grab your chance, lead your C-suite and drive manoeuvrability as your company’s competitive edge – before it becomes industry “standard operating procedure” and is no longer a source of advantage.

Hans Laessoe is Principal Consultant at AKTUS.

Gareth Byatt is Principal Consultant at Risk Insight Consulting.

No comments yet