Willis Towers Watson focuses on enterprise risk management in its latest Energy Market Review, listing nine factors driving an ERM focus

The energy sector has been through tough times in recent years, putting its risk management practices into sharp focus.

Enterprise risk management (ERM) gets its own section in Willis Towers Watson’s “Energy Market Review 2018” report – with nine factors (three external, six internal) seen to be driving ERM at energy companies.

The subheading of the insurance broker’s report asked: “Between a rock and a hard place?”; which emphasises that energy insurers are feeling the pricing pinch and are concerned about the sustainability of pricing and the quality of their underwritten risks.

That question of pricing adequacy versus risks run means insurers are navigating between continuing to invest heavily in their portfolios and scaling back to wait for better conditions to materialise, the report warned.

“Based on the continuous interactions we have with key stakeholders in the industry, and the extensive research that we are conducting, we know that the amount of time and money that organisations spend (and are planning to spend next year) on ERM is significant,” Ioannis Michos, a partner in Willis Towers Watson’s strategic risk consulting team, wrote in the broker report.

Regulation was listed as the first of three external drivers for ERM among energy firms.

“Increasing corporate regulation requires boards to demonstrate they have carried out a robust assessment of the principal risks their companies are facing,” said Michos.

He noted UK requirements for boards, including: monitor the company’s ERM framework and its risk appetites; review the effectiveness of the ERM framework each year; and report the outcomes of that review in their annual report.

The second external driver listed was rating agencies’ scrutiny of ERM frameworks “which significantly impact the overall rating process and the development of capital requirements”.

The third was “increased activism from the shareholders”, who, Michos warned, are demanding more transparency into the board’s decision-making process, including how it assesses and finances business risks.

Six internal drivers were listed by Michos, in no particular order.

The first of these was a reduction in financial volatility, through ERM and strengthening frameworks for internal controls.

The second was higher business resilience, putting together “rigorous and well tested contingency plans that cover all the plausible risk classes that organisations are facing”.

Lower operational losses were listed third, with firms looking to implement robust and proactive monitoring processes “throughout the organisation”.

The fourth internal influencer listed by Michos was “a risk-adjusted decision-making process”, to help make more informed, risk balanced decisions.

Fifth listed was “increased visibility of the ERM function to the boards of directors”, reflecting the external point about regulatory interest, which, Michos said, was demonstrating value to the organisation as a whole.

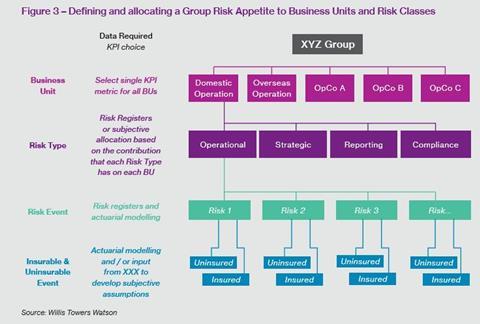

Better allocation of risk management resources was the sixth internal factor described, targeting resources on areas of risk where firms face too much or too little exposure.

Michos said: “Over the past year we have seen several energy companies, of different sizes and in different geographies, trying to establish and embed robust risk management frameworks with clearly articulated organisational structures and well defined and documented responsibilities across the enterprise.”

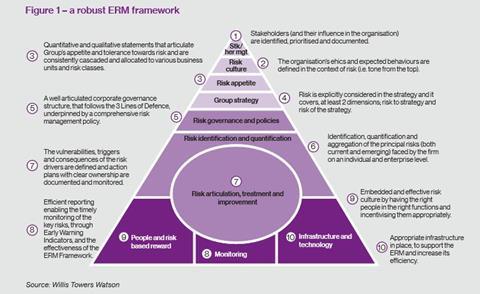

Good ERM should: “satisfy their external and internal key drivers; achieve segregation of duties; and comply with general accepted risk management standards such as the updated COSO II and the new ISO 31000 which are well regarded by their stakeholders”, he added.

The question of how ERM and strategy link together is one “we almost always get asked”, Michos observed.

“Although the industries are different, the answer is always the same – risk appetite and tolerances,” he said.

“Changes in regulations, business environment, political agenda and technology create new emerging risks and opportunities and drive organisations to adapt,” said Michos.

“The role of ERM is to enable companies in the sector to become knowledgeable risk takers, maximise the value that they create for their various stakeholders and to empower key decision makers to build bolder business visions and more resilient organisations,” he concluded.

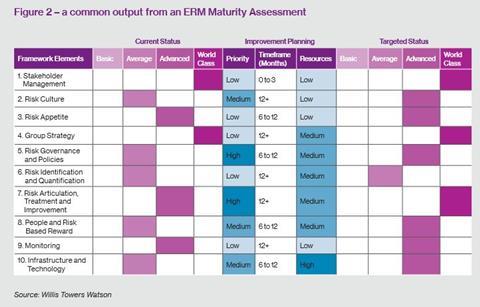

Below are three ERM slides from the Willis Towers Watson report.

No comments yet