Economic downturn is having an inevitable effect on supply chain disruption but companies can improve their resilience

The list of threats that could disrupt a global supply chain is practically endless. Interruption could be caused by traditional insurable events like a fire or flood which cause physical damage. There is also a host of events such as a port blockage, civil unrest, company insolvencies, war or political risks like asset confiscation or trade restrictions, such as India’s ban on Chinese toy imports. These may not actually result in any damage to a business’s property or stock, but they prevent the normal flow of trade nonetheless.

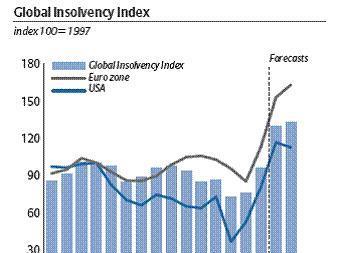

This type of disruption is likely to increase in frequency as the economic downturn takes its toll and geopolitical tensions escalate. New non-damage business interruption covers have emerged to help companies with their supply chain risk management. In the current climate they are receiving renewed attention.

Companies with tightly wound global supply chains are particularly exposed to disruption and delays, since they have many interdependent components. Outsourcing and the use of complex, global supplier networks have increased interdependencies. The whole web of manufacturers, suppliers and wholesalers is closely interlinked.

In a similar way that credit risk was contagious throughout the financial system, global manufacturers have become dangerously reliant on one another. If a key supplier or customer goes down it can have serious reverberations for others in the network.

Just-in-time manufacturing and the push to reduce spare inventory, have only served to exacerbate the risks. By liquidating excess stock in an effort to wring every drop of cash out of their supply chains, firms have put continuity of supply under threat. And in some cases, by outsourcing to the best and most efficient sources, firms, although immediately benefiting, have created dangerous concentrations of supply and potentially critical exposures. In a harshly competitive landscape, failure to deliver a product on time and to specification could signal the end of a business relationship.

Focus on risk management

All this, combined with current economic conditions and enhanced consumer and regulatory scrutiny of the products which appear at the end of the supply chain, is leading to a much stricter focus on supply chain risk management. Companies are spending more and more time assessing and mapping the risks as well as working to reduce their exposures.

If critical exposures cannot be risk managed down to an acceptable level – one that the company is comfortable retaining on its balance sheet – risk transfer becomes an attractive option. Many companies are looking for new and innovative insurance products that can help them respond to a disruption and prevent them losing face while also indemnifying them for the financial losses incurred.

“As the constraints of the financial crisis hit, contingency funds tend to shrink and if there is a disruption it could bring a company down.

Rupert Sawyer

In the past, traditional insurance policies have not addressed the potential losses attributable to non-damage events. Historically, insurance was set up to respond to easily quantifiable risks. Risk managers, or their brokers, often had to approach different underwriters to cover physical exposures and political risks separately.

Now, however, new business interruption covers have evolved to help risk managers enhance their current strategies. Miller, independent insurance broker, and Lloyd’s underwriter, Kiln, pioneered a new type of insurance around 15 years ago, when companies started trimming the supply chain fat. Sharing their specialist expertise and knowledge the partnership developed trade disruption insurance (TDI) which, unlike business interruption cover, responds to supply chain losses even if there is no physical damage.

‘Supply chain disruption was not particularly well addressed by traditional insurance solutions,’ explains Paul Culham, active underwriter of marine and special risks at RJ Kiln & Co., adding that traditional insurance solutions were restrictive in the type of indemnity they offered.

‘Miller and Kiln developed a policy that was not linked to physical loss or damage that would fill the gap in the type of exposure companies faced,’ adds Rupert Sawyer, associate director of special risks, Miller.

Today, as the economic crisis heats up, creating an extremely tough operating environment where banks refuse to unlock the flow of credit to companies, financial protection in the form of insurance is receiving greater attention. Exposures like the insolvency of a supplier or a shut down caused by a strike are practically daily events which inevitably lead to a costly interruption loss, significantly increased costs of working or substantial future revenue loss.

Another reason for the renewed attention is that companies are concerned that they may not have funds in their coffers to respond to the increased costs of a disruption on their own. With cash hard to come by, companies are unlikely to have a pot of money lying around to help deal with a major disruption, which means they could be left exposed if the worst happens.

‘As the constraints of the financial crisis hit, contingency funds tend to shrink and if there is a disruption it could bring a company down. In that case the option to transfer risk into the insurance market becomes much more attractive,’ notes Sawyer.

This is where insurance can help. TDI cover offers two strands of financial protection. ‘The indemnity provided will cover the increased costs and expenses incurred in addressing and mitigating a disruption as well as the potential loss of profit following that event,’ explains Sawyer.

“With the right risk management, insurance could play a key role in giving banks the confidence to start lending again.

Paul Culham

‘The policy gives companies the ability to put in place contingent financing, so if disruption does occur they can draw down on that financing to get them through the crisis,’ adds Culham.

Whether they choose to be covered or not, businesses should have a continuity plan in place so they are prepared to deal with a crisis. A business continuity plan can also help if they are thinking about risk transfer, because it shows that they have thought through a scenario and have an idea about what it might cost. ‘Being clear beforehand about what mitigation will be undertaken in the event of a problem gives underwriters a good understanding of the risk and a basis from which they can react more quickly,’ says Sawyer. Another benefit of TDI is that it can pay for the implementation of these costly programmes.

Pressure from tighter credit

TDI can also respond to relatively commonplace disruptions. The risk of a key supplier or customer going to the wall is clearly becoming a more regular occurrence. As corporate insolvencies mount, several credit insurers have responded by tightening their credit terms or withdrawing from the market altogether.

The tight credit conditions combined with a sharp drop in consumer spending has pushed ailing companies into insolvency. With supplier networks so closely linked the contagion can spread quickly. Like dominoes, if one company falls over it can take others with it. In recent months, some large companies have paid the price of the failure of their suppliers or customers, and their dramatic collapse has demonstrated the extent of this risk.

Culham thinks companies that are well integrated into the global supply chain stand a better chance of survival. ‘Those companies can expect beneficial credit terms, because the companies that depend on them won’t want them to fail,’ he says, adding: ‘Those operating on the periphery may find it hard to procure proper insurances.’

With the right risk management, insurance could play a key role in giving banks the confidence to start lending again. An added advantage in the current climate is that companies with good TDI cover are often able to gain access to increasingly risk-averse lenders ‘A trade disruption policy could help convince a lender that a company is properly risk managed and has taken steps to protect its revenue streams therefore protecting their ability to service the financing,’ notes Culham.

What is Supply Chain/Trade Disruption Insurance?

>Is tailor made to specific demands of the buyer

>Can help attract difficult to secure capital by demonstrating good business practice

>Provides contingent financing for implementation of business continuity plans

>Protects supply chain against:

Loss of profits

Contractual penalties

Debt repayments caused by disruption

Increased operating costs

>Covers

Force majeure events

Natural events: fire, blockages, vessel breakdowns

Political events: embargoes, terrorism, war

Insolvency

Postscript

Nathan Skinner is associate editor, StrategicRISK

No comments yet