Is the risk manager’s job to report only, conduct risk transfer only or is it compliance and control? I believe it’s value creation. Here are three tips to generating stakeholder sustainability, writes Adrian Clements, international enterprise risk manager and former risk manager at ArcelorMittal

Typically, the chief finance officer’s (CFO) role is outward looking – exchange rates, market, profit, growth, funding. He is selling a story to the shareholders and stakeholders. But we also need to mention carbon foot print, corporate social responsibility and what a great company we are. Why is this important? Today, the value of a company is estimated in terms of non-tangibles. Only 20% is asset and capital based. This is a massive change compared to 10 years ago when it was exactly opposite.

Operations, however, need to reduce costs, reduce working capital, keep the assets producing, and don’t get in the news because of issues of pollution, fires or quality problems. The chief operating officer’s (COO) role is more inwards facing – assets are potentially old and in need of repair; are they able to produce the products needed for the future? How do we enhance performance?

These two, potentially opposing goals, are typical examples of the day to day dilemmas many companies have, including generating growth through cost cutting, using old assets for products they certainly weren’t designed to make.

The risk manager should be providing insight to both these stakeholders so that the company benefits from the synergies. Leveraging both into a very interesting solution. Through system transformation, using three focus areas, the CRO can really help.

Operational Support

Operations are typical long-term focused. The assets will last a long time if managed efficiently. They will be flexible enough to product a larger range of products than necessary. They will be able to run at name plate capacity, or higher, efficiently. However, they need opex and capex. If there are multiple plants, then the type of product made by each facility can play a role. By restricting capex, the CFO is forcing two things:

- The capex received needs to be efficiently invested

- This restriction, if spread over multiple sites, means there is either:

- Not enough capex per site to maintain efficiency, quality etc, or

- Some sites will be harvested.

The COO therefore needs to know:

- Where is, and where will, the company making its margins?

- Which products, and therefore plants, will be needed in the future?

Value Transparency

Transparency implies measurement and benchmarking. So, we are quickly into KPIs. No problem! The operations people have hundreds of KPIs. Same for the finance group. Through the CFO strategy in restricting capex the COO has a need: value transparency. The question is are these KPIs combined and integrated into meaningful, manageable, valuable, company enhancing tools?

Two simple examples:

- A finance KPI could be working capital reduction. Inventory is reduced, spare parts cut to a minimum. KPI achieved.

- Operations KPI could be MTBF, (Mean Time Between Failures). As the assets are getting older and working capital is reduced then one way to achieve this goal is to slow down the operations. This puts less strain on the assets and maintains quality at an acceptable level. KPI achieved.

No alignment and any potential synergy is possibly short term. What should be the future oriented companies KPI?

The question can be split into different sections which require decision to be made. These questions can be facilitated in workshops by the CRO.

- Where are we making the most EBITDA?

- Which product is making the most EBITDA?

- What do I have to do to ensure these lines and products are efficient? I.e. best fixed and variable costs, meeting and surpassing nameplate capacity?

- Where will the market be in 5 years and what do I have to do to ensure my company is prepared? I.e. plants in the right countries, assets able to produce the right products?

This value transparency and opportunity analysis is typically part of any strategic review or budget process. In fact, these should be the questions which have already been answered in the risk reporting. The risks and opportunities should be on the heat map already. However, there are many cases where the margins made by products and production lines are kept confidential. In fact, if you look at a study by McKinsey you will see that the typical questions being asked, and the solutions created, are clearly not the right ones. Typically, according to this study, only 30% of management gains are captured by the solutions being proposed. This would imply the risk and opportunity being estimated by teams are not in line with reality.

Stakeholder sustainability (Value Creation)

Is it the risk manager’s job to report only? Is it to conduct risk transfer only? Is it compliance and control? I believe its value creation. As noted in my last paper, I hope that risk managers are providing insight into what needs to be done and a little on how it can be achieved. This will generate the stakeholder sustainability and help mitigate the non-tangible risks so key in today’s society.

Here are several points which the CRO can help with.

- He can take the operational data and normalise it so that margins are not known but the projects can be prioritised correctly based on impact. If it’s crucial that financial data be kept secret. If the margins are not secret, then he can align and create a risk register that is effective. ie not based on risk but vulnerability. Afterall its key to understand which high margin line, process or product is vulnerable. It might not be the one that has the highest risk.

- Time plays a large role in decision-making, but this is not being reflected in the action plans. For example, some ideas are good but not in the current market cycle. Some ideas are good but not in this plant or for a different product line. Some ideas need to be done now rather than later even though they don’t pose the largest risk. I.e. we are extremely vulnerable to certain events, but these events are systemic and small. They will however affect image and other non-tangible risks.

- Some ideas which have been turned into projects should be stopped at some point as the market conditions have changed. This means the KPI used need to use actual rather than budgeted targets and numbers.

The CRO is acting as an advisor and facilitator to both the CFO and the COO and ensuring that ideas, projects and targets are used successfully. In addition, the actions are timely. But most important the CRO is adding value in that he is making the old-fashioned budgeting process dynamic and actual. Why use a budget that is based on last years results and future proposals when the economic and market environmental conditions are changing continuously?

So, what we need is:

- To remove the traditional budget process and replace it with a dynamic system using actuals rather than budget figures

- We need to have an Operational EBITDA bridge that guides the COO to making timely decisions and use capex and opex effectively

- We need to update these reports weekly, monthly and quarterly depending on the dynamics.

Does your risk manager have these tools?

A risk Management system transformation process rather than a performance transformation process is what’s needed. But most management consultants are offering performance transformation.

There are two key fundamental differences between the quick win method and the sustainable system transformation process.

- A continuous improvement process utilising Innovation

- A Managerial EBITDA Bridge rather than a financial one.

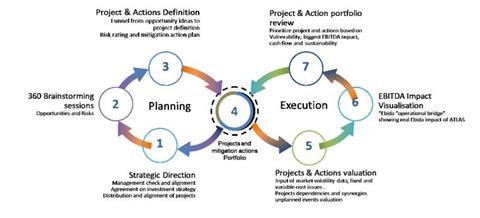

Below is an example of a system transformation process and-

Figure 1 System Transformation Process: an overview of value capture bridge which is an extraction of the Managerial EBITDA Bridge

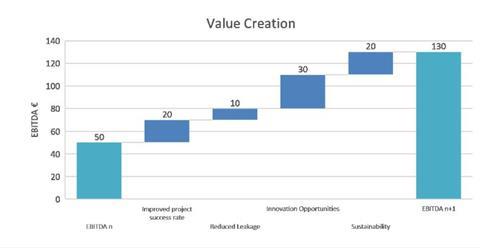

Figure 2 Value Bridge

If you are interested, I will explain these in my next paper.

1 Readers' comment