Since 1980, Europe has suffered 17 catastrophic floods that have done at least $75 billion worth of economic damage in total. Only about 25% of these losses were insured. The devastating and costly events of 2002 and 2007 have spurred searches for better planning, precautions and financial solutions. By Lee Coppack

Extreme inland flooding is one of the most common but most dangerous natural catastrophe risks throughout Europe, as the table in Figure 1 shows. Flood deaths tend to be in small numbers, but economic damages can be very high. The floods of August 2002 which devastated parts of Germany, Switzerland and central and eastern Europe have spurred efforts to improve flood management.

Exposures are rising. Although climate change is expected to aggravate the weather patterns that cause floods, the main reason is the growth of the quantity and value of property and possessions in flood risk areas.

Today, the provision and take up of flood insurance across the European community is patchy, as Figure 2 shows. In the United Kingdom and France, insured losses can represent 50% or more of the economic damage, as was in the case in the UK summer 2007 floods and the southern France 2003 Rhône valley floods. By contrast, for the 2002 continental European floods, insurance covered only about 16% of the total economic losses estimated at 14 billion euros ($21.5 billion) at 2008 rates.

Insurers and reinsurers need to know what they are underwriting and that means high resolution maps.

They also want models to manage their aggregate exposures and probable maximum losses (PMLs), and modelling inland flood is extremely difficult. On the whole, efforts have concentrated on the United Kingdom, where the high insurance density makes the considerable use of resources worthwhile.

Historically, the most devastating floods to affect Europe have been the result of storm surge when sea levels rose during tropical or extra tropical storms. The hazard remains, especially in light of rising sea levels due to climate change, but sea defences have changed the risk.

The most common types of flood that create widespread inland damage in Europe are river flood and flash flood. Meteorological conditions, such as prolonged heavy rainfall, can cause high river discharge with overtopping of river banks and defences or defence failure. Sudden intense rain can result in dangerous, fast moving floods, even away from major rivers, with damage to infrastructure and landslides. Failure of drainage systems to cope with the increased load exacerbates the problem.

When both conditions occur in close succession, or even simultaneously, as they can do, the result is devastating, In August 2002, torrential rain from Germany as far as Russia caused flash floods that broke dams and damaged infrastructure. It was followed, even overlapped, by record rainfall that flooded tens of thousands of buildings and caused major losses to infrastructure and industry in Germany, Austria, and central Europe.

Insurance density

In most European countries, flood is either excluded altogether or quite limited, according to AXCO Insurance Information Services. The picture varies greatly. In the Czech Republic, AXCO reports that most household insurers give flood cover automatically and some by an optional extension. It estimates that over 40% of homes and their contents are covered.

In Italy, by contrast, although householders are supposed to be able to extend their property policies to include flood, few companies offer cover and less than 5% of households and 35% of commercial and industrial policyholders buy it. In France, flood insurance is widely available from the insurance market thanks to the support of the state owned reinsurance company, Caisse Centrale de Reassurance (CCR).

German insurers exclude flood from standard industrial, commercial and domestic policies and cover is only available as part of an extension package of natural catastrophe risks. AXCO says that take up of the cover has been increasing as awareness of the risks grow. In the Netherlands, cover is not generally available in the local market other than for pluvial flood. In other countries, such as Slovakia, insurers include flood but increasingly subject to sub-limits.

Exceptionally, in the United Kingdom all but a small proportion of properties are insured under standard property policies. The Association of British Insurers (ABI) has waged a campaign for several years to get increased government spending on flood defences. Two bouts of serious urban flooding in 2007 intensified the debate.

Maps needed

Good flood maps underpin any serious attempt by the private sector to underwrite flood risks, Sandrine Noel, head of non-life for the European insurance and reinsurance federation, the CEA, points out. To create maps at the necessary high level of resolution is expensive and really takes a joint effort between public and private sectors.

The Austrian map (the so-called HORA system) is so far the best example of public-private partnership in this field, according to Ms Noel. HORA covers some 26,000km of Austrian river systems. Ms Noel said some countries, such as Germany, are expected to follow in the near future and others, such as France and the United Kingdom, are developing forms of public-private partnerships so public and the private action can use the same references of hazard zoning.

A significant force for improved mapping will be the 2007 European Directive on the assessment and management of flood risks. It will require each member state to identify areas where there are significant flood risks in need of reduction by 2011 and to have mapped these areas on the basis of a 100 year event by 2013. (For more on the Flood Directive, see page 22).

One issue is that insurance tends to be written on a national basis for which local governments and national associations will produce maps, but large inland floods, such as those in 2002, often involve river basins which traverse several countries.

Models

Flood models are another element of making inland flood risk insurable. However, as Rebecca Cheetham of Guy Carpenter’s European model development team remarks in her article on page 14.

“The modelling of fluvial flood is particularly complex, demanding knowledge of the inter-relationships in the discharge of rivers in a particular drainage basin, in addition to information regarding defence structures and land topography.”

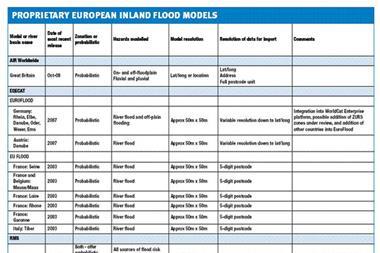

Each of the proprietary catastrophe modelling companies offers at least one stochastic model for a European country, as our survey on page 17 shows, and they are planning to extend the range. Guy Carpenter has developed a deterministic London flood model and stochastic model for the Czech Republic.

As the tools for understanding the exposures become more sophisticated, inland flood is likely to become a more insurable risk from an insurer’s perspective, anyway. Whether property owners will buy the cover unless it is simply included in their standard policy is a different issue. Evidence from the United States suggests that even in high risk areas, less than 20% insure. Insurers are left with the chronic problem of being offered only the most exposed properties.

The evidence currently suggests a gradually developing role for the private sector in the provision of post-event funds, but that responsibility for mitigation and most repair and reconstruction costs will remain the responsibility of government. Partnerships between the two could, however, be the best way of managing this common and, sometimes, catastrophic risk.

Postscript

Lee Coppack is the editor of Catastrophe Risk Management.

lee.coppack@cat-risk.com

www.cat-risk.com

No comments yet