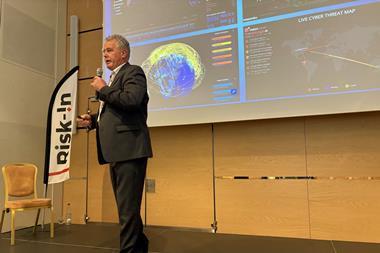

Intelligence systems can help financial institutions manage their operational risks and immediately flag up non-compliance, says Charlie Sherlock, chief executive at Cinario

Few would argue that finance is the most heavily regulated industry sector of all, with employees’ daily tasks all governed by multiple rules and restrictions designed to protect investors, shareholders, company reputations, and of course, profits. In addition to country-specific compliance legislation, international standards such as Basel II have also been introduced in recent years in order to further protect stakeholders, as well as the public at large.

Risk in the finance sector is often viewed as being synonymous with investments. While minimising this risk is critical to business success, it is equally important to reduce day-to-day operational risk. In the recent case of Société Générale, where employee Jérôme Kerviel conducted unauthorised trades resulting in a loss of 4.9bn euros, financial and operational challenges went hand in hand. The rogue trades were far from a safe financial bet, however the fact that the Kerviel was able to access the funds and slip under the corporate radar in the first place, suggests that, operationally, the organisation was also exposing itself to risk.

The two biggest operational risk challenges facing financial institutions are generally a lack of co-ordination between security systems, meaning that issues are not handled in real-time, and an inability to enforce internal controls, increasing vulnerability to both physical and virtual threats.

Quite simply, more intelligence is needed when it comes to risk management. Financial organisations will almost certainly have internal policies in place, covering issues such as limiting employee access to data, funds and accounts. Unfortunately, in all too many cases, these policies are then enforced manually, posing the danger of operational events being left un-monitored or even abandoned.

“The two biggest operational risk challenges facing financial institutions are generally a lack of co-ordination between security systems, meaning that issues are not handled in real-time, and an inability to enforce internal controls, increasing vulnerability to both physical and virtual threats.

By deploying systems capable of offering a centralised overview of internal risks companies can proactively address threats before any serious damage is done.

Whether the operational issue involves internal or external fraud, market manipulation, accounting errors or loss of client assets, financial organisations must be able to gain real-time insight into the status of all events, and automatically flag up any non-compliant activity, as well as taking immediate remedial action.

A number of high profile financial organisations have had their reputations hit severely over the past months, causing equally severe financial repercussions. Intelligent risk management can be key for companies wishing to avoid a similar fate; however, that’s by no means the only reason to consider the investment. With the Basel II standard, for example, the risk to which a financial organisation is exposed dictates the amount of capital that it needs to hold to safeguard its solvency and overall economic stability. Banks that implement effective compliance measures – protecting against fraud, data errors and information loss – will face lower operational risks, and will be required to set aside less capital. In effect, this means more money for trading, and the potential for even greater profits.

No comments yet