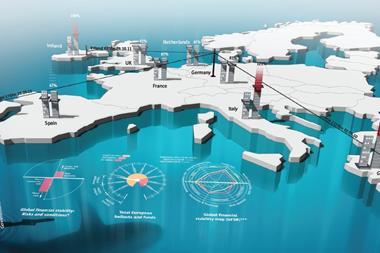

Greece, Cyprus, Germany, Austria, Belgium, France, Netherlands and the US all face ratings action

Trade credit insurer Coface has downgraded the risk assessment forecasts of eight developed countries. The downgrades were justified with the claim that financial market volatility has “spread to the real economy”.

Coface dropped the risk assessment for Greece by one notch to C, due to an increase in “payment incidents” by Greek companies since the beginning of the year.

Cyprus is also being downgraded one level, having already lost one notch last June. Some of Europe’s other big economies – namely Germany, Austria, Belgium, France and the Netherlands – have lost their positive watch on their A2 risk assessments.

Economic uncertainties could lead to consumers and investors suspending their purchases

Coface explained: “The ups and downs of the eurozone crisis and the US economic policy impasse now prevent expectations of a predictable scenario and these uncertainties could lead to consumers and investors suspending their purchases.”

The trade credit insurer expects a weakened growth of 1.6% in the monetary union in 2011. In the worsening of the eurozone crisis, Coface has also put the A3 risk assessment for Italy and the A4 for Portugal under negative watch. The two countries’ negative financial trends are affecting the “payment abilities” of companies, it said.

Besides Europe, the US is also suffering from a downgrade. The removal of the positive watch on the A2 assessment of the US is yet another blow to the Obama administration, since the US lost its AA credit rating only in August.

Coface also brought some rare good news, though. Iceland’s A4 risk assessment was placed on positive watch after it was downgraded in March 2009 and the negative watch on Thailand’s A3 risk assessment was removed, following the stabilisation of the political situation since the elections.

No comments yet