From taking out a policy to making a claim, in the insurance world your business depends on honesty and accuracy. Anything else could result in serious financial straits.

It is a fortunate middle-market company that never experiences any claims, so it’s important to know how to maximise your chances of recovering in full if you have a claim against your insurer, and how to minimise the likelihood of a successful claim against you.

Key areas are full disclosure when you take out your insurance, accurately estimating what a loss might cost you, and defensibility. If you have an insured claim, you or your broker must let your insurer know within the time limit specified in your policy.

In the case of property damage, you need to substantiate the amount of the loss. If the claim is large, it’s likely that your insurer will appoint a loss adjuster to investigate the loss and negotiate settlement. When you complete an insurance proposal or provide information to your brokers so that they can place your risk in the insurance market, you must give full details of any material facts. These are facts that you know (or ought to know) that could affect the way that insurers view your risks and the amount of premium they charge.

If you leave out any material facts, your insurer has the right to void cover. Material facts might include a poor claims history, any claims that you know or believe are pending, or misrepresenting the physical securities that you have in place to protect your property. The sensible rule here has to be: if in doubt, disclose it.

The importance of accuracy

When you are insuring property, you need to consider values very carefully. If you’re insuring on an indemnity basis, the insurer will pay compensation based on the value of your property at the time of any loss. You will only be entitled to an amount equivalent to what it would cost to buy or rebuild that property in its current condition.

For example, if you are insuring your computer equipment on an indemnity basis, you will receive a sum that allows you to buy the same equipment secondhand, with no allowance for upgrading.

Most companies that have a significant loss will want to take the opportunity to upgrade their premises or property. In this case, you should consider insuring on a ‘reinstatement as new’ basis.

Whatever basis of compensation you select, you must make sure that the valuation (sum insured) that you decide upon accurately reflects the amount you will need. This is essential because, if you have undervalued the cost of replacement or reinstatement as new, your insurer is entitled to reduce the compensation it pays by the same proportion.

This ‘average’ clause is one of the main reasons companies that consider themselves adequately insured can find themselves in financial straits after a loss.

Remember, when selecting a replacement sum insured, it’s important to include the ‘extras’ associated with a total loss. These can incorporate things like the cost of complying with public authority requirements, disaster recovery, debris removal and professional fees. Otherwise, with the total loss exceeding the sum insured, average will apply.

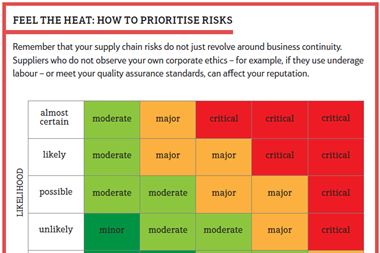

The amount you insure for business interruption and the time you estimate it will take your business to get back on its feet again also need to be accurate. It’s important here to take account of not only the effects of damage to your own premises but also the consequences of a key supplier being out of action for some time.

A business interruption review that includes looking at the supply chain will help you to assess the amount and type of coverage you need.

Demonstrating defensibility

If someone makes a claim against your company – whether insured or uninsured – you need to be able to put up a robust defence. A key part of good risk management has to be building defensibility into your systems and processes.

If you can demonstrate good working practices and a history of care in safeguarding employees, members of the public and customers, this will go a long way in protecting you against successful liability claims.

This is particularly important in refuting spurious or exaggerated claims and documenting incidents is key here. You should record, report and investigate any incidents that could lead to a claim.

No comments yet