Insurers are competing fiercely for business. And that has to be good news for buyers, says Guy Malyon

Following a year of very favourable reductions for European commercial insurance buyers, 2007 looks to be plotting a similar course with great deals available in a fiercely competitive market putting the buyers of both property and liability cover firmly in the driver’s seat.

Despite the weather extremes being experienced across the continent – high temperatures have sparked off forest fires in Greece and Bulgaria, Moldova has suffered its worst drought in 60 years with the mercury topping 41°C and the UK has been submerged under record rainfall levels – insurers have shown no sign of retreating from the competitive fray and are continuing to offer lower rates, favourable terms and looking at ways of expanding their books outside their traditional lines of business.

Buyers meanwhile now have every opportunity to review their existing risk strategies and decide whether they want to review their own levels of self insurance, perhaps taking advantage of such favourable market conditions to pass on risks that they were previously content to retain on their balance sheets.

Keeping the customer satisfied

The name of the game at the moment for insurers is keep hold of what they have got at all costs. Even those clients that have experienced large losses are benefiting from this marketplace. Competing insurers view a client that has experienced a total loss as a client with a brand new, well protected building and will fight to attract the business. The existing insurers feel they need to get their money back from future premiums. With plentiful supplies of capacity sloshing around, it is still very much a buyer’s market and their loyalty is being rewarded with reduced rates.

In Europe, the capacity competition is well illustrated in the liability market where AIG, Allianz, Axa and Zurich alone have posted £240m in capacity for 2007 and new capacity seems to be appearing every month. Together with increasing interest rates, and sustained low combined ratios, this situation continues to create rate reducing conditions for buyers to exploit.

Last year, Aon surveyed European commercial property buyers and more than half predicted rates would continue to fall in 2007. This prediction has been borne out and not just in property but across liability lines too. In some cases reductions have been up to 50%, though more usually we are seeing average reductions of 20% to 30% across all lines, with the exception of pharmaceutical liability and North American windstorm exposed risks, where rates continue to hold firm. And with price reductions, insurers are throwing in more incentives from their product shelves in a bid to maintain that customer loyalty.

Typically, more generous terms and conditions are giving buyers more for less premium and the re-emergence of multi-year deals illustrates a willingness from insurers to ensure their commercial buyers don’t get tempted to insure elsewhere. However, timing the inception of a multi-year deal is critical: what if rates continue to decline in the next couple of years? Some clients that bound to multi-year deals in the last two years have been successful in breaking these deals, reducing the premium and binding new deals. There remains a difficult decision for risk managers as to whether they want to bank stability or benefit from declining premiums in future years.

“Insurers have shown no sign of retreating from the competitive fray and are continuing to offer lower rates, favourable terms and looking at ways of expanding their books outside their traditional lines of business

Guy Malyon is head of casualty risk transfer, Aon Global UK

With competition so strong in the traditional lines of business (for example property damage, business interruption, public liability), as well as cross selling products more effectively, insurers are also looking for growth in other, less traditional lines such as product recall and environmental impairment. There are also instances of more exotic ‘alternative deals’ such as loss portfolio transfers which enable buyers to clean up their own self insured books and offload any potential losses back onto the traditional markets. Retro active covers, typically used to protect a company from any unseen liabilities post a merger or acquisition, are also coming back into vogue. Almost nothing is impossible it seems in this current market.

This increased appetite for business is also demonstrated by an increased willingness to quote for business in new sectors and industries that might previously have been outside an insurer’s area of interest. UK railway companies would, in past years, have attracted interest from two, maybe, three markets whereas now we are seeing interest from four or five. All of this increased competition then of course translates into more choice and a better deal for the customer.

Looking east

A growing trend amongst European businesses to relocate manufacturing and service operations to areas such as Eastern Europe or Asia, is also raising issues for insurers as the nature of the risk they cover changes. Recent years have seen many blue chip companies move significant operations from their home base. Taking advantage of operating in an area that has a lower cost base can throw up different insurable challenges particularly around supply chain management. Ensuring your manufacturing facility is supplied with the necessary raw material and components necessary to make the finished product suddenly becomes more of a challenge when you’re operating in a country less familiar and perhaps with a less secure and robust infrastructure.

The challenge of transporting goods also becomes more of an issue, particularly if you’ve moved your operation a significant distance and it may be that you now have increased marine cargo exposures. Throw into the mix the political risk implications of operating in a country less stable than the company’s domestic market and it is clear that insurers have a challenge to meet this new and changing risk profile. The signs are that the insurance industry is responding positively to the challenge though it will lift the more prosaic risks up a notch or two in complexity and present a bigger test of an insurer’s underwriting skills.

Can pay, will pay

Turning to the buyers themselves, they (particularly the larger clients), still continue to rate financial strength highly as a key factor in their purchasing decision and are dictating insurer selection on their programmes, even to the extent of imposing minimum limits on financial strength for blind capacity on their programme. Willingness to pay also continues to rate highly as a yard stick when choosing an insurer.

With plentiful and cheap capacity available, risk managers are also reviewing their retention levels and looking to transfer risk back to the market where possible. Again, this is a sea change in recent experience when buyers, in reaction to high prices, grew their levels of retention. Many commentators forecasted that as buyers grew comfortable with these higher levels of retention then great chunks of premium would be lost permanently from the traditional insurance market. It’s amazing how a soft market can challenge those perceptions!

“To put it into perspective, the recent UK floods are projected to cost the insurance industry something over £2.5bn, while losses from the 2005 hurricanes may well exceed $90bn

Guy Malyon is head of casualty risk transfer, Aon Global UK

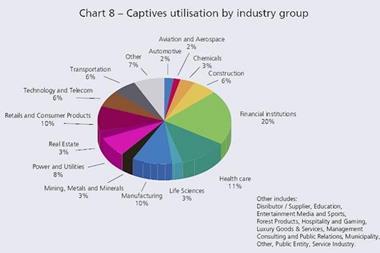

This market will also, no doubt, raise questions around the use of captives and their value. We said last year that a softening market had not decreased interest in captive programmes and we see no reason for this trend to change. The widespread benefits of self insuring this way go beyond the single benchmark of price.

The terrorism threat looms

The spectre of the terrorist threat continues to loom long over Europe and while the commercial buyer has in the past not always taken advantage of insurance cover, there is now plentiful capacity available on the liability side. Recent terrorist events in the UK brought a stark reminder of the ever present threat and may have shifted a few of the ‘it won’t happen to me’ perceptions that continue to feature amongst many businesses. Some buyers decided that terrorism cover wasn’t necessary for their business but changed their mind following the terrorist incident in Glasgow in Scotland, only to be confronted by a higher quote for cover than that quoted pre-Glasgow. This case is likely to be the exception to the norm however and we don’t expect a European wide change in attitudes to the threat.

Partying like it’s 1999?

As the year progresses, the question as to whether the current rate reductions are sustainable in the long term will become more pertinent, particularly as existing claims inflation is still rising. Are we back yet to the levels of the soft market of 1999? It’s difficult to say but there is still a demand from insurers for comprehensive information to support their underwriting decisions, suggesting that the industry is continuing to take a responsible approach and we’re certainly not seeing any reckless blind underwriting of risks.

The European weather events on their own are unlikely to halt the rate reductions (insurers may impose more restrictions for some personal lines), though they may of course temper the rate of decline, but of course, a significant reversal in the current benign hurricane conditions in the Gulf of Mexico and North America may well be the trigger that reverses or at least flattens the current trend. To put it into perspective, the recent UK floods are projected to cost the insurance industry something over £2.5bn, while losses from the 2005 hurricanes may well exceed $90bn.

All things being equal, 2008 will probably see more reductions but at a more gradual decline. The message for the European buyer is to take advantage while the going is good.

Guy Malyon is head of casualty – risk transfer, Aon Global UK, www.aon.com/uk

Five key steps to a successful renewal

Test different deductible levels with insurers

Consider long term deals and timing

Consider areas of uninsured exposure

Consider opportunities to clean up past retained losses

Take advantage of reduced premiums to increase capacity or widen cover.

No comments yet