With the right communication and data, risk managers can speak the language of the c-suite and become a driver of real climate change says Chris Hickin, vice president - operations engineering manager, London operations at FM Global

The recent extreme heatwaves and devastating wildfires across Europe have once again highlighted the adverse impact of climate change on our lives.

From tourism to agriculture, many sectors are affected and should carefully consider how climate risk may impact their operations.

Amidst these challenges, risk managers play a crucial role in showing that we are not powerless against climate change, as they work to guide organisations towards long-term continuity and resilience.

Given both their deep understanding of the unique risks their businesses face and insight into what must be done to overcome them, risk managers are well-placed to help create resilience against climate change.

“Risk managers have a responsibility to use their access to decision-makers to drive change.”

Often, however, it is not enough to simply identify and understand risks. Risk managers must also communicate them effectively to persuade senior colleagues in the C-suite to act and adopt climate resilience solutions, to protect today and prosper tomorrow.

Risk managers have a responsibility to use their access to decision-makers to drive change. With the right approach, and using the valuable tools at their disposal, they can provide the guidance required to help make this change a success.

Assembling this knowledge and evidence into compelling recommendations is a challenge but an ability to communicate clearly and effectively is now a core skill for modern risk managers.

Clarity is key

Speaking the language of the C-suite means highlighting financial data, illustrating the potential for intangible loss, and using concise language to develop a compelling argument for helping the business flourish.

Risk management professionals rely on data and science to make the decisions responsible for preventing losses through risk improvement, so the same information should be used to illustrate the potential impact of risks associated with climate change.

But to convey the complexity of the modern risk landscape to C-suite executives, clarity is essential. Business leaders need easily-digestible data, which communicates the seriousness of the risks faced and, importantly, the actionable steps required to help overcome them.

“Risk managers could work with insurance partners to construct a case for resilience improvement spending to present to the board”

It can be challenging for risk managers to keep their case persuasive unless the true financial impact of a property loss is understood. To overcome this, risk managers could work with insurance partners to construct a case for resilience improvement spending to present to the board.

A constructive partnership can open doors regarding access to valuable tools that aid in condensing complicated financial data into an easy-to-understand format and forming a convincing argument.

Tools such as this can provide actionable insight for risk managers to promote, helping to develop a coherent and cost-effective argument for specific investments in climate resilience solutions.

Beyond the physical

As stability is vital for building towards prosperity, decision-makers cannot afford to ignore the deeply intertwined nature of physical climate-related risks and business continuity.

Intangible asset loss, through problems such as reputational damage, lost market share, missed growth opportunities and declining investor confidence, can play a significant role in the difference between insured loss and uninsured loss.

For example, research commissioned by FM Global found that after reporting financial damage following a major flood event, 71 of the world’s largest publicly traded companies saw an average decline in shareholder value of five per cent a year after the initial flood losses.

Traditional property insurance policies can fall short of predicting, and therefore comprehensively insuring, outcomes such as this, meaning the most effective way to reduce exposure to this type of loss is by improving climate resilience.

It can prove difficult to convey this concept effectively to C-suite executives due to the intangible nature of these problems and their unpredictability.

“Ultimately, risk managers must be the optimists - the data is available to measure climate-related threats and there are solutions available to help”

Yet, walking them through the resilience-building process in a clear way can illustrate the link between physical damages and their wider repercussions, laying out mitigation measures and clarifying the steps that make potential losses less likely to occur in the long term.

The consequences of climate change are already with us, disrupting operations, shifting investment decisions and complicating supply chains.

FM Global’s research has found that climate-related losses at commercial properties with critical climate risk are 30 times more likely to occur, and be 180 times more severe, than at properties with the highest climate resilience, underlining the significant difference preparedness can make.

Although the pandemic has made many C-suite executives more aware of the importance of managing major risk events, it is vital that they remain engaged when it comes to developing resilience.

Ultimately, risk managers must be the optimists - the data is available to measure climate-related threats and there are solutions available to help enable organisations to thrive now and in the future.

By communicating this effectively and helping others to understand the complexity and breadth of risk, we can help steer decision-makers to a better, more resilient future in the face of climate change.

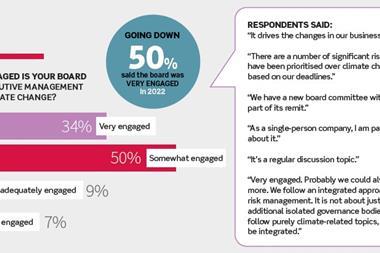

Calling all risk managers!

Is climate change on your risk radar as a physical risk, transition risk or in some other form? How prepared is your organisation for the transition to net-zero? How engaged are your board and executive management with these

issues?

StrategicRISK’s annual

climate survey tracks how risk managers are thinking about and dealing with climate risks. We want you to tell us how you are mitigating the threats and capitalising on the opportunities created by the race to net-zero.

Please take part in our quick survey. All will be anonymised and the results will appear in this year’s annual special climate change report in the Q3 edition of

StrategicRISK,

as well as being published on our website.

https://www.surveymonkey.co.uk/r/3FZBYRD

No comments yet