A slowdown in the BRIC economies is partly a result of their link with first-world losses and not necessarily a cause to panic – yet

As the rest of the developed world crumbled in the 2008 financial Armageddon, the BRIC (Brazil, Russia, India, China) countries seemed to hold fast to their economic boom.

A healthy combination of large populations and rapid economic growth meant the BRICs were on track to become some of the largest economies in the world, with China predicted to be the biggest of all. But recently, along with other emerging market economies, the BRICs have begun to experience a severe slowdown, raising questions over whether they may be victims of their own hype.

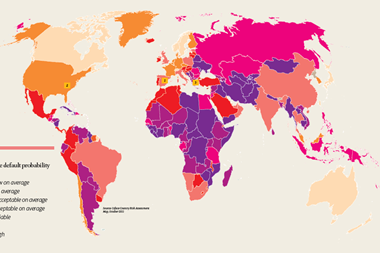

However, the situation is complex and sometimes contradictory. The malaise and uncertainty created by October’s partial shutdown of the US administration over its budget impasse has led to fears of another fi nancial crisis enveloping the country and potential adverse eff ects for businesses and economies across the globe, particularly those in the BRIC bloc that rely on continuous US investor funding.

The ties that bind

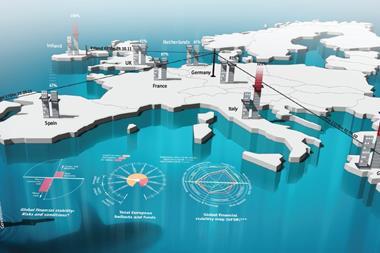

According to International Monetary Fund forecasts, growth in China will almost halve to 7.6% in 2013, and will fall in India by 3.8%, in Brazil by 2.5%, and in Russia by 1.5% over the next year.

The reason for such a sharp drop in fortunes is because developing countries are tied far more closely to fi rst-world economies than at first thought. American economist Nouriel Roubini believes a period of overheating in 2010-2011 left the BRICs and other emerging economies with growth figures above potential and inflation. The economies then tightened monetary policies, with negative consequences for growth that have carried on in 2012-2013.

“The idea that emerging-market economies could fully decouple from economic weakness in advanced economies was far-fetched: recession in the eurozone, near-recession and slow economic growth elsewhere were always likely to aff ect emerging-market performance negatively,” says Roubini. Owen Belman, chief executive, Greater China, Aon Asia sees further change ahead as the region evolves economically. “Since concerns over the global economy do not appear to be dissipating, organisations and national economies need to embrace the economic slowdown from a global perspective,” he says. “The rapid ascent of the Chinese economy has been largely dependent on consumption from foreign economies and it now faces a litany of challenges associated with continued growth. External challenges include slowing overall global growth rates, political turmoil and uncertainty, increased regulatory and legislative measures along with numerous other macroeconomic factors.

“President Xi Jinping is engaging in a number of internal activities to transform the Chinese economic and political environment to provide a more stable and sustainable growth model for the Chinese economy. As growth continues to slow globally, the Chinese economy will be forced to take measures to sustain growth while beginning to shift from a producing to a consuming economy.”

The economic prospects of the BRIC nations are dependent upon continued investor interest, as well as healthy export prospects off shore. Businesses need to ensure that any falling economic tides don’t leave them high and dry.

No comments yet