As war and conflict increasingly creep across the globe, organisations must reconsider how they do business in volatile countries and, indeed, as the situation in Libya demonstrates, just who they’re doing business with

War risks in several parts of the Middle East and Africa are intensifying, posing significant threats to international businesses in these regions, including probable asset damage and supply disruptions.

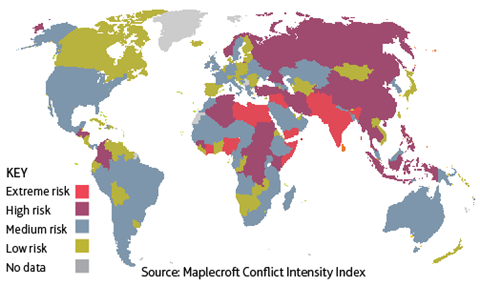

A recently published conflict risk index warned that 12 countries in these volatile regions are rated ‘extreme risk’. The Arab Spring uprisings have accounted for an increase in violence in several parts of the Middle East.

India, Afghanistan, Cote d’Ivoire, Libya, Iraq, Pakistan and South Sudan are the deadliest parts of the world, according to Maplecroft’s third annual Conflict Intensity Index, a tool developed to assess ongoing trends for conflict and potential risks to operations and investors.

Libya, which rose from 120th in last year’s index to fourth this year, has a death toll running into the tens of thousands, making its civil war the deadliest conflict of 2011.

“Conflict exponentially increases the risk of doing business within a country, as operations are disrupted and employees and assets are endangered,” comments Maplecroft analyst Jordan Perry.

“This threat was all too apparent to the oil majors in Libya, as they evacuated employees in response to the violence. Ongoing monitoring of political risk …

is essential for companies to ensure business continuity.”

Volatility in central Africa is also intensifying. “Civil war is spreading in Sudan, and concerted international action is needed to stem the violence and prevent it from engulfing the entire country and the wider region,” the International Crisis Group (ICG) has warned. Hundreds of thousands of people have been displaced by the conflict in Sudan - at least 20,000 of these people have fled into Ethiopia. “The situation will escalate if the international community is delayed or disjointed in its response,” ICG stated.

Top 10 at-risk countries

- Afghanistan

- Côte d’Ivoire

- Iraq

- Libya

- Pakistan

- South Sudan

- Syria

- Nigeria

- Somalia

- Yemen

Source: Maplecroft

Much of the Western media’s attention in recent months, however, has been focused on Libya. Businesses in the region are trying to get back to work as the interim government attempts to impose some form of stability. But the operational risk environment is challenging.

Continuing political instability, problems with economic sanctions and widespread corruption are all hampering a return to business as usual.

As every international business knows, political uncertainty makes long-term planning very difficult. The only thing that’s certain in Libya at present is that the interim government is prone to quarrelling and in-fighting, which, for business, can lead to postponement and delays.

Foreign organisations that may have established working relationships with the former regime are now having to spark up fresh ones with the new order despite the fact that it’s still not clear who has the firmest grip on the levers of power. If foreign organisations are still dealing with business representatives that had links to Gaddafi and his regime, they should be prepared to see these people ousted.

Economic sanctions also still pose a risk to foreign investors. “From a regulatory point of view, the EU continues to list sanctions on Libya,” says Maplecroft’s risk analysis specialist for Libya Jonathan Terry. The EU has begun to repeal some of the sanctions that it imposed on Libya, but sanctions still pose a serious reputational threat for companies. It’s likely to be some time before the picture is entirely clear.

Another threat that’s common in lawless parts of the world is corruption and abuse of power, which will continue to be a major problem in Libya for some time to come.

No comments yet