Competition may be intense and margins tight but aviation insurance coverage remains a buyers’ market. StrategicRISK looks at what the future holds for the global aviation industry

The aviation sector is in rude health. Year on year, more people want to travel on planes, with nearly three billion passengers expected to take to the skies this year.

Europe’s airlines are expected to double their profits over 2013/14 to £1 billion (€1.2 bn), according to research by The International Air Transport Association. Globally, airline industry profits are expected to hit £8.3 billion, easily smashing the expected £6.8 billion predicted in March. Larger planes, lower fuel prices and increasing passenger numbers have all played their part. But these figures are only half the story and things in the airline business are far from the good times that they might suggest. Competition is fierce, capital investment is huge and operating costs are high. Cash flow is tough; financially, the sector is broadly cyclical, with several years of loss proceeding a similar period of profit. But even in good years margins are tight, generally only 2-3%. Against this background, premium rate is a crucial consideration. “But buyers are not only looking at price,” says Rob Sage, UK head of underwriting aerospace at AIG. “More and more, they are looking at broadening their coverage as well. With rates at such a historic low, buyers are looking for the widest coverage available.”

There is a huge amount of capacity available to meet those needs. “This is only growing,” says Sage. “There are new entrants into the market and rates are still declining.” So far, 2013 has seen no change in the downward direction of insurance premiums, with power still firmly in the hands of buyers.

This is partly because the aviation sector has seen no big claims for years. The last major incident was in June 2009, when a combination of technical failure and human error led to the crash of an Air France Airbus A330 over the Atlantic and 228 passenger and crew deaths. Despite the deaths of three passengers, the crash landing of the Asiana Airlines Flight 214 at San Francisco Airport on 6 July this year didn’t upset market conditions and, if anything, the incident reinforced the perception of solid safety standards: 305 of the 307 passengers survived, and a third of them didn’t require hospitalisation.

“The aviation sector is enjoying an extended period of low losses,” says Nigel Weyman, head of aviation at JLT Group. “Lower in fact than most people would have thought possible. The safety trend has really improved; we have seen a big investment in new technology over the last 10 years and this has really paid dividends in terms of reduced losses.”

Rob Sage agrees. “Losses have been benign,” he says. “In part, this is down to technology, and in part to better safety generally. I think that there is a range of factors involved. But the end result is a better record.”

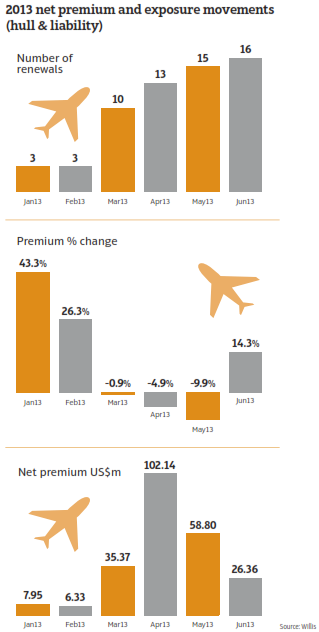

According to research by Willis, premium levels reduced by 5% in the first half of 2013, which equates to £8.5 million (€9.8 million) being eroded from the overall market premium.

In addition, the growth in exposures continues to remain in the mid-single digits and, as a result, rating levels continue to drop, with average hull rates down 11%, and average liability rates per passenger down 13%. This has resulted in the overall cost per passenger for insurance falling by 12%.

Losses for the first six months of the calendar year (excluding Asiana) are currently estimated to be US$488 million, including anticipated attritional losses. The question everyone is asking is how long can these conditions be maintained?

Soft for how long?

“With low loss levels, high safety levels, high passenger growth and fleet value growth, it’s a buyer’s market,” says Steven Doyle, chief and commercial officer, Willis Aerospace.

Of course, it would be complacent to say that there won’t be another incident. “Sadly, there almost certainly will be, and there will be more losses as a result,” says Sage.

“Ultimately that is something we can’t stop; however good your safety precautions are and however much you invest in technology, major incidents are usually the result of a chain of events rather than just one factor, and so are difficult to eradicate completely.

“But the market should be able to cope well.” Although no one in the industry likes to talk about September 11, many now believe that it is only a massive incident of that scale that would trigger a sudden movement in the market, which should be able to sustain losses of a lower order. “Most events do not affect everyone,” says Stephen Doyle. “No one has the ‘market result’.

“No one writes every risk. Half may be on every risk, but that’s not the same as half the market. There are checks and balances.” Given this apparent stability – and the constant pressure on rates – insurers and brokers must push themselves to gain a competitive edge through innovation.

“Today’s market environment is here to stay for some time so we’re focusing on delivering different solutions for clients as well as the right capacity and price,” says Sage.

Innovation

The great challenge for insurers is to find an affordable way to differentiate themselves from their competitors and gain some market traction.

“The aviation sector is quite mature,” says Rob Sage. “Most products are a legal requirement for clients. This can be quite a difficult environment within which to innovate; there may be the interest from buyers but, in cost-conscious times, can they afford it?”

The aviation sector is becoming increasingly complex and clients are not only asking to do more with their existing cover, they are looking to place new risks in the market. In common with almost all business sectors, risk managers are showing an increasing interest in specialist cyber policies.

“Especially from the US,” says Sage. Security at airports has always been tight – and even tighter since September 11. But as technology becomes more and more complex, the risk profile is changing and becoming more complex as well.

Cyber attacks now pose a significant new challenge for risk managers. Just how serious these threats can be was illustrated in 2010, when a group of ‘white hat’ hackers were able to bypass German airport security.

The Chaos Computer Club remotely accessed data stored on the key cards used by airport employees. If they had been a terrorist cell, it may have been possible to use this data to access restricted areas of airports.

“The system was relatively simple to crack,” said Chaos Computer Club member, Karsten Nohl. “We were quite honestly shocked to find there were absolutely no obstacles that we had to overcome.”

New technology is also having an effect in other areas and posing real challenges. “There are losses that haven’t hit the headlines but that are eroding premium incomes,” says Nigel Weyman.

Disruption caused by the 2010 ash cloud prompted a surge in demand for relevant cover. At its peak between April 17-19 it was costing operators up to £260 million a day, according to the International Air Transport Association.

“There was a lot of interest in products that would cover airlines should anything similar ever happen again,” says Sage. “But when they saw how much it costs, that interest evaporated.”

Steven Doyle says: “It’s hard to sell a product that clients may only need once every 70 years.” Where new products are emerging – and being taken up – is in covering more traditional risks, where clients are looking for innovation that unites different risks together to provide a broader coverage that closes gaps, provides more stability and, of course, comes at a competitive price.

Interest in future proofing products against market fluctuations is also developing. “We are seeing many clients trying to fix some of their minor lines for 24 months,” says Sage.

“I think there is a feeling that the bottom of the market is not far away and airlines are trying to protect themselves over the longer term.” Weyman agrees: “If airlines feel like they are getting close to the bottom of the market then they are more likely to give up the lowest premiums in return for some stability. And similarly, insurers are also looking for stability.

“We see very sophisticated buyers [in aviation] and they do understand the market dynamics well. Increasingly they do not want the cheapest premiums, they go for stability.” New players are entering the sector and this is also having a risk impact.

In recent years there has been a growth in the scale of institutional investment and the influence of sovereign wealth funds, driven by factors including high commodity costs, the growth of pension funds assets, privatisation trends and changing regulations – all of which have increased the attractiveness of infrastructure investment to institutional investors. These investors take a global view of their portfolio and increasingly require help gathering the intelligence necessary to do this – and the developing role of brokers in helping provide this is one area where innovation will be needed. With aviation infrastructure come risks that new investors may not have experienced: high up-front costs and very large scale projects.

A further complicating factor is the lack of quality global data on infrastructure investments, which makes it hard for clients to weigh up risks and fully understand their exposure – and in the future they will need help. If anything, the increasingly complex risk profile in aviation will lead to increasingly complex claims – and an increasingly important role for good brokers.

In years to come risk in the aviation sector will only get more complicated, more international, more high-tech, and clients will want more and more from their brokers and insurers. The challenge is, can this be delivered?

Satellites

There are more than 8,000 operating satellites orbiting the Earth, helping with all aspects of communication, from GPS and mobile broadband to navigation and terrain mapping.

Not only are these satellites highly complex – and mission critical to many firms – but they are also extremely expensive to build and launch.

“We began to see the earliest insurance policies in the late 1970s,” says Jeff Temple-Heald, UK head of space underwriting at AIG.

Since then there has been steady year-on-year growth following the broader development of technology in society, “with some surges relating to higher use areas like GPS and mobile broadband.”

Future growth is expected, particularly as communications firms take mobile broadband into areas where appropriate cabling doesn’t exist.

Unusually, most cover is only a proportion of total value. “Perhaps half what a satellite is worth,” says Temple-Heald. “There is a cost to insuring satellites and clients take what they can afford.

“The reason for this is that there is a catastrophic risk involved, when things go wrong they can go royally wrong.”

As in other areas of aviation, innovation is proving to be the key to success for insurers.

“Clients are looking for longer-term protection,” says Temple-Heald, “long-term protection would enable clients to take this [protection] to the bank to use to negotiate loans and increased funding.”

Cyber risk is also an exciting new area. “Many operators are being hit by hacker attacks,” explains Temple-Heald, “clients are looking to expand cyber cover to cover the risk of losing sensitive data from satellites.”

Claims

When things go wrong, you want action from your insurer and the test of any market is in the way it handles claims.

Given the potentially catastrophic nature of airline incidents, the knife-edge margins and the fragile, interconnected nature of global air travel, there are few sectors where claims handling is more important.

Despite – or perhaps because of this – morale among buyers and brokers remains high when it comes to claims.

“The aviation market deals very well with claims,” says Sean Orton, partner JLT aerospace. “It is a very commercial sector. I always say to clients that the sector is much more commercial than many others. Everyone involved is very pro-client; they all know that whatever happens, planes have to keep flying. It’s in everyone’s interest to make sure that happens.”

Alan May, partner JLT aerospace, agrees: “In the event of a major incident, everyone in the market, the insurers, brokers, loss adjusters, underwriters, everyone works together to keep the airlines flying. It is a very proactive situation.”

Unlike other markets, in aviation lawyers are instructed to defend the insured, and loss adjusters are instructed by the underwriters. “They go in very open-minded,” says Orton. “In fact, a good loss adjuster will actually advise the insured to claim money that they are entitled to and perhaps not aware of.”

“The loss adjusters are all engineers, they are all ex-airline, they know the business,” says May. “But they are also independent, and that’s very important … The lawyers are all experts in aviation law and they are there to protect the airline, protect the brand.”

Insurers are proud of the effort they put into claims, and outsourcing is far from the norm it has become in other sectors. “It is very important for us not to outsource our claims handling,” says Rob Sage. “We have an excellent claims team, who are very good at handling all types of incidents. Others might choose to outsource, but we feel strongly that what we are selling is our claims service.

“I think what risk managers are looking for in an insurer is strong leadership and great claims handling.”

In the event of an incident, brokers immediately collect a large fund of money from the insurance market with which to settle any hardship claims, settlements, and expenses.

“The only reason that sometimes people criticise the pace of payments is because claimant expectations – and the expectations of the lawyers who advise them – are too high,” says May. “The aviation sector prides itself on its ability to respond proactively and help the client.”

However, the sector is not without its risks. Talking off the record, one senior broker suggested that while the London market is very good on claims, some overseas markets operate to a much lower standard and he had some concerns about claims in these areas. “Defence costs are growing and legal costs are increasingly an issue when defending claims,” he said. But generally, most seem content.

“While we don’t always have an easy life, we don’t have the politics and problems [in aviation] that are present in some other sectors,” says Orton

In association with

No comments yet