Which will be first to arrive in the Middle East - a sophisticated approach to risk management across industry sectors, or greater use of captive insurance? One will almost certainly drive the other

A lot has been written about the prospect of a captive insurance market in the Middle East in recent years. The market has a long way to go and, to date, only a handful of pioneers have tested the waters.

But the international financial centres of Dubai, Qatar and Bahrain are determined to foster an environment that is conducive to captive formation. They are keen to grow their slice of a lucrative multinational business, worth tens of billions of dollars. More than 65% of all Fortune 500 companies have captive subsidiaries, and it is estimated that there are about 5,000 captives around the world. Estimates show the global captive insurance market is worth more than $30bn (€22bn) in annual premiums and has more than $130bn in assets.

An easy sell

There are plenty of characteristics that make the Middle East market appealing as a captive domicile. The wealth of the region, huge investment in energy and infrastructure, steadily growing insurance penetration and increasing risk awareness are just some of them. State-owned assets are being privatised, transparency and governance requirements are growing, and company managers and directors are becoming more sophisticated in their approach to risk financing.

The countries of the Gulf Cooperation Council (GCC) are home to some of the world’s biggest oil and gas reserves, and many of the energy and petrochemical companies that are located in the region have risk profiles that lend themselves to captive insurance. There is also a determination to diversify the Middle East economies, with investment in education, healthcare and technology among other sectors that traditionally benefit from self-insurance.

Bahrain, Dubai, Jordan and Qatar have introduced captive legislation and worked hard to lower barriers to entry. For example, the Qatar Financial Centre (QFC) allows 100% foreign ownership of financial services firms, and issued new captive rules in July 2011 that offer greater flexibility in captive structuring and a risk-based model for setting minimum capital requirements.

Several captive managers have set up shop in the region and are working hard to educate the market on the benefits of self-insurance and the various structures available. In 2008, Marsh was granted a captive insurance management licence by the Dubai International Financial Centre. Marsh Risk Consulting managing director Marc Paasch says a natural shift from West to East is taking place in the captive universe.

“Captive clients are definitely looking at the cost side – the capital needed, running costs and compliance costs, and total cost of risk – but the regional presence is also starting to be key,” he says. “Some of the large European groups, because of growth in Asia, have significant parts of their business now executed by divisions in Asia. Some of the management board members have already moved to Asia and these companies, for new captives, are definitely contemplating locations like Singapore, for example.

“In India and the Middle East there is a starting dynamic of captive formations and Dubai is a good example.”

In other parts of the world, tightening regulation – in particular, Solvency II – is also expected to benefit the market. There is ongoing uncertainty surrounding the new regulatory regime and whether European captives will be given proportional treatment under the new rules. Organisations considering setting up new captives are more likely to consider domiciles outside the European Union.

This does not automatically mean parent companies will shun the established captive domiciles of Bermuda, Cayman and Guernsey in favour of Dubai or Qatar. But these centres could be an option. Organisations with significant operations in the Middle East or Asia could see the appeal in keeping their captive closer to home. And with growing interest surrounding Takaful captive structures, the Middle East is the obvious place for organisations wanting to go down the shariah-compliant route.

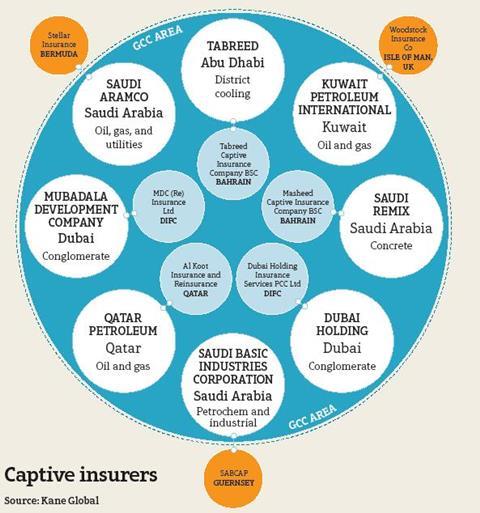

As of November 2011, the region boasted eight captive insurers. The Middle East’s first, Tabreed Captive Insurance Company, was set up in Bahrain in 2007. The island country is now also home to Masheed, the captive insurer of Saudi Remix, a concrete company based in Saudi Arabia. Dubai is home to two captives and one cell company, while Qatar currently boasts one captive insurer, Al Koot Insurance and Reinsurance Company, which was set up by Qatar Petroleum in 2008 to meet the energy company’s risk retention needs.

There are also several GCC groups that have established captives elsewhere. It is understood that one UAE-based group is currently in the process of opening a captive in Guernsey, which is already home to a Kuwaiti parent’s captive insurer. Three Saudi-based groups have captives in Bermuda and Guernsey.

Lack of momentum

The existence of these companies suggests there is a template from which to build, but so far the market has been slow to develop. According to AM Best in its Gulf Region report, GCC Rich in Potential, But Hurdles Remain, the competitive local insurance market is one reason why captive insurance has been slow to develop.

“There is still a lack of awareness and understanding surrounding captives, as they are a new offering,” the report says. “A common attraction of the captive structure is the ability to lower premiums, but with GCC insurance prices already being generally low, there is little incentive to self-insure.

“Nevertheless, optimism surrounds the prospects for captives. The Dubai International Finance Centre (DIFC) recently reduced its application fee for captives from $15,000 to $5,500, and for protected cell companies from $40,000 to $8,000 for the core cell, plus $1,000 per additional cell.”

Some market commentators believe the financial crisis has held back momentum. Others point out that many of the region’s small family-owned insurance companies are already used in the same manner as captives.

Solidarity General Takaful Company general manager Youssef Al Kareh says: “The owners of a lot of large conglomerates that can benefit from captive insurance are also shareholders in insurance companies.”

Al Kareh says that cheap insurance rates in the region is another reason that GCC-based firms do not feel motivated to consider self-insurance, and adds that there is a general lack of understanding about captive insurance.

“Even when management is convinced about the merits of this tool, it is difficult for them to get board approval for setting up and capitalising a risk management subsidiary,” he says.

“Sometimes you will be surprised at the lack of a proper risk management structure within organisations. For example, an oil company might have an excellent understanding of the engineering aspects of safety, but far less experience with financial risk management.”

Clearly, there are plenty of challenges ahead for the Middle East market if it is to become a successful captive jurisdiction. Educating insurance buyers on the benefits of risk retention and encouraging a more sophisticated approach to risk management will be crucial. There are plenty of signs this is already happening.

Institute of Risk Management head of thought leadership Carolyn Williams says: “The Middle East is growing much faster than the UK and Europe, and that reflects the growing economic activity in the region and the investment that companies are making in training and professional qualifications, and in using risk management.”

No comments yet