Nearly all businesses with international operations and supply chains are ringside for the battle for the next world order. Control Risks principal Dan Tawfik and senior partner Jacqueline Day explain how to prepare for tomorrow.

Nearly all businesses with international operations and supply chains are ringside for the battle for the next world order. The bigger players are increasingly in the ring themselves. From the Made in China 2025 strategy, to the US Trade Representative (USTR)’s shift from promotion to protection, the need to play coordinated defence against macro political opponents has never felt so real. Investors with an appetite for certain emerging and frontier markets are likely preparing for a nail-biting year, as governments under financial pressure pass on their pain through regulation, changing taxation, and defensive economic policy.

With dramatic change come outsized opportunities, and risk-taking in 2019 promises great rewards. For example, despite the wave of political change in key Latin American markets, private credit investing in the region is set to reach record highs in the next year. While the spectre of a more statist approach in Mexico has given investors pause, the scale of infrastructure need and privatisation continues to retain strong interest for debt and equity players and the developers with which they partner. In this new world, the best positioned companies will treat resilience as at minimum a competitive advantage, and for many an existential imperative, as they boldly move forward to capitalise on the volatility.

From the development of political risk awareness across all C-Suite functions, to the empowerment of hyper-aware global security and intelligence operations centres, the most sophisticated organisations are successfully instituting a step change in corporate philosophy. In doing so, they are swallowing whole two important tenets of this new hyper-competitive world order. First, that political risks will impact the success of all functions of business, in all markets. And second, that corporate resilience will be the strategic enabler in 2019.

Corporate resilience requires better organisation and alignment of awareness and early warning across all functions of a business to prevent disruptive events thwarting commercial opportunity. Strong market awareness will of course be ever-important, but those achieving the greatest competitive advantage will ensure all departments, product and service groups, and geographies are actively incorporating geopolitical risk awareness and intelligence in their everyday thinking.

To ensure all oars are pulling in the same direction and all relevant threats are identified, this must be a collaborative effort, but with each function looking after their specific interests and responsibilities. Strategy, risk and finance groups will have to more robustly forecast how the economic policy behaviours of certain markets create disharmony in 2019. This may manifest in disadvantageous regulation, credit and country risk. Business operations should be able to confront the implications of more rapid shifts in geopolitical alliances, and the increasing vulnerability of supply chains and infrastructure, to cultivate viable alternatives. Service, product and business heads will encounter rising nationalist, nativist and activist trends, and will need to avoid antagonising customer segments and the public while competing for market share across these divides. Intelligence and security teams will as always be expected to remain ahead of both global and local issues, from physical space to cyber space, and all with the potential to drive enterprise impacts.

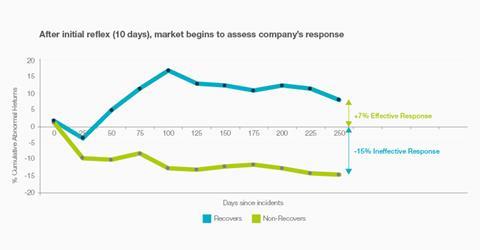

Bad things will still happen, despite measures to prevent them. However, resilient companies will ensure that they are detected and recognised quickly, and effectively addressed by leveraging the relevant expertise – both internal and external. Over the years, Control Risks has carefully catalogued the decline in shareholder value companies experience as a major issue or crisis becomes more protracted. The argument for rapid and multi-dimensional response based on solid intelligence from a range of sources is compelling.

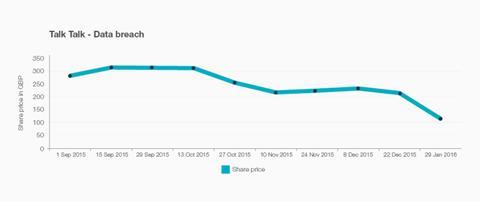

Fig. 1 Crisis: Immediate shareholder impact

The evolution in the orientation of the government and public-affairs groups of some high-performing global companies is a good example of adventurous leadership addressing this challenge. Historically, these groups focused on networking and gaining the access necessary to lubricate business objectives, often leveraging big names from the international policy sphere to interact with senior government officials. The best of these teams are now attracting talent with the necessary in-market experience to more comprehensively map particular stakeholder environments, escalate issues early and to the appropriate level, and understand the best communications and advocacy strategies to speak effectively across power brokers on multiple fronts.

Fig. 2 and 3 Crisis: Immediate shareholder impact

This is particularly important in cases where increasingly empowered mid-level regulators may be immune to the charms of a major name. Effective navigators of the global risk waters engage with stakeholders early to head off issues at the pass, but understand that investing in the right relationships takes time and focused effort.

Fig. 4 Crisis: Immediate shareholder value

Beyond this, companies are also recognising the immediate requirement to connect the trends of the stratosphere to realities on the ground. Leadership teams are now reprioritising to enhance and extend their capacity to engage with issues at a local level while monitoring the business impacts of macro-level geopolitics.

The way senior leadership conducts itself is also critical. There are three essential behaviours:

1. Not living in an ivory tower, being willing to listen to bad news, and avoiding a culture in which mistakes are suppressed.

2. An ability to match the standards espoused at head office with the business’s performance in the most remote of locations.

3. Above all, the ability to see humility as a strength and not a weakness.

These are hard skills to sustain, particularly in a business culture that celebrates the cult of the omnipotent superhero CEO driven by short-term goals. The tech sector has particular vulnerabilities here. The period of time between a small group of often very young entrepreneurs having a good idea and that idea turning into a multi-billion-dollar enterprise is staggeringly short, measured in months not years. These companies are often at the vanguard of the fourth industrial revolution, redefining the modern corporation faster than can be taught at business school. They very often rely on an overwhelming sense of mission and intent, and a willingness to rip up the rule book and make a virtue of non-conformity. But reaching for the stars without exposing oneself to a range of potentially catastrophic risks is one of the primary managerial challenges of these strange times.

Taken superficially, the risk outlook for 2019 might encourage a battening down of the hatches. But here is where geopolitical awareness, organisational alignment, scenario planning, issues and crisis management discipline, and an ability to respond to multi-faceted challenges pay off.

From business process outsourcing companies with strategic bets in the Philippines, consumer goods companies pursuing Asia’s millennials, agricultural investors seeking new markets in Eastern Europe, and telecoms providers seeking to penetrate Southern Africa’s opening sector, to infrastructure investors eyeing a Brazil under Bolsonaro and US conglomerates pondering the riddle of Brexit, in the coming year, risk readiness and responsiveness will actively create valuable space and free up leadership to focus on growth.

For more insights from the Control Risks team, click here.

1 Readers' comment