A leading investment adviser explains how some of the pressures currently facing the world economy, including sovereign defaults and inflation versus deflation, could affect risk managers

Pippa Malmgren, president and founder of Principalis Asset Management, specialises in understanding the risks you can’t quantify.

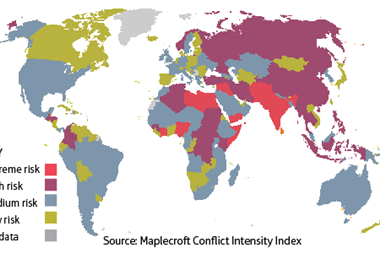

In this video she lists some of the pressures currently facing the world economy: “We have the risk of inflation versus deflation, the high probability we get sovereign defaults and that includes municipal defaults in the US, which I think are very likely to occur. Now you also have food inflation pressures, which leads to political instability and civil unrest issues in emerging markets all of which starts to deteriorate the productivity of those emerging markets.

“All these things tell me that volatility ought to be higher,” adds Malmgren. “And that will affect all sorts of asset classes, we’ll see this in particular in commodities. Brands are very powerful in this new environment. You want to own brands that have the capacity to pass on higher costs because I think higher costs are inevitable.”

This scale of uncertainty makes like very hard for risk managers. But nowhere is uncertainty more monstrous than in the European sovereign debt crisis.

Commenting on the eurozone crisis Malmgren says: “I think we’re going to have sovereign defaults, I think that’s unavoidable. And that’s been my view since the beginning of the financial crisis.

Brands are very powerful in this new environment. You want to own brands that have the capacity to pass on higher costs

“What we [governments] did was we took the losses that were on the banks balance sheets and we moved them onto the governments’ balance sheet. But that doesn’t diminish the loss. It still has to be paid for.

“The first round of austerity that we’ve experienced here in the UK is only round one. Eventually it becomes clear to the political leadership that the cost of defaulting is lower than the cost of paying.

I think we’re going to have sovereign defaults, I think that’s unavoidable

Offering sage advice to investors, she adds: “My bottom line is we should buy when the default is announced. Most people will do the opposite, they will see default get scared and want to sell everything in their portfolio. My view is once you get default it is like hitting the reset button on your computer. It clears the decks you start again and now you can grow.

Europe’s bailout fund for troubled sovereigns now stands at a staggering €1 trillion. “The European bailout fund was supposedly designed to bailout Greece but what it was really designed for is to bail out the banks if Greece defaults,” explains Malmgren. “What we now know is that firewall is working and so maybe companies are a better bet than countries. And that raises some interesting questions for investors. The new risk free rate of return maybe isn’t governments. That’s something to really think about.”

No comments yet